Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 32E

Use the following information for Exercises 11-31 and 11-32:

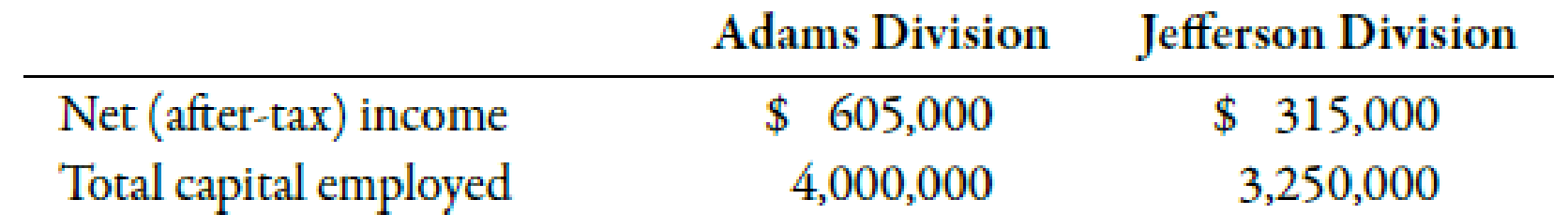

Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year’s results:

Washington’s actual cost of capital was 12%.

Exercise 11-32 Residual Income

Refer to the information for Washington Company above. In addition, Washington Company’s top management has set a minimum acceptable

Required:

- 1. Calculate the residual income for the Adams Division.

- 2. Calculate the residual income for the Jefferson Division.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Western Division of Claremont Company had net operating income of $154,000 and average invested assets of $557,000.

Claremont has a required rate of return of 14.75 percent. Western has an opportunity to increase operating income by $48,000 with a

$84,000 investment in assets.

Compute Western Division's return on investment and residual income currently and if it undertakes the project.

Note: Enter your ROI answers as a percentage rounded to two decimal places, (i.e., 0.1234 should be entered as 12.34%). Round

your Residual Income (Loss) answers to the nearest whole dollar.

Return on Investment (ROI)

Residual Income (Loss)

Current

%

Proposed Project

Coolbrook company has the following information available for the past year:(Chart in photo below)

Required:1. calculate return on Investment (ROI) and residual income for each divison for the last year2. Recalculate ROI and residual income for the division for each independent situration that follows:a.) operating income increases by 9 percentb.) operating Income decreases by 9 percentc.) The company invests 255,000 in each division, an amount that generates 106,000 additional income per division.d.) Coolbrook changes its hurdle rate to 5.26 percent

The following information is related to the current operation of Kenanga Branch. Operating income

5,000,000 Sales revenue 62, 500,000 Average operating asset 25,000,000 Average balance in current

liabilities 13,400,000 The management of the company has decided that the minimum return required

is 11 percent. Residual income is another approach that can be used to measure performance of an

investment centre. Define residual income and determine the residual income for Kenanga Branch.

Chapter 11 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 11 - Discuss the differences between centralized and...Ch. 11 - Prob. 2DQCh. 11 - Explain why firms choose to decentralize.Ch. 11 - What are margin and turnover? Explain how these...Ch. 11 - What are the three benefits of ROI? Explain how...Ch. 11 - What is residual income? What is EVA? How does EVA...Ch. 11 - Can residual income or EVA ever be negative? What...Ch. 11 - What is transfer price?Ch. 11 - Prob. 9DQCh. 11 - (Appendix 11A) What is the Balanced Scorecard?

Ch. 11 - (Appendix 11A) Describe the four perspectives of...Ch. 11 - The practice of delegating authority to...Ch. 11 - Which of the following is not a reason for...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - The key difference between residual income and EVA...Ch. 11 - It ROI for a division is 15% and the company's...Ch. 11 - Prob. 9MCQCh. 11 - Prob. 10MCQCh. 11 - (Appendix 11A) Which of the following is a...Ch. 11 - (Appendix 11A) The length of time it takes to...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 16BEACh. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 21BEBCh. 11 - Calculating Transfer Price Teslum Inc. has a...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Types of Responsibility Centers Consider each of...Ch. 11 - Margin, Turnover, Return on Investment Pelak...Ch. 11 - Margin, Turnover, Return on Investment, Average...Ch. 11 - Return on Investment, Margin, Turnover Data follow...Ch. 11 - Residual Income The Avila Division of Maldonado...Ch. 11 - Economic Value Added Falconer Company had net...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Prob. 33ECh. 11 - Use the following information for Exercises 11-33...Ch. 11 - Prob. 35ECh. 11 - (Appendix 11A) Cycle Time and Velocity Prakesh...Ch. 11 - (Appendix 11A) Cycle Time and Velocity Lasker...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - Return on Investment and Investment Decisions...Ch. 11 - Return on Investment, Margin, Turnover Ready...Ch. 11 - Return on Investment for Multiple Investments,...Ch. 11 - Return on Investment and Economic Value Added...Ch. 11 - Transfer Pricing GreenWorld Inc. is a nursery...Ch. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - (Appendix 11A) Cycle Time, Velocity, Conversion...Ch. 11 - (Appendix 11A) Balanced Scorecard The following...Ch. 11 - (Appendix 11A) Cycle Time and Velocity,...Ch. 11 - Prob. 50C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The operating income and the amount of invested assets in each division of Conley Industries are as follows: a. Compute the return on investment for each division. b. Which division is the most profitable per dollar invested? Based on the data in Exercise 10 assume that management has established a 15% minimum acceptable return for invested assets. a. Determine the residual income for each division. b. Which division has the most residual income?arrow_forwardThe following selected data pertain to the Argent Division for last year: Required: 1. How much is the residual income? 2. How much is the return on investment? (Rounded to four significant digits.)arrow_forwardGGX is the general manager of the Jung Division, and his performance is measured using the residual income method. GGX is reviewing the following forecasted information for the division for next year. Category Amount (thousands) Working capital P 1,800 Revenue 30,000 Plant and equipment 17,200 To establish a standard of performance for the division’s manager using the residual income approach, four scenarios are being considered. Scenario 1 assumes an imputed interest charge of 12% and a target residual income of P1,500,000. Scenario 2 assumes an imputed interest charge of 15% and a target residual income of P2,000,000. Scenario 3 assumes an imputed interest charge of 18% and a target residual income of P1,250,000. Scenario 4 assumes an imputed interest charge of 10% and a target residual income of P2,500,000. What is the residual income for scenario 2?arrow_forward

- Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results: Adams Division Jefferson Division Net (after-tax) income $726,000 $327,600 Total capital employed 4,280,000 3,412,500 In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 11%. Calculate the residual income for the Adams Division Calculate the residual income for the Jefferson Divisionarrow_forwardINVESTMENT CENTER: The AAA Division has permanent current assets of P50,000 and operating non-current assets of 350,000. It provides annual operating income after tax of P100,000. Its cost of capital is 15% but the minimum required rate of return by the entity is 16%. How much is its current return on investment? How much is its economic value added? How much is its residual income? Assume that the Senna Division is presented by the head office to manage a P60,000 investment option yielding a 20% return on its investment. Should the Division agree to manage this investment opportunity? Yes, because the ROI will increase. Yes, because the RI and EVA will increase. No, because the ROI will decrease. No, because the RI and EVA will decrease.arrow_forwardBack Mountain Industries (BMI) has two divisions: East and West. BMI has a cost of capital of 10 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Investment (beginning of year) Current liabilities (beginning of year) R&D expendituresa Divisions aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming BMI uses return on investment (ROI). (Round your final answers to nearest whole percentage value.) East West ROI O East O West % % a-2. Which division had the better performance? East $2,100 750 3,100 310 1,050 acerarrow_forward

- Lasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expendituresa aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). a-2. Which division had the better performance? Complete this question by entering your answers in the tabs below. Req A1 Divisions Req A2 Carolinas Northeast Carolinas $ 1,100 190 1,000 190 550 Evaluate the performance of the two divisions assuming Lasky Manufacturing uses economic value added (EVA). Note: Note: Enter answers in thousands of dollars. Round your answers to 1 decimal place. EVAarrow_forwardLasky Manufacturing has two divisions: Carolinas and Northeast. Lasky has a cost of capital of 7.5 percent. Selected financial information (in thousands of dollars) for the first year of business follows: Sales revenue Income Divisional assets (beginning of year) Current liabilities (beginning of year) R&D expendituresa aR&D is assumed to benefit two periods. All R&D is spent at the beginning of the year. Required: a-1. Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). a-2. Which division had the better performance? Complete this question by entering your answers in the tabs below. Req A1 Divisions Carolinas $2,400 160 1,000 320 1,200 Req A2 Carolinas Northeast Evaluate the performance of the two divisions assuming Lasky uses return on investment (ROI). Note: Enter your answers as a percentage rounded to 1 decimal place (i.e., 32.1). Northeast $ 7,200 372 1,500 320 1,120 ROI % %arrow_forwardCoolbrook Company has the following information available for the past year: River Stream Division Division Sales revenue $1,200,000 900,000 $1,800,000 1,300,000 Cost of goods sold and operating expenses Net operating income $ 300,000 $ 500,000 Average invested assets $1,200,000 $1,800,000 The company's hurdle rate is 6 percent. Required: 1. Calculate return on investment (ROI) and residual income for each division for last year. 2. Recalculate ROI and residual income for each division for each independent situation that follows: a. Operating income increases by 10 percent. b. Operating income decreases by 10 percent. c. The company invests $250,000 in each division, an amount that generates $100,000 additional income per division. d. Coolbrook changes its hurdle rate to 10 percent. Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Req 28 Reg 20 Reg 2D Calculate return on investment (ROI) and residual income for each division for last year. (Enter your ROI…arrow_forward

- Golden Goodness (GG) has an investment center that had the following data: Operating Income $28,000 Sales $350,000 Invested assets $175,000 PMB has set a minimum acceptable rate of return at 14%. Using the information, answer the following questions. You must include what type of number it is (%, $, etc.) Part A: What is the residual income? Part B: Show calcualtions on how you got answerarrow_forwardUse the following information for the Problems below: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 8 percent. Sales revenue Income Average investment Sales margin k Capital turnover ROI Residual income Division A ? Division B Division C $ 11,000,000 ? $ 550,000 $ 2,160,000 ? ? $ 2,610,000 ? 20% ? 25% 3 ? ? ? ? 20% ? ? $ 130,000 Required: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 8 percent. Note: Round "Capital turnover" answers to 2 decimal places. Division A Division B Division C Sales revenue Income S 40,700,000 $ 1,840,000 $ 8,140,000 Average investment $ 10,175,000 + Sales margin 20 % % 25 % Capital turnover ROI Residual income 1.00 % % 20 % $ 489,000arrow_forwardThe vice president of operations of Moab Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year ending October 31, 20Y9, for each division are as follows: (P14-5) Touring Bike Division Trail Bike Division Sales $1,500,000 $5,00 Cost of goods sold Operating expenses Invested assets 900,000 4,000,000 495,000 968,000 750,000 3,600,000 Instructions 1. Prepare condensed divisional income statements for the year ended October 31, 20Y9, assuming that there were no service department charges. Touting Bike Division Trial Bike Divisionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License