Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134128528

Author: Karen W. Braun, Wendy M. Tietz

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 14, Problem 14.48ACT

Using financial statement ratios to analyze Coca-Cola and PepsiCo (Learning Objectives 1, 2, 3, & 4)

REAL LIFE

The Coca-Cola Company and PepsiCo, Inc., are fierce competitors in the beverage and snack markets. A perennial question among consumers is “Coke or Pepsi”? In this case, we will be looking at the financial positions of both companies to answer the question of which company is in a stronger financial position, Coke or Pepsi.

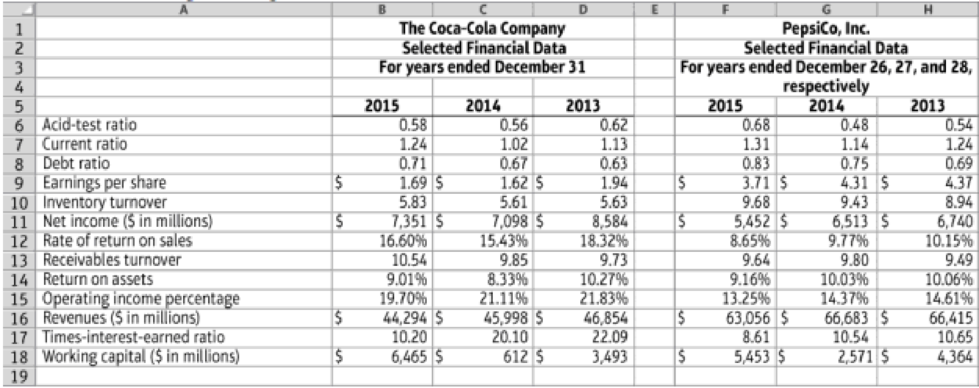

Following is a table of various financial data and ratios for both Coca-Cola and PepsiCo. The data are arranged in alphabetic order.

14.7-99 Full Alternative Text

Requirements

- 1. Rearrange the data and ratios into a report format that groups similar data and ratios together, to make it easier to analyze the data.

- 2. Using the given financial data for The Coca-Cola Company, discuss the company’s:

- a. Ability to pay current liabilities;

- b. Ability to sell inventory and collect receivables;

- c. Ability to pay long-term debt; and

- d. Profitability.

- 3. Using the given financial data for PepsiCo, Inc., discuss the company’s:

- e. Ability to pay current liabilities;

- f. Ability to sell inventory and collect receivables;

- g. Ability to pay long-term debt; and

- h. Profitability.

- 4. Now compare Coca-Cola’s financial position to PepsiCo’s financial position. How do the two companies compare in the following areas?

- i. Ability to pay current liabilities

- j. Ability to sell inventory and collect receivables

- k. Ability to pay long-term debt

- l. Profitability

- 5. What conclusions can you draw from your analysis of the two companies? Which company do you think is in a stronger financial position?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

8. A business has a debt to equity ratio of 4.5 : 1. They plan to expand the business interstate by purchasing another business that is one of its competitors. Which source of funding would best suit their plans for expansion?

(a) Banks

(b) External

(c) Internal

(d) Short term

9. Which is the main piece(s) of legislation that a marketing department would have to comply with when advertising and promoting a product?

(a) Competition and Consumer Act 2010.

(b) The Fair Trading Act(NSW) 1987

(c) Anti-Discrimination Act (d) (a) and (b)

10. Which of the following would improve the financial position of a business?

(a) Lower current ratio and lower accounts receivable turnover ratio

(b) Higher current ratio and lower accounts receivable turnover ratio

(c) Lower current ratio and higher accounts receivable turnover ratio

(d) Higher current ratio and higher accounts receivable turnover ratio

Question:1) These three Companies Artistic Denim Mills Ltd, Faisal Spinning Millis Ltd., And the Feroze 1888 Mills Ltd as attached data in image You are required to comment/analyze specifically the following aspects Of these companies.i) Chosen companies leverage.ii) Debt management.iii) DuPont variants i.e., profitability, asset efficiency, and leverage.2) Also draw strength from market intelligence, if, you have or are able to obtain about the chosen companies(s) and is worth explanation. Such information typically may include major expansion project initiated during the last two years

Question:1) You are expected and required to comment/analyze specifically the following aspects on These three Companies Artistic Denim Mills Ltd, Faisal Spinning Millis Ltd. And the Feroze 1888 Mills Ltd.i) Chosen companies leverage.ii) Debt management.iii) DuPont variants i.e., profitability, asset efficiency, and leverage.4) Also draw strength from market intelligence, if, you have or are able to obtain about the chosen companies(s) and is worth explanation. Such information typically may include major expansion project initiated during the last two years

Chapter 14 Solutions

Managerial Accounting (5th Edition)

Ch. 14 - (Learning Objective 1) Which of the following...Ch. 14 - Prob. 2QCCh. 14 - Prob. 3QCCh. 14 - Prob. 4QCCh. 14 - (Learning Objective 3) Which of the following is...Ch. 14 - (Learning Objective 4) Working capital is defined...Ch. 14 - Prob. 7QCCh. 14 - Prob. 8QCCh. 14 - Prob. 9QCCh. 14 - Prob. 10QC

Ch. 14 - Prob. 14.1SECh. 14 - Find trend percentages (Learning Objective 1)...Ch. 14 - Prob. 14.3SECh. 14 - Prepare common-size income statements (Learning...Ch. 14 - Analyze common-size income statements (Learning...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Cartwrights Data Set used for S14-6 through...Ch. 14 - Prob. 14.9SECh. 14 - Prob. 14.10SECh. 14 - Prob. 14.11SECh. 14 - Prob. 14.12AECh. 14 - Prob. 14.13AECh. 14 - Prob. 14.14AECh. 14 - Prob. 14.15AECh. 14 - Prob. 14.16AECh. 14 - Calculate ratios (Learning Objective 4) Kelleher...Ch. 14 - Prob. 14.18AECh. 14 - Prob. 14.19AECh. 14 - Prob. 14.20AECh. 14 - Prob. 14.21AECh. 14 - Classify company sustainability measurements into...Ch. 14 - Prob. 14.23BECh. 14 - Prob. 14.24BECh. 14 - Prob. 14.25BECh. 14 - Prob. 14.26BECh. 14 - Prob. 14.27BECh. 14 - Calculate ratios (Learning Objective 4) Ponderosa...Ch. 14 - Prob. 14.29BECh. 14 - Prob. 14.30BECh. 14 - Prob. 14.31BECh. 14 - Calculate ratios (Learning Objective 4) Thornton...Ch. 14 - Prob. 14.33BECh. 14 - Prob. 14.34APCh. 14 - Comprehensive analysis (Learning Objectives 2, 3, ...Ch. 14 - Prob. 14.36APCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Prob. 14.38APCh. 14 - Prob. 14.39BPCh. 14 - Prob. 14.40BPCh. 14 - Prob. 14.41BPCh. 14 - Ratio analysis over two years (Learning Objective...Ch. 14 - Make an investment decision (Learning Objective 4)...Ch. 14 - Prob. 14.44SCCh. 14 - Discussion Questions 1. Describe horizontal...Ch. 14 - Prob. 14.47ACTCh. 14 - Using financial statement ratios to analyze...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Write a research paper on the following learning objectives. OBJECTIVES: Explain the difference between accounting value and market value Discuss the difference between accounting income and cash flow Asses the difference between average and marginal tax rates Evaluate how to determine a firm's cash flow from its financial statementsarrow_forward1. Compute for the profitability ratios of both Elen and Melanie. Which of the two companies do you believe is more profitable? 2. Compute for the operational efficiency ratios of both Elen and Melanie. Which of the two companies do you believe is more efficient? 3. Compute for the financial health ratios of both Elen and Melanie. Which of the two companies do you believe is more financially healthy?arrow_forwardA financial services company is considering investing in a new fintech startup that has developed a new technology platform for investment management. The company is concerned about the risks associated with the investment and wants to evaluate the potential return on investment. You have been hired as a consultant to help the company make an informed decision. Which of the following financial ratios would be most appropriate for the financial services company to evaluate the financial health and performance of the fintech startup? Gross profit margin Debt-to-equity ratio Return on investment (ROI) Price-to-earnings (P/E) ratioarrow_forward

- Here you will find some income statements and balance sheets for Sears Holdings (SHLD) and Taget Corp (TGT). Assume that you are a financial manager at Sear and want to compare your firm’s situation with that of Target. Calculate represenatative ratios for liquidity, asset management efficiency, financial leverage (capital structure), and profitability for both Sears and Target. How would you summarize the financial performance of Sears compared to target (its benchmark firm)? Include Sears and Targets current ratio, acid-test ratio, average collection period, accounts receivable turnover, inventory turnover, debt ratio, timed interest earned, total asset turnover, fixed asset turnover, gross profit margin, operating profit margin, net profit margin, operating return on assets, and return on equity.arrow_forwardRead the article. Whats the author point of view? How does this relate to financing a business? What would be a solution for this pronblem? The role of finance is undergoing a significant shift. As businesses strive for growth and competitiveness in an increasingly complex and dynamic market, finance leaders are being challenged to add more value beyond their traditional responsibilities.Insights from Microsoft’s Economic Guardians of the Future report show finance teams are going through an evolution and must strike the right balance between strategic innovation and protecting the long-term health of their company. Eighty percent of finance leaders believe that they and their teams are being challenged more than ever to add value beyond their standard roles and responsibilities. This shift has been driven in part by the uncertain economic climate, marked by factors such as inflation, recession, and international conflicts.Finance teams are being asked to provide insight into the…arrow_forwardselect a “start-up” company in an industry of your choice and provide a brief summary description of the start-up company you chose and the goods or services it provides. 1. As a start-up company, identify three Credit Risks the company currently faces today or could face in the future. Explain in detail why these risks are a threat to the company. 2. What advice would you give to the CEO of the company to prevent or minimize these credit risks?arrow_forward

- You are asked to briefly answer the following questions:Profitability ratios are a set of ratios that indicate how profits relate to sales and the size of a company's capital, and this category includes various ratios such as: Gross Profit Margin Ratio, Net Profit Margin Ratio, Return on Assets Ratio and Return on Equity Ratio of funds. One of the top executives at the company where you work is asking for your help in understanding the following:1. How the above efficiency indicators are calculated.2. The company decided to pay cash to suppliers to achieve better purchase prices. What is the effect of this fact on the value of the aforementioned efficiency indicators?3. Could (beyond the above fact) be affected in any way positively the figures in question for the company where you work?arrow_forwardWhich of the following statements is(are) true about ESG? Select one or more: a. ESG is an important consideration in financial decisions as it provides a positive impact for long-term success for corporates through “Risk Reduction”. b. ESG is an important consideration in financial decisions as it provides positive impact for long-term success for corporates through “Fiscal policy”. c. ESG is an important consideration in financial decisions as it provides positivearrow_forwardProblem 1: Compute for the profitability ratios of both Ellane and meLanie. Which of the two companies do you believe is more profitable? Problem 2: Compute for operational efficiency ratios of both Ellane and meLanie. Which of the two companies is more efficient? Problem 3: Compute for the financial health ratios of both ellane and meLanie. Which of the two companies is more financially healthy?arrow_forward

- Most investors and analysts in the financial community pay particular attention to a company's ROE. The ROE can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the ROE. Investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. An analyst gathered the following data and calculated the various terms of the DuPont equation for three companies: Company A Company B Company C ROE 12.0% 15.5% 21.5% Profit Margin 57.3% 58.2% 58.0% X Total Assets Turnover X Equity Multiplier 9.8 10.2 10.3 2.14 2.61 3.60 Referring to these data, which of the following conclusions will be true about the companies' ROES? O The main driver of Company A's inferior ROE, as compared with that of Company B's and Company C's ROE, is its use of higher debt financing. O The main driver of Company C's superior ROE, as compared with that of Company A's and Company B's ROE,…arrow_forwardTutorial Questions Explain to John, your mentor, the primary goal of the organization? Your manager is requesting you to provide an explanation to the question. Would the role of a financial manager be likely to increase or decrease in importance if the rate of inflation increased? What is the difference between stock price maximization and profit maximization? What are the three principal forms of business organization? What are the advantages and disadvantages of each? What mechanisms exist to influence managers to act in shareholders’ best interests? What is an agency relationship? What agency relationships exist within a corporation? What are financial intermediaries, and what economic functions do they perform? How does an efficient capital market help to reduce the prices of goods and services? What is the term structure of interest rates? What is a yield curve? How should users and savers of…arrow_forwardDirection: Answer comprehensively the following questions. 1. Explain the shareholder wealth maximization goal of the firm and how it can be measured. Make an argument for why it is better goal than maximizing profit. 2. What conflicts of interest can arise between managers and stockholders? 3. Name and describe as many stockholders as you can. 4. State the kinds of assurances that investors and creditors seek from a firm. 5. What are the three types of financial management decisions? For each type of decision, give an example of a business transaction that would be relevant.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Topic 6 - Financial statement analysis; Author: drdavebond;https://www.youtube.com/watch?v=uUnP5qkbQ20;License: Standard Youtube License