GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

5th Edition

ISBN: 9781259911651

Author: William N. Lanen Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 28E

Comparing Business Units Using ROI

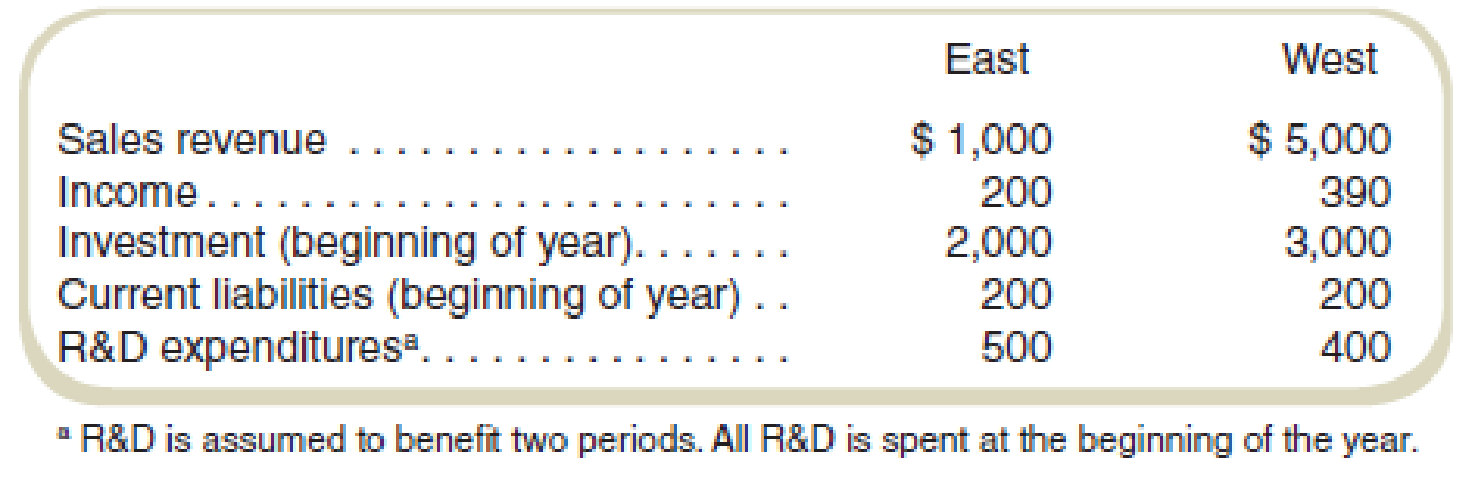

Back Mountain Industries (BMI) has two divisions: East and West. BMI has a cost of capital of 15 percent. Selected financial information (in thousands of dollars) for the first year of business follows:

Required

Evaluate the performance of the two divisions assuming BMI uses

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using ROI and RI to evaluate investment centers

Zims, a national manufacturer of lawn-mowing and snow-blowing equipment, segments its business according to customer type: professional and residential. The following divisional information was available for the past year:

Management has 21 26% target rate of return for each division.

Requirements

Calculate each division’s ROI. Round all of your answers to four decimal places.

Calculate each division’s profit margin ratio. Interpret your results.

Calculate each division’s asset turnover ratio. Interpret your results.

Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude.

Chick-Fil-A are the Lord’s Calories (CLC) has the following divisions within their company that achieved the reported ROIs for the previous year:

Division ROI

A 15%

B 20%

C 18%

CLC has been approached with a $350,000 investment opportunity. Which division will AFA choose to invest in, and how much operating income will be generated from the investment?

A. AFA will invest in Division A; the investment will earn operating income of $52,000

B. AFA will invest in Division C; the investment will earn operating income of $63,000

C. AFA will invest in Division B; the investment will earn operating income of $70,000

D. AFA will invest in Division A; the investment will earn operating income of $63,000

Saved

Compute return on investment for each of the divisions below (each is an investment center). Which division performed the best,

based on return on investment?

Complete this question by entering your answers in the tabs below.

Performance

Based on ROI

Return on

Investment

Compute return on investment for each of the divisions below (each is an investment center). (Round your final answers to 1

decimal place.)

Average Assets

Return on

Investment

Investment Center

Net Income

Cameras and camcorders

2$

6,118,000 $ 26,600,000

Phones and communications

3,628,500

17,700,000

%

Computers and accessories

2,106,000

10,800,000

K Returm on Investment

Performance Based on ROI >

Chapter 14 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

Ch. 14 - What are the advantages of divisional income as a...Ch. 14 - How is divisional income like income computed for...Ch. 14 - How is return on investment (ROI) computed?Ch. 14 - What are the advantages of using an ROI-type...Ch. 14 - How can ratios, such as ROI, be used for control...Ch. 14 - How does residual income differ from ROI?Ch. 14 - How does EVA differ from residual income?Ch. 14 - What impact does the use of gross book value or...Ch. 14 - What are the dangers of using only business unit...Ch. 14 - A company prepares the master budget by taking...

Ch. 14 - Prob. 11CADQCh. 14 - What problems might there be if the same methods...Ch. 14 - Prob. 13CADQCh. 14 - The chapter identified some problems with ROI-type...Ch. 14 - Failure to invest in projects is not a problem...Ch. 14 - How would you respond to the following comment?...Ch. 14 - Prob. 17CADQCh. 14 - Prob. 18CADQCh. 14 - Prob. 19CADQCh. 14 - Prob. 20CADQCh. 14 - Prob. 21CADQCh. 14 - Compute Divisional Income Arlington Clothing,...Ch. 14 - Compute Divisional Income Refer to Exercise 14-22....Ch. 14 - Computing Divisional Income: Incomplete...Ch. 14 - Compute RI and ROI The Campus Division of...Ch. 14 - Prob. 26ECh. 14 - Compare Alternative Measures of Division...Ch. 14 - Comparing Business Units Using ROI Back Mountain...Ch. 14 - Comparing Business Units Using Residual Income...Ch. 14 - Prob. 30ECh. 14 - Impact of New Asset on Performance Measures The...Ch. 14 - Prob. 32ECh. 14 - Prob. 33ECh. 14 - Impact of an Asset Disposal on Performance...Ch. 14 - Prob. 35ECh. 14 - Compare Historical Cost, Net Book Value to Gross...Ch. 14 - Prob. 37ECh. 14 - Compare Current Cost to Historical Cost Refer to...Ch. 14 - Effects of Current Cost on Performance...Ch. 14 - Comparing Business Units Using Divisional Income,...Ch. 14 - Comparing Business Units Using Economic Value...Ch. 14 - Comparing Business Units Using EVA: Solving for...Ch. 14 - Equipment Replacement and Performance Measures...Ch. 14 - Prob. 44PCh. 14 - Prob. 45PCh. 14 - Prob. 46PCh. 14 - Prob. 47PCh. 14 - Prob. 48PCh. 14 - Evaluate Performance Evaluation System: Behavioral...Ch. 14 - ROI, EVA, and Different Asset Bases Hys is a...Ch. 14 - Economic Value Added Bisbee Health Products...Ch. 14 - Prob. 52P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for Exercises 11-31 and 11-32: Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last years results: Washingtons actual cost of capital was 12%. Exercise 11-32 Residual Income Refer to the information for Washington Company above. In addition, Washington Companys top management has set a minimum acceptable rate of return equal to 8%. Required: 1. Calculate the residual income for the Adams Division. 2. Calculate the residual income for the Jefferson Division.arrow_forwardUsing ROI and RI to evaluate investment centers Consider the following condensed financial statements of Forever Free, Inc. The Company’s target fate of return is 40% Requirements Calculate the company’s ROI. Round all of your answers to four decimal places. Calculate the company’s profit margin ratio. Interpret your results. Calculate the company’s asset turnover ratio. Interpret your results. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results. Calculate the company’s RI. Interpret your results.arrow_forwardReturn on Investment and Residual Income Skyview Company has two divisions: Residential Skylights and Automotive Sunroofs. The manager of the Residential Skylights Division is evaluated based on return on investment (ROI). The manager of the Automotive Sunroofs Division is evaluated based on residual income. The required return is 12% and the return on investment has been 16% for the two divisions. Each manager is currently considering a project with the following projections (in $000s): Projected operating income Investment in operating assets Residential Skylights Automotive Sunroofs $840 $5,500 $1,344 $8,800 a. What is Residential Skylights' expected ROI on the project? Round percent to one decimal place. 0 % b. What is Automotive Sunroofs' expected residual income on the project? Round answer to the nearest dollar (in $000s). $0 c. According to the current evaluation system for managers, which manager(s) would have incentive to undertake the project?arrow_forward

- Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI). 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 17%. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. ROI Osaka $ 10,100,000 $ 808,000 $ 2,525,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 31,000,000 $ 3,100,000 $ 15,500,000 Yokohama %arrow_forwardFor its three investment centers, Gerrard Company accumulates the following data: I II III Sales $2,062,000 $3,914,000 $3,905,000 Controllable margin 848,640 2,161,620 4,103,120 Average operating assets 4,992,000 8,006,000 12,068,000 Compute the return on investment (ROI) for each center. I II III The return on investment % % % eTextbook and Mediaarrow_forwardThe vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,00 Cost of goods sold Operating expenses Invested assets 900,000 4,000,000 495,000 968,000 750,000 3,600,000 Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 20Y9, assuming that there were no service department charges. Touting Bike Division Trial Bike Divisionarrow_forward

- Tan Corporation of Japan has two regional divisions with headquarters in Osaka and Yokohama. Selected data on the two divisions follow: Sales Net operating income Average operating assets Required 1 Required 2 Required: 1. For each division, compute the return on investment (ROI). 2. Assume that the company evaluates performance using residual income and that the minimum required rate of return for any division is 18%. Compute the residual income for each division. Complete this question by entering your answers in the tabs below. ROI Osaka $ 9,400,000 $ 752,000 $ 2,350,000 Osaka Division For each division, compute the return on investment (ROI). % Yokohama $ 24,000,000 $ 2,400,000 $8,000,000 Yokohama %arrow_forwardThe Custodial Division of Clark's Corporate Services (CCS) has assets of $1.2 million. During the past year, the division had profits of $228,000. CCS has a cost of capital of 7.5 percent. Ignore taxes. Required: a. Compute the divisional ROI for the Custodial Division. b. Compute the divisional RI for the Custodial Division. Complete this question by entering your answers in the tabs below. Required A Required B Compute the divisional ROI for the Custodial Division. Divisional ROI % Required A Required B >arrow_forwardFor its three investment centres, National Inc. accumulates the following data: Centre I Centre II Centre III Sales $2,000,000 $4,000,000 $4,000,000 Operating income 1,300,000 1,840,000 2,880,000 Average Operating Assets 5,000,000 8,000,000 12,000,000 Minimum required return 15% 20% 25% 1.) What is the return on investment (ROI) for Centre I? a. 20% b. 23% c. 24% d. 26% 2.)The residual income (RI) for Centre III is a. $150,000 b. $550,000 c. $240,000 d. -$120,000 3.)The ranking of the centres based on return on investment (ROI) with the best performer listed first is as follows a. Centre I, Centre II, Centre III b. Centre I, Centre III, Centre II c. Centre III, Centre II, Centre I d. Centre II, centre III, Centre I 4.)What is the return on investment (ROI) for Centre II? a. 20% b. 23% c. 24% d. 26%arrow_forward

- For its three investment centres, Stahl Company accumulates the following data: Centre I Centre il Centre III Sales $1,996,000 $4,043,000 $3,962,000 Controllable margin 785,760 2,663,760 4,372,200 Average operating assets 4,911,000 8,072,000 12,145,000 Calculate the return on investment (ROI) for each centre. The return on investment Centre I % Centre II % Centre IIIarrow_forwardA company has three investment alternatives. The alternatives have similar economic lives. The following data is available for each alternative Investment A Investment B Investment $100,000 $100,000 Annual net income $31,000 $18,000 Residual value of investment $10,000 $20,000 Assuming the company can select only one investment, which investment would be selected under ROI analysis? ROI on Investment A ROI on Investment Barrow_forwardThe average operating assets and minimum required rate of return of each segment are as follows: Segment Average operating assets (in thousands) Required rate of return Pastry 2,500,000 15% Fruit Juices and Desserts 1,270,000 12% Compute, analyze, and discuss with top management: How much is the ROI and residual income of each segment? How would you compare each segment's performance based on ROI and residual income? What actions would you recommend to improve or maintain each segment's. ROI and residual income? Fast Food 890,000 3%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License