Advanced Accounting

7th Edition

ISBN: 9781119373209

Author: JETER, Paul K. Chaney

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 9P

Consider the following information:

- 1. On December 1. 2011. a U.S. firm plans to sell a piece of equipment [with an asking price of 200,000 units of a foreign currency FC)] during January of 2012. The transaction is probable, and the transaction is to the denominated in euros.

- 2. The company enter into a forward contract on December 1. 2011 to sell 200.000 FC on February 1, 2012. for $1.02.

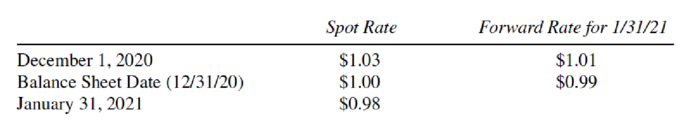

- 3. Spot rates and the forward rates for January 31, 2012. settlement were as follows (dollars per mum):

- 4. spot January 31, the equipment was sold for 200,000(K) [C. The cost of the equipment was 5170.000.

Required:

- A. Prepare all

journal entries needed on December 1, December 31, January 31, and February 1 to account for theforecasted transaction. the forward contract, and the transaction to sell the equipment. - B. Prepare any entry needed on February 1 to reclassify amounts from other accumulated comprehensive income into earnings.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

[Cross Currency Arbitrage] According to the

data below calculate the cross currency

arbitrage opportunity. What is the minimum

FWD exchange rate which would offer an

arbitrage gain?

On February 9, 2021

USD/TRY 7.0852 – 7.0878

FWD USD/TRY 1221 8.1500 – 8.1600

(settlement on December 31st )

Interest rate for TRY 17.2500 – 18.1116

Interest rate for USD 0.30628 – 0.30648

To minimize the risk from exchange rate because the U.S. firm is going to receive euro 100,000 in 90 days, the firm can _____.

A.

obtain a 90-day forward purchase contract on euros

B.

obtain a 90-day forward sale contract on euros

C.

sell euros 90 days from now at the spot rate

D.

purchase euros 90 days from now at the spot rate

DO NOT USE AI TO COMPLETE

An investor enters today into a one-year-long currency forward on 1000000 units of foreign currency. The current exchange rate is 1.05 dollars per Swiss franc. Interest rates in the US and Switzerland are 3% and 4% per annum, respectively, with continuous compounding.

A. What should be the delivery price for this contract?

B. Explain the transactions that will occur at maturity if the spot exchange rate at that moment is1.03 dollars per Swiss franc

Chapter 12 Solutions

Advanced Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Economics Suppose that the exchange rates between euro, U.S. dollar and the yen are given in the table below. Explore the possibility of three-point arbitrage between these currencies once you have $1,000,000. Bid Ask USD/EUR 1.3183 1.3196 USD/JPY 0.01009 0.010102 EUR/JPY 0.00758 0.00763 a. It is possible to have a loss of 10818.25 USD b. It is possible to have a loss of 10067.91 USD C. It is possible to make a profit of 3322 USD Od. It is possible to make a profit of 2131 USDarrow_forwardQUESTION It is 1 June, and DML Ltd. is anticipating payment of GBP100,000 to a British supplier in two months’ time. The spot GBPGHS exchange rate is currently GHS5.2110 – GHS5.2260 = GBP1. Pundits are suggesting that the cedi might weaken against the pound sterling in the coming months. The directors of the company are considering hedging against potential currency risk using either forward market transaction or money market transactions. Below are information relating to instruments in the two markets. Forward market (contract specifications): 2-month forward bid rate on 1 June: GHS5.2340 = GBP1 2-month forward ask rate on 1 June: GHS5.2490 = GBP1 Money market (annualized interest rates on 1 June): Investing rate Borrowing rate Ghana 24.0% 28.0% United Kingdom 2.4%…arrow_forward10. Using foreign exchange derivatives Mobile Insurance Company (a U.S.-based company) plans to invest about $30 million in Korean won 6 months from now. If Mobile Insurance Company is concerned that the Korean won will depreciate against the dollar by the time of the purchase, a won forward contract would benefit the company.arrow_forward

- 5. A U.S. firm expects a receivable (cash inflow) of €1,000,000 in six months. The current exchange rate is $1.125/€. Firm wants to sell euros in six months (to convert the inflow into dollars). Consider 3 possible spot prices in six months. 1. $1.195/€ 2. $1.100/€ 3. $1.025/€ What kind of option, put or call, is appropriate to hedge with? In each scenario, what is the total amount of the firm's NET receivable? NET receivable implies you should consider the receivable as well as the hedging costs of buying the option. (Assume an option exercise price of $1.130/€ and option premium of $.016/€) | 1. 2. 3.arrow_forwardWhat are the expected U.S. dollars UCD ends up receiving for its 250,000 euro receivable based on its exchange rate forecasting given below? Scenario Spot Exchange Rate One Year Later Probability 1 $1.14 15% 2 $1.17 60% 3 $1.20 25%arrow_forwardB Lakonishok Equipment has an investment opportunity in Europe. The project costs €15,250,000 and is expected to produce cash flows of €3,850,000 in Year 1, €4,850,000 in Year 2, and €5,250,000 in Year 3. The current spot exchange rate is $.78/€ and the current risk-free rate in the United States is 2.6 percent, compared to that in euroland of 2.2 percent. The appropriate discount rate for the project is estimated to be 12 percent, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €9,750,000. What is the NPV of the project in U.S. dollars? (Do not found intermediate calculations and enter your answer in dollars, not in millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) Answer is complete but not entirely correct. $ 525,486,652 40 NPVarrow_forward

- QUESTION 1 On May 19, 2020, Marchand, Inc. sells its hockey pucks to a Mexican hockey team and expects to receive 10 million Mexican pesos one year later. The company does not want to incur any foreign exchange risk, so it decides to hedge through the money market. The one-year risk-free rate in Mexico is 10%; the one-year risk free rate in the US is 5%. The spot exchange rate on May 19, 2020 is 20 pesos=1 dollar (or MXN20=USD1). To initiate the hedging process, the company borrows. 2020). Note: figures may be approximations. _on May 19, 2020. It then uses that amount to buy on the same day (May 19, O a. MXN11%; USD550,000 Ob. MXN10%; USDS00,000 O c. MXN10.1m; USD555,000 d. MXN9.1m; USD455,000 O e. USD500,000; MXN10m QUESTION 2 Question 1. On May 19, 2020, Marchand, Inc. sells its hockey pucks to a Mexican hockey team and expects to receive 10 million Mexican pesos one year later. The company does not want to incur any foreign exchange risk, so it decides to hedge through the money…arrow_forwardGive typed solution only In January 2023, the exchange rate between Euro (€) and U.S. dollar ($) is $0.99/€.The nominal interest rate for the E.U. and U.S for the next 1-year period is 11%and 8%, respectively. Also, the real interest rate for the E.U. and U.S for the next1-year period is 5% and 6%, respectively. What would you forecast the exchangerate to be at around January 2024?arrow_forwardSuppose you, a German importer, expect to pay $1 million in 90 days for taking delivery of import goods from a U.S. exporter. St = $1.14/€; Ft, k = $1.16/€, where k =90 days. If St+k = $1.15/€, what would be the gain or loss from the forward hedge relative to remaining unhedged?arrow_forward

- You have bid for a possible export order that would provide a cash inflow of €1 million in 6 months. The spot exchange rate is USD1.31 = EUR1, and the 1-year forward rate is USD1.29 = EUR1. There are two sources of uncertainty: (i) The euro could appreciate or depreciate, and (i) you may or may not receive the export order. Fill in the following table to illustrate in each case the profits or losses that you would make if you sell €1 million forward by filling in the following table. Assume that the exchange rate in 1 year will be either USD1.21 = EUR1 or USD1.41 = EUR1. (Negative values should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Total Profit/Loss (in millions) Spot Rate Receive Order Lose Order USD1.21 = EUR1 USD1.41 = EUR1arrow_forwardA U.S. firm holds an asset in France and faces the following scenario: Probability Spot rate P* P State 1 25% State 2 25% State 3 25% $ 1.35 per euro € 1,500 $ 1.25 per euro € 1,400 $ 1.15 per euro € 1,300 $ 1,860 $ 1,600 $ 1,330 State 4 25% $ 1.05 per euro € 1,200 $ 1,110 In the above table, P* is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset. Required: a. Compute the exchange exposure faced by the U.S. firm. b. What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure? c. If the U.S. firm hedges against this exposure using a forward contract, what is the variance of the dollar value of the hedged position? a. Exposure b. Variance C. Variancearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business Analytics

Statistics

ISBN:9781285187273

Author:Camm, Jeff.

Publisher:Cengage Learning,

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License