FUNDAMENTALS OF COST ACCOUNTING

6th Edition

ISBN: 9781266742040

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 13, Problem 36E

Estimate Cash Collections

Ewing Company is preparing a

The remaining 3 percent is not collected and is written off as

Required

What are the estimated cash receipts from accounts receivable collections in September?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Cash budget

The controller of Mercury Shoes Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information:

July

August

$160,000 $185,000 $200,000

66,000 82,000 105,000

51,000

120,000

40,000 46,000

The company expects to sell about 10% of its merchandise for cash. Of sales on account, 60% are expected to be collected in the month following the sale and the remainder the

following month (second month after sale). Depreciation, insurance, and property tax expense represent $12,000 of the estimated monthly manufacturing costs. The annual insurance

premium is paid in February, and the annual property taxes are paid in November. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which

they are incurred and the balance in the following month.

Sales

Manufacturing costs

Selling and administrative expenses

Capital expenditures

June

Current assets as of June 1 include cash of $42,000,…

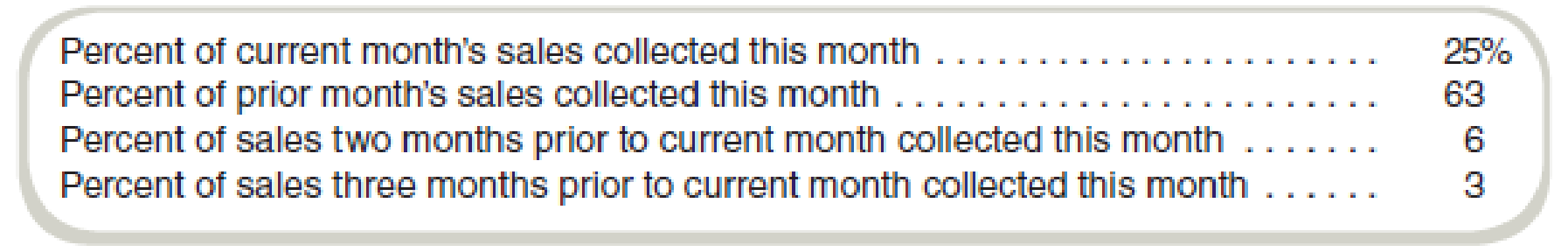

Ewing Company is preparing a cash budget for September. The following information on accounts receivable collections is available

from past collection experience.

Percent of current month's sales collected this month

308

Percent of prior month's sales collected this month

Percent of sales two months prior to current month collected this month

Percent of sales three months prior to current month collected this month

55

10

3

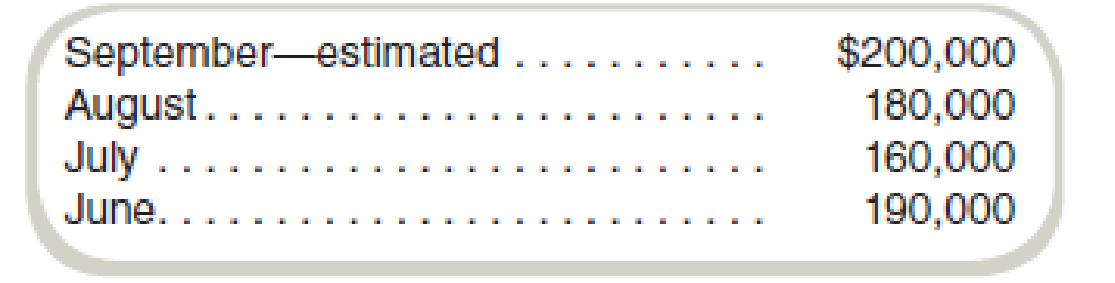

The remaining 2 percent is not collected and is written off as bad debts. Credit sales to date are as follows.

September-estimated

$170,000

153,000

130,000

155,000

August

July

June

Required:

What are the estimated cash receipts from accounts receivable collections in September?

Estimated cash receipts

CASH BUDGET; REQUIRED:

Prepare a schedule showing cash collections during October.

Prepare cash disbursements (payments) during October.

Assuming that company had $150,000 cash balance as of October 1, calculate cash balance as of October 31.

Company’s accounts receivable collection experience is as follows:

Cash collected from current month’s sales; terms 1/10 n/30: 20%

Cash collected from prior month’s sales (no discount) 65%

Cash collected from sales two months ago: 13%

Uncollectible receivables 2%

Company’s estimated credit sales (company has no cash sales):

July $480,000

August 420,000

September 370,000

October 350,000

November 400,000

Company’s…

Chapter 13 Solutions

FUNDAMENTALS OF COST ACCOUNTING

Ch. 13 - Prob. 1RQCh. 13 - Prob. 2RQCh. 13 - Prob. 3RQCh. 13 - What role does the master budget play in the...Ch. 13 - What problems might arise if a firm relies solely...Ch. 13 - What is the coordinating role of budgeting?Ch. 13 - Prob. 7RQCh. 13 - Write out the inventory equation that is used to...Ch. 13 - What makes creating budgets for marketing and...Ch. 13 - Prob. 10RQ

Ch. 13 - Preparing a budget is a waste of time. The...Ch. 13 - In the Business Application feature, Using the...Ch. 13 - Prob. 13CADQCh. 13 - Would the budgeting plans for a company that uses...Ch. 13 - Government agencies are limited in spending by...Ch. 13 - What is the difference between the planning and...Ch. 13 - When might the master budget start with a forecast...Ch. 13 - In some organizations (firms, universities,...Ch. 13 - Our cash budget shows a surplus for the quarter,...Ch. 13 - Your boss asks for your estimate on the costs of a...Ch. 13 - The chapter identified four techniques used for...Ch. 13 - Role of Budgets and Plans

Cosmic Corporation is a...Ch. 13 - Human Element in Budgeting

Roller Partners is a...Ch. 13 - Estimate Sales Revenues Stubs-R-Us is a local...Ch. 13 - Estimate Sales Revenues Friendly Financial has 160...Ch. 13 - Estimate Sales Revenues Larson, Inc., manufactures...Ch. 13 - Estimate Production Levels Offenbach Son has just...Ch. 13 - Estimate Sales Levels Using Production Budgets...Ch. 13 - Estimate Inventory Levels Using Production Budgets...Ch. 13 - Estimate Production Levels: Capacity Constraints...Ch. 13 - Prob. 31ECh. 13 - Estimate Purchases and Cash Disbursements Midland...Ch. 13 - Estimate Purchases and Cash Disbursements Lakeside...Ch. 13 - Estimate Cash Disbursements Cascade, Ltd., a...Ch. 13 - Estimate Cash Collections Minot Corporation is...Ch. 13 - Estimate Cash Collections Ewing Company is...Ch. 13 - Estimate Cash Receipts Scare-2-B-U (S2BU)...Ch. 13 - Estimate Cash Receipts Varmit-B-Gone is a pest...Ch. 13 - Prepare Budgeted Financial Statements

Refer to the...Ch. 13 - Prepare Budgeted Financial Statements Cycle-1 is a...Ch. 13 - Prepare Budgeted Financial Statements Carreras Caf...Ch. 13 - Budgeting in a Service Organization Executive...Ch. 13 - Prob. 43ECh. 13 - Prob. 44ECh. 13 - Prob. 45ECh. 13 - Prob. 46ECh. 13 - Sensitivity Analysis Sanjanas Sweet Shoppe...Ch. 13 - Sensitivity Analysis Classic Limo, Inc., provides...Ch. 13 - Prob. 49ECh. 13 - Prob. 50ECh. 13 - Prepare Budgeted Financial Statements The...Ch. 13 - Prob. 52PCh. 13 - Prepare Budgeted Financial Statements Gulf States...Ch. 13 - Prob. 54PCh. 13 - Prob. 55PCh. 13 - Prepare a Production Budget Haggstrom, Inc.,...Ch. 13 - Sales Expense Budget SPU, Ltd., has just received...Ch. 13 - Budgeted Purchases and Cash Flows Mast Corporation...Ch. 13 - Prepare Budgeted Financial Statements HomeSuites...Ch. 13 - Prob. 60PCh. 13 - Comprehensive Budget Plan Brighton, Inc.,...Ch. 13 - Comprehensive Budget Plan Panther Corporation...Ch. 13 - Budgeted Financial Statements in a Retail...Ch. 13 - Cash Budgets and Sensitivity Analysis in a Retail...Ch. 13 - Prob. 66IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cash collections for Renew Lights found that 65% of sales were collected in the month of sale, 25% was collected the month after the sale, and 10% was collected the second month after the sale. Given the sales shown, how much cash will be collected in March and April?arrow_forwardⒸPR 22-5A Cash Budget Obj. 5 The controller of Bridgeport Housewares Inc. instructs you to prepare a monthly cash budget for the next three months. You are presented with the following budget information: Sales Manufacturing costs Selling and administrative expenses Capital expenditures September $250,000 150,000 42,000 October $300,000 180,000 48,000 Answer Check Figure: November deficiency, $(8,500) 2. November $315,000 185,000 51,000 The company expects to sell about 10% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month following the sale and the remainder the following month (second month following sale). Depreciation, insurance, and property tax expense represent $50,000 of the estimated monthly manufacturing costs. The annual insurance premium is paid in January, and the annual property taxes are paid in December. Of the remainder of the manufacturing costs, 80% are expected to be paid in the month in which they are incurred and the…arrow_forwardCash collections The treasurer of Homeyra Corp. needs to estimate cash collections from accounts receivable for September, October, and November. Forty percent of the company's customers pay in cash and the rest are credit customers. The collection pattern for the credit customers is 20 percent in the month of sale and 80 percent in the following month. Because of Homeyra's established client base, the company experiences almost zero uncollectible accounts. Estimated total sales for August, September, October, and November follow. Month Sales August $78,000 September 80,000 October 95,000 November 91,000 Determine Homeyra Corp.'s cash collections for September, October, and November. Cash Collections: September $ 32,000 x October $ 0 x November $ 0 x Checkarrow_forward

- Cash collections The treasurer of Homeyra Corp. needs to estimate cash collections from accounts receivable for September, October, and November. Forty percent of the company’s customers pay in cash and the rest are credit customers. The collection pattern for the credit customers is 20 percent in the month of sale and 80 percent in the following month. Because of Homeyra’s established client base, the company experiences almost zero uncollectible accounts. Estimated total sales for August, September, October, and November follow. Month Sales August $78,000 September 80,000 October 95,000 November 91,000 Determine Homeyra Corp.’s cash collections for September, October, and November. Cash Collections: September Answer 0 October Answer 0 November Answer 0arrow_forwardAll sales at Alaska Company are on credit. The company is preparing a cash budget for November. The following information on accounts receivable collections is available from customer payment history: Percent of current month's sales collected this month Percent of prior month's sales collected this month Percent of sales two months prior to current month collected this month Percent of sales three months prior to current month collected this month The remaining 2 percent is not collected and is written off as bad debts. Sales to date are as follows: November (estimated) October September August $ 370,000 410,000 340,000 480,000 Required: What are the estimated cash receipts from accounts receivable collections in November? 30% 60 253arrow_forwardPrepare a cash budget for May. (Cash deficiency, repayments and interest should be indicated by a minus sign.) Minden Company Cash Budget For the Month of May Beginning cash balance Add collections from customers Total cash available Less cash disbursements: Purchase of inventory Selling and administrative expenses Purchases of equipment Total cash disbursements Excess of cash available over disbursements Financing: Borrowing-note Repayments-note Interest Total financing Ending cash balance $ 0 0 0 0 0arrow_forward

- Carmen is a retailer of scrapbooking products. The sales forecast for the coming months is: Revenues April May $ 253,000 $ 272,000 $ 299,000 $ 346,000 $ 355,000 June July August Carmen's sales are 60% cash and 40% store credit. The credit sales are collected 60% in the month of sale, the remainder the following month. Accounts receivable on April 1 are $34,000. Carmen's cost of sales averages 65% of revenues. The inventory policy is to carry 30% of next month's sales needs. April 1 inventory will be as expected under the policy. Carmen pays for purchases 40% in the month of purchase and 60% the following month. Accounts payable on April 1 is $133,000. a. Prepare a purchases budget for as many months as is possible. April May June July August Sales Cost of Sales Percentage % % Cost of Sales Ending Inv Beginning Inv Purchasesarrow_forwardJim Daniels Health Products has eight stores. The firm wants to expand by two more stores and needs a bank loan to do this. Mr. Hewitt, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. Following are actual and forecasted sales figures: Actual November December $420,000 January 440,000 February March Forecast Additional Information $500,000 April forecast $550,000 540,000 560,000 of the firm's sales, 40 percent are for cash and the remaining 60 percent are on credit. Of credit sales, 30 percent are paid in the month after sale and 70 percent are paid in the second month after the sale. Materials cost 35 percent of sales and are purchased and received each month in an amount sufficient to cover the current month's expected sales. Materials are paid for in the month they are received. Labour expense is 45 percent of sales and is paid in the month of sales. Selling and administrative expense is 4 percent of…arrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 87,500 September 91,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: $fill in the blank 1 × fill in the blank 2 % $fill in the blank 3 $fill in the blank 4 July: $fill in the blank 5 × fill in the blank…arrow_forward

- Ewing Company is preparing a cash budget for September. The following information on accounts receivable collections is available from past collection experience. Percent of current month’s sales collected this month 20 % Percent of prior month’s sales collected this month 57 Percent of sales two months prior to current month collected this month 12 Percent of sales three months prior to current month collected this month 8 The remaining 3 percent is not collected and is written off as bad debts. Credit sales to date are as follows. September—estimated $ 280,000 August 252,000 July 240,000 June 286,000 Required: What are the estimated cash receipts from accounts receivable collections in September?arrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 86,800 September 91,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers.arrow_forwardPreparing a Schedule of Cash Collections on Accounts Receivable Kailua and Company is a legal services firm. All sales of legal services are billed to the client (there are no cash sales). Kailua expects that, on average, 20% will be paid in the month of billing, 50% will be paid in the month following billing, and 25% will be paid in the second month following billing. For the next 5 months, the following sales billings are expected: May $84,000 June 100,800 July 77,000 August 87,800 September 93,000 Required: Prepare a schedule showing the cash expected in payments on accounts receivable in August and in September. If an amount box does not require an entry, leave it blank or enter "0". Be sure to enter percentages as whole numbers. Kailua and Company Schedule August September June: $fill in the blank 1 × fill in the blank 2 % $fill in the blank 3 $fill in the blank 4 July: $fill in the blank 5 × fill in the blank…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

The management of receivables Introduction - ACCA Financial Management (FM); Author: OpenTuition;https://www.youtube.com/watch?v=tLmePnbC3ZQ;License: Standard YouTube License, CC-BY