Concept explainers

Prepare Budgeted Financial Statements

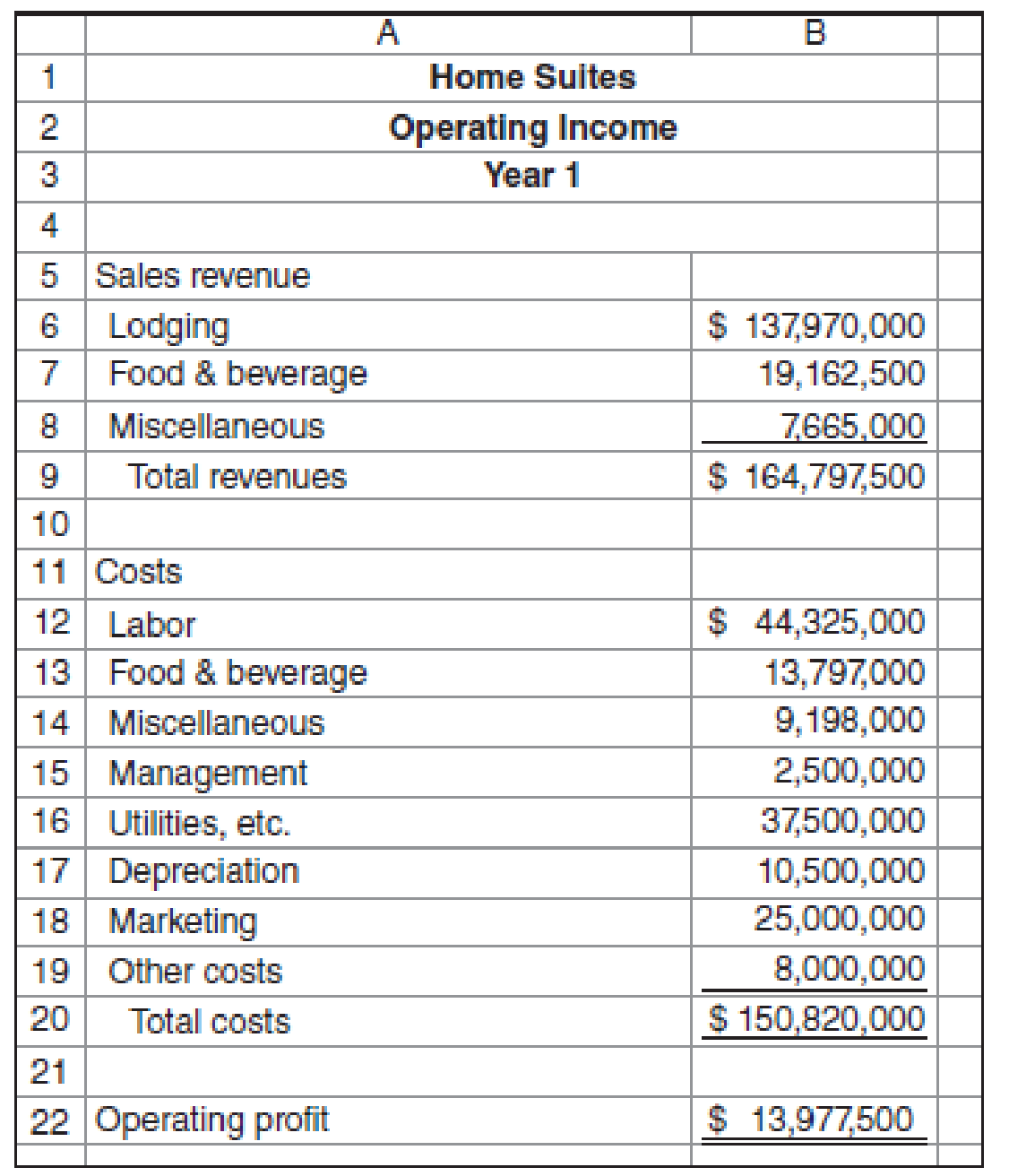

HomeSuites is a chain of all-suite, extended-stay hotel properties. The chain has 15 properties with an average of 200 rooms in each property. In year 1, the occupancy rate (the number of rooms filled divided by the number of rooms available) was 70 percent, based on a 365-day year. The average room rate was $180 for a night. The basic unit of operation is the “night,” which is one room occupied for one night.

The operating income for year 1 is as follows:

In year 1, the average fixed labor cost was $400,000 per property. The remaining labor cost was variable with respect to the number of nights. Food and beverage cost and miscellaneous cost are all variable with respect to the number of nights. Utilities and

At the beginning of year 2, HomeSuites will open three new properties with no change in the average number of rooms per property. The occupancy rate is expected to remain at 70 percent. Management has made the following additional assumptions for year 2:

- The average room rate will increase by 5 percent.

- Food and beverage revenues per night are expected to decline by 20 percent with no change in the cost.

- The labor cost (both the fixed per property and variable portion) is not expected to change.

- The miscellaneous cost for the room is expected to increase by 25 percent, with no change in the miscellaneous revenues per room.

- Utilities and depreciation costs (per property) are

forecast to remain unchanged. - Management costs will increase by 8 percent, and marketing costs will increase by 10 percent.

- Other costs are not expected to change.

Required

Prepare a

Prepare a budgeted income statement for year 2.

Explanation of Solution

Budgeted income statement:

The budgeted income statement shows the overall profit and loss of the business in the budgeted period. It includes the sales revenue and direct and indirect cost of the production to calculate the operating profit of the budgeted period.

Prepare a budgeted income statement:

|

Company H Budgeted Income Statement For year 2 | ||

| Particulars | Amount | Total amount |

| Sales revenue (1): | ||

| Lodging | 173,842,200 | |

| Food & beverage | 18,396,000 | |

| Miscellaneous | 9,198,000 | |

| Total revenue | 201,436,200 | |

| Operating costs: | ||

| Labor (4) | 53,190,000 | |

| Food & beverage (1) | 16,556,400 | |

| Miscellaneous (1) | 13,797,000 | |

| Management (2) | 2,700,000 | |

| Utilities (3) | 45,000,000 | |

| Depreciation (3) | 12,600,000 | |

| Marketing (2) | 27,500,000 | |

| Other costs | 8,000,000 | |

| Total operating cost | 179,343,400 | |

| Operating profit | 22,092,800 | |

Table: (1)

Thus, the operating profit is $22,092,800 for company H for year 2.

Working note 1:

Calculate the revenue and costs for year 2:

| Particulars |

Total nights in a year 2 (8) (a) |

Cost per night (5) (b) |

% change (c) |

Total amount |

| Sales revenue: | ||||

| Lodging | 919,800 | 180 | 1.05 | $173,842,200 |

| Food & beverage | 919,800 | $25 | 0.8 | $18,396,000 |

| Miscellaneous | 919,800 | $10 | - | $9,198,000 |

| Costs: | ||||

| food & beverage | 919,800 | $18 | - | $16,556,400 |

| Miscellaneous | 919,800 | $12 | 1.25 | $13,797,000 |

Table: (2)

Working note 2:

Calculate the management and marketing costs:

| Particulars |

Amount (a) |

% change (b) |

Total amount |

| Costs: | |||

| Management | 2,500,000 | 1.08 | 2,700,000 |

| Marketing | 2,500,000 | 1.1 | 2,750.000 |

Table: (3)

Working note 3:

Calculate the utilities and depreciation:

| Particulars |

Amount (a) |

Number of property in year 1 (b) |

Cost per property |

Number of property in year 2 (d) |

Total cost in year 2 |

| Costs: | |||||

| Utilities | $3,750,000 | 15 | $250,000 | 18 | $4,500,000 |

| Depreciation | $1,050,000 | 15 | $70,000 | 18 | $1,260,000 |

Table: (4)

Working note 4:

Calculate the labor cost:

| Particulars |

Cost per property (a) |

Number of property (b) |

Total nights in a year 2 |

Variable labor cost per night (d) |

Total variable cost |

Total cost |

| Labor cost | $400,000 | 18 | $7,200,000 | 919,800 | $45,990,000 | $53,190,000 |

Table: (5)

Working note 5:

| Particulars |

Amount (a) |

Total nights in a year (7) (b) |

Cost per night |

| Revenue: | |||

| Food & beverage | $19,162,500 | 766,500 | $25 |

| Miscellaneous | $7,665,000 | 766,500 | $10 |

| Costs: | |||

| Food & beverage | $13,797,000 | 766,500 | $18 |

| Miscellaneous | $9,198,000 | 766,500 | $12 |

Table: (6)

Working note 6:

Calculate average variable cost per unit:

| Particulars |

Total fixed labor cost (a) |

Labor cost for year 1 (b) |

Net labor cost |

Total nights in a year (d) |

Cost per night |

| Labor cost | $6,000,000 | $44,325,000 | $38,325,000 | $766,500 | $50 |

Table: (7)

The fixed labor cost per property is $400,000, and there are 15 properties so the total fixed labor cost will be $6,000,000

Working note 7:

Calculate the number of nights for year 1:

|

Number of properties (a) |

Number of rooms in each property (b) |

Days in a year (c) |

Occupancy rate (d) |

Total nights in a year |

| 15 | 200 | 365 | 70% | 766,500 |

Table: (8)

Working note 8:

Calculate the number of nights for year 2:

|

Number of properties (a) |

Number of rooms in each property (b) |

Days in a year (c) |

Occupancy rate (d) |

Total nights in a year |

| 18 | 200 | 365 | 70% | 919,800 |

Table: (9)

Want to see more full solutions like this?

Chapter 13 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- [The following information applies to the questions displayed below.] Phoenix Management helps rental property owners find renters and charges the owners one-half of the first month's rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month's rent of $700. Budgeted cost data per tenant application for 2022 follow: Professional labor: 1.5 hours at $20.00 per hour Credit checks: $50.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $3,000 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $9,500 for 400 hours of professional labor. Credit checks went up to $55 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $3,600. The average first monthly rentals for August 2022 were $800 per apartment unit for 90 units.…arrow_forwardSunrise Suites and Nationwide Inns operate competing hotel chains across the region. Hotel capacity information for both hotels is as follows: Number of Hotels Average Number of Rooms per Hotel Sunrise Suites 120 90 Nationwide Inns 150 76 Information on the number of guests for each hotel and the average length of visit for June were as follows: Number of Guests Average Length of Visit (in Nights) Sunrise Suites 183,600 1.5 Nationwide Inns 228,000 1.2 a. Determine the guest nights for each hotel in June. Guest Nights Sunrise Suites fill in the blank 1 Nationwide Inns fill in the blank 2 b. Determine the room nights for each hotel in June. Room Nights Sunrise Suites fill in the blank 3 Nationwide Inns fill in the blank 4 c. Determine the occupancy rate of each hotel in June. Occupancy Rate Sunrise Suites fill in the blank 5 % Nationwide Inns fill…arrow_forwardPhoenix Management helps rental property owners find renters and charges the owners one-half of the first month's rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month's rent of $1,020. Budgeted cost data per tenant application for 2022 follow: ⚫ Professional labor: 1.5 hours at $20.00 per hour ⚫ Credit checks: $66.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $4,600 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $8,400 for 380 hours of professional labor. Credit checks went up to $71 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $5,200. The average first monthly rentals for August 2022 were $1,120 per apartment unit for 90 units. Required: 1. (a) What is the master budget variance for August 2022?…arrow_forward

- A real estate office handles a 40-unit apartment complex. When the rent is $540 per month, all units are occupied. For each $40 increase in rent, however, an average of one unit becomes vacant. Each occupied unit requires an average of $65 per month for services and repairs. What rent should be charged to obtain a maximum profit.arrow_forwardGrohs Kennel uses tenant-days as its measure of activity; an animal housed in the kennel for one day is counted as one tenant-day. During December, the kennel budgeted for 2,500 tenant-days, but its actual level of activity was 2,530 tenant-days. The kennel has provided the following data concerning the formulas to be used in its budgeting: Fixed Element per Month Variable element per tenant-day Revenue $ 0 $33.00 Wages and salaries $ 3,800 $ 7.90 Food and supplies 1,000 11.60 Facility expenses 8,600 2.20 Administrative expenses 6,200 0.20 Total expenses $19,600 $21.90 The net operating income in the planning budget for December would be closest to: Multiple Choice A. $8,150 B. $11,914 C. $8,483 D. $11,633arrow_forwardRelevant data from Picta Company’s operating budgets are presented below. The company’s financial year ends on 30 June: Equipment was sold in July for $8,000 and $4,500 in November. Dividends of $5,500 were paid in August. The beginning cash balance was $80,395 and a required minimum cash balance per quarter is $60,000. The company has a 15% open line of credit for $70 000 with their bank. Required: a) Use this information to prepare a cash budget for the first two quarters of the year b) Briefly comment on Picta Company’s expected cashflow position in the first two quarters of the year.arrow_forward

- G Curtis Party Rentals offers party equipment such as tents, tables, chairs, and so on for outdoor events. The rental fees average $870 per event. Curtis receives a 15 percent deposit two months before the event, 60 percent the month before, and the remainder on the day the equipment is delivered and set up. Planners at Curtis estimate the following number of events for the last half of the current year: July August September October November December 260 280 330 240 200 230 Required: a. What are the expected revenues for Curtis Party Rentals for each month, July through December? Revenues are recorded in the month of the event. b. What are the expected cash receipts for each month, July through October? Complete this question by entering your answers in the tabs below.arrow_forwardHandy Hardware is a retail hardware store. Information about the store’s operations follows.• November 20x1 sales amounted to $200,000.• Sales are budgeted at $220,000 for December 20x1 and $200,000 for January 20x2.• Collections are expected to be 60 percent in the month of sale and 38 percent in the month following the sale. Two percent of sales are expected to be uncollectible. Bad debts expense is recognized monthly.• The store’s gross margin is 25 percent of its sales revenue.• A total of 80 percent of the merchandise for resale is purchased in the month prior to the month of sale, and 20 percent is purchased in the month of sale. Payment for merchandise is made in the month following the purchase.• Other monthly expenses paid in cash amount to $22,600.• Annual depreciation is $216,000. The company’s balance sheet as of November 30, 20x1, is as follows: Required: Compute the following amounts.1. The budgeted cash collections for December 20x1.2. The budgeted income…arrow_forwardA hotel has 120 rooms. It has 86% occupancy and an average daily rate (ADR) of $125 in April and is forecasting 88% occupancy and an average daily rate (ADR) of $130 for May. Hotel's collection pattern for sales is as follows: 15% of sales are cash and the remaining 85% are invoiced to tour groups. For credit sales, 60% is collected in the month of sale and 40% is collected in the month following the sale. How much is the hotel's forecasted Revenue in May? O a. $452,865 O b. $452,658 Oc $425,856 O d. $425,568arrow_forward

- Phoenix Management helps rental property owners find renters and charges the owners one-half of the first month’s rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month’s rent of $700. Budgeted cost data per tenant application for 2022 follow: Professional labor: 1.5 hours at $20.00 per hour Credit checks: $50.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $3,000 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $9,500 for 400 hours of professional labor. Credit checks went up to $55 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $3,600. The average first monthly rentals for August 2022 were $800 per apartment unit for 90 units. Part 1 (Static) Required: 1. (a) What is the master budget variance…arrow_forwardPhoenix Management helps rental property owners find renters and charges the owners one-half of the first month’s rent for this service. For August 2022, Phoenix expects to find renters for 100 apartments with an average first month’s rent of $960. Budgeted cost data per tenant application for 2022 follow: Professional labor: 1.5 hours at $20.00 per hour Credit checks: $64.00 Phoenix expects other costs, including the lease payment for the building, secretarial help, and utilities, to be $4,400 per month. On average, Phoenix is successful in placing one tenant for every three applicants. Actual rental applications in August 2022 were 270. Phoenix paid $8,500 for 390 hours of professional labor. Credit checks went up to $69 per application. Other costs in August 2022 (lease, secretarial help, and utilities) were $5,000. The average first monthly rentals for August 2022 were $1,080 per apartment unit for 90 units. Required: 1. (a) What is the master budget variance for…arrow_forwardImprovement Station is a national home improvement chain with more than 100 stores throughout the country. The manager of each store receives a salary plus a bonus equal to a percent of the store’s net income for the reporting period. The following net income calculation is on the Denver store manager’s performance report for the recent monthly period. Sales . $2,500,000 Cost of goods sold . 800,000 Wages expense 500,000 Utilities expense 200,000 Home office expense . . . . . . . . . . . . . . 75,000 Net income . $ 925,000 Manager’s bonus (0.5%) $ 4,625 In previous periods, the bonus had also been 0.5%, but the performance report had not included any charges for the home office expense, which is now assigned to each store as a percent of its sales. Required Assume that you are the national office manager. Write a half-page memorandum to your store managers explaining why home office expense is in the new performance report.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub