Compare Current Cost to Historical Cost

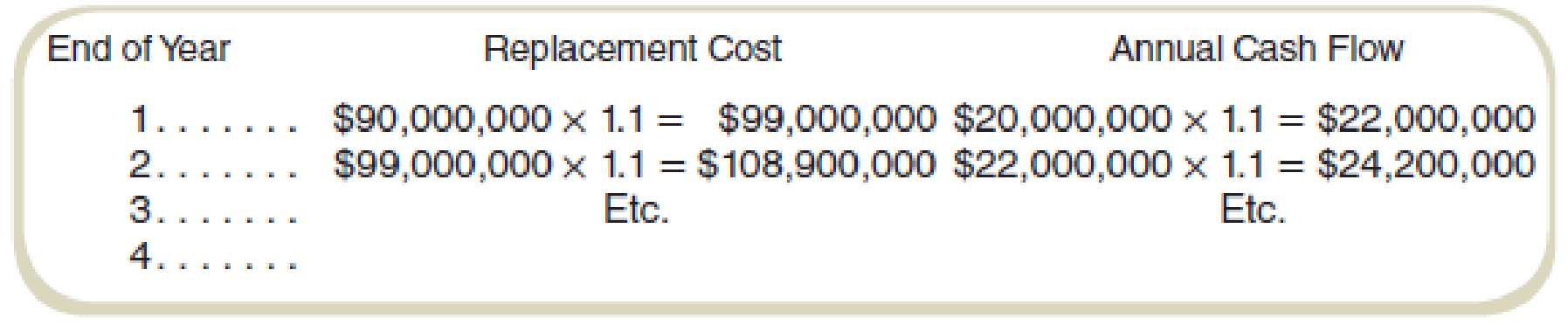

Refer to the information in Exercise 14-36. In computing

Note that “accumulated” depreciation is 10 percent of the gross book value of depreciable assets after one year, 20 percent after two years, and so forth.

Required

- a. Compute ROI using historical cost, net book value.

- b. Compute ROI using historical cost, gross book value.

- c. Compute ROI using current cost, net book value.

- d. Compute ROI using current cost, gross book value.

a.

Compute ROI by using historical cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Explanation of Solution

Net book value:

Net book value refers to the value of the asset after the adjustment of the depreciation. The value of the asset is calculated by deducting the cumulative depreciation from the book value of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment(3) (a) |

Operating profit (1) (b) |

ROI |

| 1 | $81,000,000 | $13,000,000 | 16.05% |

| 2 | $72,000,000 | $15,200,000 | 21.11% |

| 3 | $63,000,000 | $17,620,000 | 27.97% |

| 4 | $54,000,000 | $20,282,000 | 37.56% |

Table: (1)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 16.05%, 21.11%, 27.97%, and 37.56%.

Working note 1:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (1) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,000,000 | $13,000,000 |

| 2 | $22,000,000 | $24,200,000 | $9,000,000 | $15,200,000 |

| 3 | $24,200,000 | $26,620,000 | $9,000,000 | $17,620,000 |

| 4 | $26,620,000 | $29,282,000 | $9,000,000 | $20,282,000 |

Table: (2)

Working note 2:

Calculate the depreciation:

Working note 3:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Annual depreciation (b) |

Depreciation |

Net asset value |

| 1 | $90,000,000 | 10% | $9,000,000 | $81,000,000 |

| 2 | $90,000,000 | 20% | $18,000,000 | $72,000,000 |

| 3 | $90,000,000 | 30% | $27,000,000 | $63,000,000 |

| 4 | $90,000,000 | 40% | $36,000,000 | $54,000,000 |

Table: (3)

The depreciation has been calculated on the historical cost in this method.

b.

Compute ROI using historical cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (1) (b) |

ROI |

| 1 | $90,000,000 | $13,000,000 | 14.44% |

| 2 | $90,000,000 | $15,200,000 | 16.89% |

| 3 | $90,000,000 | $17,620,000 | 19.58% |

| 4 | $90,000,000 | $20,282,000 | 22.54% |

Table: (4)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 14.44%, 16.89%, 19.58%, and 22.54%.

c.

Compute ROI by using current cost, net book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Explanation of Solution

Current cost:

Current cost is the current market value of the asset. The depreciation is calculated on the current value of the asset rather than the historical cost of the asset.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (7) (a) |

Operating profit (4) (b) |

ROI |

| 1 | $89,100,000 | $12,100,000 | 13.58% |

| 2 | $87,120,000 | $13,310,000 | 15.28% |

| 3 | $83,853,000 | $14,641,000 | 17.46% |

| 4 | $79,061,400 | $16,105,100 | 20.37% |

Table: (5)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 13.58%, 15.28%, 17.46%, and 20.37%.

Working note 4:

Calculate the operating profit over the life of the asset:

| Year |

Gross cash flow (a) |

Net cash flow |

Depreciation (5) (c) |

Operating profit |

| 1 | $20,000,000 | $22,000,000 | $9,900,000 | $12,100,000 |

| 2 | $22,000,000 | $24,200,000 | $10,890,000 | $13,310,000 |

| 3 | $24,200,000 | $26,620,000 | $11,979,000 | $14,641,000 |

| 4 | $26,620,000 | $29,282,000 | $13,176,900 | $16,105,100 |

Table: (2)

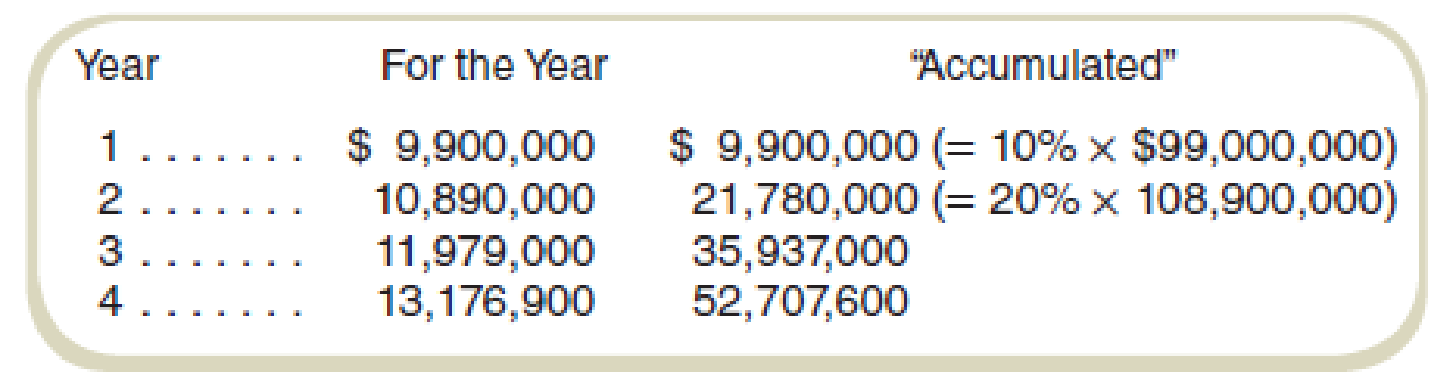

Working note 5:

Calculate the depreciation over the life of the asset:

| Year |

Asset value (a) |

Annual Increment (b) |

The gross value of the asset |

Yearly depreciation |

Total depreciation |

| 1 | $36,000,000 | 10% | $39,600,000 | $9,900,000 | $9,900,000 |

| 2 | $39,600,000 | 10% | $43,560,000 | $10,890,000 | $21,780,000 |

| 3 | $43,560,000 | 10% | $47,916,000 | $11,979,000 | $35,937,000 |

| 4 | $47,916,000 | 10% | $52,707,600 | $13,176,900 | $52,707,600 |

Table: (6)

The closing gross value of each year will be the opening asset value of the next year.

Working note 6:

Calculate the asset value for the first year:

Working note 7:

Calculate the investment base over the life of the asset:

| Year |

Gross asset value (a) |

Depreciation (5) (b) |

Net asset value |

| 1 | $9,900,000 | $9,900,000 | $89,100,000 |

| 2 | $10,890,000 | $21,780,000 | $87,120,000 |

| 3 | $11,979,000 | $35,937,000 | $83,853,000 |

| 4 | $13,176,900 | $52,707,600 | $79,061,400 |

Table: (7)

d.

Compute ROI using current cost, gross book value.

Answer to Problem 38E

The ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Explanation of Solution

Gross book value:

Gross book value is the value of the asset without the adjustment of the depreciation. The asset is recorded on the book value or the cost value.

Calculate the ROI using historical cost, net book value:

| Year |

Investment (a) |

Operating profit (4) (b) |

ROI |

| 1 | $99,000,000 | $12,100,000 | 12.22% |

| 2 | $108,900,000 | $13,310,000 | 12.22% |

| 3 | $119,790,000 | $14,641,000 | 12.22% |

| 4 | $131,769,000 | $16,105,100 | 12.22% |

Table: (8)

Thus, the ROI for year 1, year 2, year 3 and year 4 is 12.22% each year.

Want to see more full solutions like this?

Chapter 14 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education