Concept explainers

infoPractice Pack

infoPractice Pack

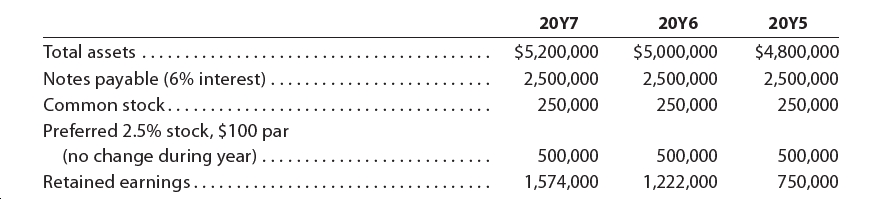

The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5:

Please see the attachment for details:

The 20Y7 net income was $411,000, and the 20Y6 net income was $462,500. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7.

a. Determine the return on total assets, the return on

b. What conclusions can be drawn from these data as to the company’s

profitability?

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 7 steps with 6 images

- Please include steps to understand alsoarrow_forwardThe following information was extracted from the records of Cascade Company at the end of the fiscal yea were completed: Common stock ($0.01 par value; 230,000 shares authorized, 55,500 shares issued, 53,500 shares outstanding) Additional paid-in capital Dividends declared and paid during the year Retained earnings at the end of the year Treasury stock at cost (2,000 shares) Net income Current stock price Required: 1. Prepare the stockholders' equity section of the balance sheet at the end of the fiscal year. 2. Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the dividend yield ratio. Determine the number of shares of stock that received dividends. Note: Do not round your intermediate calculations. Round Dividend yield ratio to 2 decimal places. Dividend yield ratio Number of shares % $ 555 459,000 23,500 315,000 (16;500) $ 96,500 $ 10 >arrow_forwardThe transactions listed below relate to Wainwright Inc. You are to assume that on the date on which each of the transactions occurred, the corporation's accounts showed only common stock ($100 par) outstanding, a current ratio of 2.7:1, and a substantial net income for the year to date (before giving effect to the transaction concerned). On that date, the book value per share of stock was $151.53. Each numbered transaction is to be considered completely independent of the others, and its related answer should be based on the effect(s) of that transaction alone. Assume that all numbered transactions occurred during 2021 and that the amount involved in each case is sufficiently material to distort reported net income if improperly included in the determination of net income. Assume further that each transaction was recorded in accordance with generally accepted accounting principles and, where applicable, in conformity with the all-inclusive concept of the income statement. For each of…arrow_forward

- The following selected data were taken from the financial statements of the Winter Group for the three most recent years of operations: Dec. 31, Year 3 Dec. 31, Year 2 Dec. 31, Year 1 Total assets $3,000,000 $2,700,000 $2,400,000 Notes payable (10% interest) 1,000,000 1,000,000 1,000,000 Common stock 400,000 400,000 400,000 Preferred $6 stock, $100 par 200,000 200,000 200,000 Retained earnings 1,126,000 896,000 600,000 The Year 3 net income was $242,000 and the Year 2 net income was $308,000. No dividends on common stock were declared during the 3 years. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for Years 2 and 3. If required, round your answers to one decimal place. i cant figure out the stockholders equity or common stockholders equityarrow_forwardPlease do not give solution in image formatarrow_forwardMarkus Company’s common stock sold for $1.75 per share at the end of this year. The company paid a common stock dividend of $0.42 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 27,000 $ 43,800 Accounts receivable $ 48,000 $ 41,300 Inventory $ 45,100 $ 48,000 Current assets $ 120,100 $ 133,100 Total assets $ 312,000 $ 263,800 Current liabilities $ 49,500 $ 34,500 Total liabilities $ 82,000 $ 73,800 Common stock, $1 par value $ 105,000 $ 105,000 Total stockholders’ equity $ 230,000 $ 190,000 Total liabilities and stockholders’ equity $ 312,000 $ 263,800 This Year Sales (all on account) $ 580,000 Cost of goods sold $ 336,400 Gross margin $ 243,600 Net operating income $ 49,500 Interest expense $ 3,000 Net income $ 32,550 7. What are the working capital and current ratio at the end of this year?arrow_forward

- Lake Incorporated and River Incorporated reported net incomes of $275,000 and $231,000, respectively, for the most recent fiscal year. Both companies had 55,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $58, while River's sold for $62 per share. Required a. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Required A Required B Determine the P/E ratio for each company. Note: Do not round intermediate calculations. Round your answers to the nearest whole number. Company Lake, Incorporated River, Incorporated P/E Ratioarrow_forwardanapparel manufacturer, reported net income (amounts in thousands) for Year 4 of $58,615 onsales of $1,460,235. It declared preferred dividends of $21,122. Preferred shareholders’ equitytotaled $264,746 at both the beginning and end of Year 4. Common shareholders’ equitytotaled $296,157 at the beginning of Year 4 and $364,026 at the end of Year 4. Phillips-VanHeusen had no noncontrolling interest in its equity. Total assets were $1,439,283 at the beginningof Year 4 and $1,549,582 at the end of Year 4. Compute the rate of ROCE for Year 4 anddisaggregate it into profit margin for ROCE, assets turnover, and capital structure leverage ratiocomponents.arrow_forwardMarkus Company’s common stock sold for $4.75 per share at the end of this year. The company paid preferred stock dividends totaling $4,400 and a common stock dividend of $1.09 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 44,000 $ 43,200 Accounts receivable $ 92,000 $ 66,200 Inventory $ 73,300 $ 92,000 Current assets $ 209,300 $ 201,400 Total assets $ 750,000 $ 809,000 Current liabilities $ 84,000 $ 87,000 Total liabilities $ 210,000 $ 189,000 Preferred stock $ 50,000 $ 50,000 Common stock, $1 par value $ 108,000 $ 108,000 Total stockholders’ equity $ 540,000 $ 620,000 Total liabilities and stockholders’ equity $ 750,000 $ 809,000 This Year Sales (all on account) $ 1,080,000…arrow_forward

- [The following information applies to the questions displayed below.] Markus Company’s common stock sold for $5.25 per share at the end of this year. The company paid a common stock dividend of $0.63 per share this year. It also provided the following data excerpts from this year’s financial statements: EndingBalance BeginningBalance Cash $ 49,000 $ 44,200 Accounts receivable $ 92,000 $ 68,700 Inventory $ 76,300 $ 92,000 Current assets $ 217,300 $ 204,900 Total assets $ 801,000 $ 875,400 Current liabilities $ 85,500 $ 90,000 Total liabilities $ 206,000 $ 185,400 Common stock, $1 par value $ 165,000 $ 165,000 Total stockholders’ equity $ 595,000 $ 690,000 Total liabilities and stockholders’ equity $ 801,000 $ 875,400 This Year Sales (all on account) $ 1,095,000 Cost of goods sold $ 635,100 Gross margin $ 459,900 Net operating income $ 313,875 Interest expense $ 15,500 Net income $ 208,862 10. What is the…arrow_forwardThe balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Bonds payable, 6% $1,500,000 Preferred $5 stock, $50 par $182,000 Common stock, $12 par $163,800.00 Income before income tax was $342,000, and income taxes were $50,800 for the current year. Cash dividends paid on common stock during the current year totaled $43,680. The common stock was selling for $160 per share at the end of the year. Determine each of the following. Round answers to one decimal place, except for dollar amounts which should be rounded to the nearest whole cent. Use the rounded answers for subsequent requirements, if required. a. Times interest earned ratio fill in the blank 1 times b. Earnings per share on common stock $fill in the blank 2 c. Price-earnings ratio fill in the blank 3 d. Dividends per share of common stock $fill in the blank 4 e. Dividend yieldarrow_forwardWhat is another way of saying "Interest earned on interest"?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education