Advanced Accounting

7th Edition

ISBN: 9781119373209

Author: JETER, Paul K. Chaney

Publisher: WILEY

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 1P

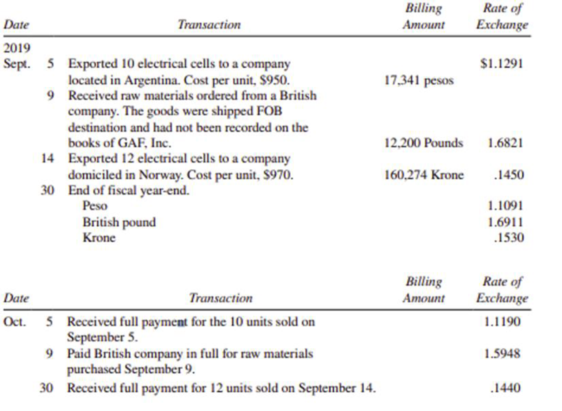

GAF manufactures electrical cells at its St. Louis facility. The company’s fiscal year-end is September 30. It has adopted the perpetual inventory cost flow method to control inventory costs. The company entered into the following transact ions during the month of September. All exchange rates are direct quotations.

Required:

A. Prepare the journal entries rt.-spired on the books of GAF to record the transactions and year-end adjustments. Round all computations to the nearest dollar.

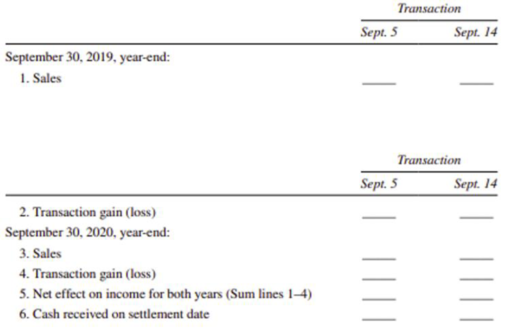

B. Based on the two exporting transactions limed above. complete the following table.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ces

C

Required information

The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. For specific identification,

ending inventory consists of 230 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase,

and 45 are from beginning inventory.

Date

Activities

January 1 Beginning inventory

January 10 Sales

January 20

January 25

January 30

Specific Id

Purchase

Sales

Purchase

Totals

Complete this question by entering your answers in the tabs below.

Weighted

Average

a) Specific Identification

Beginning inventory

Purchases:

January 20

January 30

Total

Required:

Assume the periodic inventory system is used. Determine the cost assigned to ending inventory and to cost of goods sold using (a)

specific identification, (b)weighted average, (c) FIFO, and (d) LIFO:

FIFO

Units Acquired at Cost

155 units. @ $ 6.00

75 units

@

$ 5.00

180 units

410 units

LIFO

# of units

Cost…

Journalizing Sales and Purchase-Related Transactions

Detoya Distributors and Naranjo Retailers engaged in the following transactions during the month of November 2020:

November

4

Detoya sold merchandise on account to Naranjo, P162,000.

Terms: FOB Destination; 2/10, n/30. Freight charges

amounted to P2,000.

5

Detoya sold merchandise on account to Naranjo, P710,000.

Terms: FOB Shipping pint; 2/10, n/30. Freight charges

amounted to P8,000.

6

Naranjo paid freight charges on the purchase of November 5.

7

Detoya received returned merchandise from Naranjo in the

amount of P12,000 from the November 4 sale.

9

Detoya received payment from Naranjo for the November 4.

10

Detoya paid the transportation charges on the November 4 shipment.

12

Detoya received payment from Naranjo for the November 5

transaction.

18

Detoya sold merchandise on account to Naranjo, P250,000.

Terms:…

Instructions

The following selected transactions were completed by Betz Company during July of the current year. Betz Company uses the net method under a

perpetual inventory system.

July

1

Purchased merchandise from Sabol Imports Co., $13,377, terms FOB destination, n/30.

3

Purchased merchandise from Saxon Co., $10,650, terms FOB shipping point, 2/10, n/eom. Prepaid

freight of $230 was added to the invoice.

Purchased merchandise from Schnee Co., $14,350, terms FOB destination, 2/10, n/30.

Issued debit memo to Schnee Co. for merchandise with an invoice amount of $5,000 returned from

purchase on July 5.

13

Paid Saxon Co. for invoice of July 3.

14

Paid Schnee Co. for invoice of July 5, less debit memo of July 6.

19

Purchased merchandise from Southmont Co., $25,850, terms FOB shipping point, n/eom.

19

Paid freight of $430 on July 19 purchase from Southmont Co.

20

Purchased merchandise from Stevens Co., $23,000, terms FOB destination, 1/10, n/30.

30

Paid Stevens Co. for invoice of July 20.…

Chapter 12 Solutions

Advanced Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- X Company accepts goods on consignment from C Company, and also purchases goods from P Company during the current month. X Company plans to sell the merchandise to customers during the following month. In each of these independent situations, who owns the merchandise at the end of the current month, and should therefore include it in their companys ending inventory? Choose X, C, or P. A. Goods ordered from P, in transit, with shipping terms FOB destination. B. Goods ordered from P, in transit, with shipping terms FOB shipping point. C. Goods ordered from P, inventory in stock, held in storage until floor space is available. D. Goods ordered from C, inventory in stock, set aside for customer pickup and payments to finalize sale.arrow_forwardPurchase-related transactions using periodic inventory system Selected transactions for Niles Co. during March of the current year are listed in Problem 5-1B. Instructions Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.arrow_forwardPurchase-related transactions using perpetual inventory system The following selected transactions were completed by Niles Co. during March of the current year: Instructions Journalize the entries to record the transactions of Niles Co. for March.arrow_forward

- Journal Entries Mead Company uses a perpetual inventory system and engaged in the following transactions during the month of May: Required: Record the preceding transactions in a general journal.arrow_forwardPeriodic Inventory System Raynolde Company uses a periodic inventory system. At the end of the year, the following information is available: Required: Prepare a schedule to compute Raynoldes cost of goods sold.arrow_forwardSelected transactions for Niles Co. during March of the current year are listed in Problem 6-1B. Instructions Journalize the entries to record the transactions of Niles Co. for March using the periodic inventory system.arrow_forward

- Perpetual versus Periodic Inventory Systems Howard, Inc. is a merchandising company that began operations on January 1, 2019. During January, the following inventory transactions occurred: Required: 1. Assume that Howard uses a perpetual inventory system. Prepare the journal entries to record the January inventory transactions. 2. Assume that Howard uses a periodic inventory system. Prepare the journal entries to record the January inventory transactions. Be sure to include any adjusting entries necessary. 3. Next Level Howards CEO states that a perpetual inventory system would result in a better inventory valuation. Evaluate this statement and provide a discussion of the benefits of each type of inventory system.arrow_forwardInventory by three cost flow methods Details regarding the inventory of appliances on January 1, 20Y7, purchases invoices during the year, and the inventory count on December 31. 2O’7. of Amsterdam Appliances are summarized as follows: Instructions Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardSales and purchase-related transactions using perpetual inventory system The following were selected from among the transactions completed by Essex Company during July of the current year: Instructions Journalize the transactions.arrow_forward

- Sales and purchase-related transactions using perpetual inventory system The following were selected from among the transactions completed by Babcock Company during November of the current year: Instructions Journalize the transactions.arrow_forwardRecording Sales Transactions Jeet Company and Reece Company use the perpetual inventory system. The following transactions occurred during the month of April: On April 1, Jeet purchased merchandise on account from Reece with credit terms of 2/10, n/30. The selling price of the merchandise was $3,100, and the cost of the merchandise sold was $2,225. On April 1, Jeet paid freight charges of $250 cash to have the goods delivered to its warehouse. On April 8, Jeet returned $800 of the merchandise. The cost of the merchandise returned was $500. On April 10, Jeet paid Reece the balance due. Required: Prepare the journal entries to record these transactions on the books of Reece Company. For a compound transaction, if those boxes in which no entry is required, leave the box blank.arrow_forwardPurchase-related transactions using perpetual inventory system The following selected transactions were completed by Niles Co. during March of the current year: Mar. 1. Purchased merchandise from Haas Co., $43,250, terms Freight terms in which the buyer pays the transportation costs from the shipping point to the final destination.FOB shipping point, 2/10, n/eom. Prepaid freight of $650 was added to the The bill that the seller sends to the buyer.invoice. 5. Purchased merchandise from Whitman Co., $19,175, terms Freight terms in which the seller pays the transportation costs from the shipping point to the final destination.FOB destination, n/30. 10. Paid Haas Co. for invoice of March 1. 13. Purchased merchandise from Jost Co., $15,550, terms FOB destination, 2/10, n/30. 14. Issued A form used by a buyer to inform the seller of the amount the buyer proposes to debit to the account payable due the seller.debit memo to Jost Co. for merchandise with an invoice amount of $3,750…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License