FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

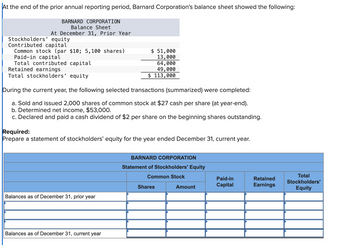

Transcribed Image Text:At the end of the prior annual reporting period, Barnard Corporation's balance sheet showed the following:

BARNARD CORPORATION

Balance Sheet

At December 31, Prior Year

Stockholders' equity

Contributed capital

Common stock (par $10; 5,100 shares)

Paid-in capital

Total contributed capital

Retained earnings

Total stockholders' equity

$ 51,000

13,000

64,000

49,000

$ 113,000

During the current year, the following selected transactions (summarized) were completed:

a. Sold and issued 2,000 shares of common stock at $27 cash per share (at year-end).

b. Determined net income, $53,000.

c. Declared and paid a cash dividend of $2 per share on the beginning shares outstanding.

Required:

Prepare a statement of stockholders' equity for the year ended December 31, current year.

BARNARD CORPORATION

Statement of Stockholders' Equity

Common Stock

Shares

Amount

Paid-in

Capital

Retained

Earnings

Total

Stockholders'

Equity

Balances as of December 31, prior year

Balances as of December 31, current year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Entries for selected corporate transactionsSelected transactions completed by ATV Discount Corporation duringthe current fiscal year are as attached: Instructions Journalize the transactions.arrow_forwardThe stockholders' equity section of Larkspur Inc. at the beginning of the current year appears below. Common stock, $10 par value, authorized 954,000 shares, 307,000 shares issued and outstanding Paid-in capital in excess of par-common stock Retained earnings During the current year, the following transactions occurred. 1. 2. 3. 4. 5. 6. (a) $3,070,000 553,000 614,000 The company issued to the stockholders 92,000 rights. Ten rights are needed to buy one share of stock at $35. The rights were void after 30 days. The market price of the stock at this time was $37 per share. The company sold to the public a $194,000, 10% bond issue at 103. The company also issued with each $100 bond one detachable stock purchase warrant, which provided for the purchase of common stock at $33 per share. Shortly after issuance, similar bonds without warrants were selling at 96 and the warrants at $7. All but 4,600 of the rights issued in (1) were exercised in 30 days. At the end of the year, 80% of the…arrow_forwardKohler Corporation reports the following components of stockholders’ equity at December 31 of the prior year. Common stock—$15 par value, 100,000 shares authorized, 50,000 shares issued and outstanding $ 750,000 Paid-in capital in excess of par value, common stock 70,000 Retained earnings 430,000 Total stockholders' equity $ 1,250,000 During the current year, the following transactions affected its stockholders’ equity accounts. January 2 Purchased 4,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 1,500 of its treasury shares at $24 cash per share. August 22 Sold 2,500 of its treasury shares at $16 cash per share. September 5 Directors declared a $2 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend…arrow_forward

- Which assets depreciate?arrow_forwardKinkaid Company was incorporated at the beginning of this year and had a number of transactions. The following journal entries impacted its stockholders’ equity during its first year of operations. Transaction General Journal Debit Credit a. Cash 290,000 Common Stock, $25 Par Value 245,000 Paid-In Capital in Excess of Par Value, Common Stock 45,000 b. Organization Expenses 180,000 Common Stock, $25 Par Value 128,000 Paid-In Capital in Excess of Par Value, Common Stock 52,000 c. Cash 43,500 Accounts Receivable 16,000 Building 81,600 Notes Payable 59,800 Common Stock, $25 Par Value 51,300 Paid-In Capital in Excess of Par Value, Common Stock 30,000 d. Cash 125,000 Common Stock, $25 Par Value 80,000 Paid-In Capital in Excess of Par Value, Common Stock 45,000 Required: 2. How many shares of common stock are outstanding at year-end? 3. What is the total paid-in capital at year-end?arrow_forwardKohler Corporation reports the following components of stockholders’ equity at December 31 of the prior year. Common stock—$15 par value, 100,000 shares authorized, 40,000 shares issued and outstanding $ 600,000 Paid-in capital in excess of par value, common stock 70,000 Retained earnings 400,000 Total stockholders' equity $ 1,070,000 During the current year, the following transactions affected its stockholders’ equity accounts. January 2 Purchased 5,000 shares of its own stock at $20 cash per share. January 5 Directors declared a $4 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. July 6 Sold 2,500 of its treasury shares at $24 cash per share. August 22 Sold 2,500 of its treasury shares at $16 cash per share. September 5 Directors declared a $4 per share cash dividend payable on October 28 to the September 25 stockholders of record. October 28 Paid the dividend…arrow_forward

- The records of Seahawks Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $11 par value, 49,000 shares outstanding Preferred stock, 8 percent, $9 par value, 9,000 shares outstanding Retained earnings, $231,000 On September 1 of the current year, the board of directors was considering the distribution of a(n) $71,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions: a. The preferred stock is noncumulative. b. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. Note: Round your "per share" amounts to 2 decimal places. Noncumulative: Total Per share Cumulative: Total Per share $ Preferred stock Common stock 35,280 $ 64,520arrow_forwardBlossom Ltd. reported the following balances at January 1, 2023: Common shares Retained earnings Accumulated other comprehensive income $355,000 67,200 68,200 During the year Blossom earned net income of $297,000 and generated other comprehensive income of $61,300. Prepare a statement of changes in shareholders' equity for the year ended December 31, 2023.arrow_forwardMarkus Company’s common stock sold for $4.75 per share at the end of this year. The company paid preferred stock dividends totaling $4,400 and a common stock dividend of $1.09 per share this year. It also provided the following data excerpts from this year’s financial statements: Ending Balance Beginning Balance Cash $ 44,000 $ 43,200 Accounts receivable $ 92,000 $ 66,200 Inventory $ 73,300 $ 92,000 Current assets $ 209,300 $ 201,400 Total assets $ 750,000 $ 809,000 Current liabilities $ 84,000 $ 87,000 Total liabilities $ 210,000 $ 189,000 Preferred stock $ 50,000 $ 50,000 Common stock, $1 par value $ 108,000 $ 108,000 Total stockholders’ equity $ 540,000 $ 620,000 Total liabilities and stockholders’ equity $ 750,000 $ 809,000 This Year Sales (all on account) $ 1,080,000…arrow_forward

- Using the following information for the year ended 30 June, prepare the Retained Earnings Account for Kramer Ltd. Retained earnings as at 1 July $450,000 Transfer from Dividend Equalisation Reserve $200,000 Operating Profit (before income tax expenses $270,000) $900,000 Create a provision for dividend of 15 cents per share. There are 7,500,000 shares issuearrow_forwardNeed help correctingarrow_forwardVishalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education