Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

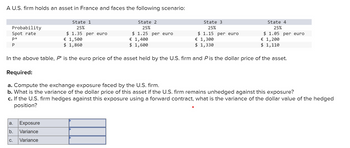

Transcribed Image Text:A U.S. firm holds an asset in France and faces the following scenario:

Probability

Spot rate

P*

P

State 1

25%

State 2

25%

State 3

25%

$ 1.35 per euro

€ 1,500

$ 1.25 per euro

€ 1,400

$ 1.15 per euro

€ 1,300

$ 1,860

$ 1,600

$ 1,330

State 4

25%

$ 1.05 per euro

€ 1,200

$ 1,110

In the above table, P* is the euro price of the asset held by the U.S. firm and P is the dollar price of the asset.

Required:

a. Compute the exchange exposure faced by the U.S. firm.

b. What is the variance of the dollar price of this asset if the U.S. firm remains unhedged against this exposure?

c. If the U.S. firm hedges against this exposure using a forward contract, what is the variance of the dollar value of the hedged

position?

a.

Exposure

b.

Variance

C.

Variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prblmarrow_forwardA U.S. firm holds an asset in Israel and faces the following scenario: Probability Spot rate Pº O121.971 12,898.00 1,289.80 State 1 O-52.6316 40% $ IS 0.30 /IS 1,000 State 2 35% $ IS 0.20 /IS 2,500 State 3 25% Where P= Israeli shekel (IS) price of the asset held by the U.S. firm. The "exposure" (i.e.. the regression coefficient beta) is $ 0.15 /IS IS 1.500arrow_forwardA U.S. firm holds an asset in Great Britain and faces the following scenario: State State 2 State 3 1 Probability 25% 50% 25% Spot rate $2.2/E $2/£ $1.8/E P" £3000 £2500 £2000 $6600 $5000 $3600 P where, P-Pound sterling price of the asset held by the U.S. firm P-Dollar price of the same asset The firm should the foreign currency risk. (buy/sell) forward of E at the prevailing 1-year forward price to hedgearrow_forward

- Consider the following international investment opportunity. It involves a gold mine that can be opened at a cost, then produces a positive cash flow, but then requires environmental clean-up. Year 0 + -€64,000 Year 1 Year 2 €160,000 -€100,000 The current exchange rate is $1.60 = €1.00. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent. Find the euro-zone cost of capital. Write it down in percent with two decimals places.arrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €18,406,730 and is expected to produce cash flows of €3,681,369 in Year 1, €4,992,682 in Year 2, and €6,337,782 in Year 3. The current spot exchange rate is $1.23/€ and the current risk-free rate in the United States is 3.71%, compared to that in Europe of 3.03%. The appropriate discount rate for the project is estimated to be 10.55%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €12,529,609. What is the NPV of the project?arrow_forwardi need help with this problem i know the answer is 5.86 i just need help on how to do it step by steparrow_forward

- Lakonishok Equipment has an investment opportunity in Europe. The project costs €20,065,563 and is expected to produce cash flows of €3,524,370 in Year 1, €4,549,121 in Year 2, and €5,590,740 in Year 3. The current spot exchange rate is $1.38/€ and the current risk-free rate in the United States is 3%, compared to that in Europe of 3.08%. The appropriate discount rate for the project is estimated to be 11.07%, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €13,733,917. What is the NPV of the project?arrow_forwardAssume the following information: 90-day U.S. interest rate 90-day Malaysian interest rate 3% 5% 90-day forward rate of Malaysian ringgit Spot rate of Malaysian ringgit $0.394 $0.398 Assume that the Santa Barbara Co. in the United States will need 250,000 ringgit in 90 days. It wishes to hedge this payables position. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated costs for each type of hedge. Do not round intermediate calculations. Round your answers to the nearest dollar. The firm will pay out $ in 90 days if it uses the forward hedge and $ if it uses the money market hedge. Thus, it should use the -Select- hedge.arrow_forwardProblem 19-4 (Algo) Required: Suppose a U.S. investor wishes to invest in a British firm currently selling for £33 per share. The investor has $66,000 to invest, and the current exchange rate is $2/£. Consider three possible prices per share at £31, £36, and £41 after 1 year. Also, consider three possible exchange rates at $1.60/£, $2/£, and $2.40/£ after 1 year. Calculate the standard deviation of both the pound- and dollar- denominated rates of return if each of the nine outcomes (three possible prices per share in pounds times three possible exchange rates) is equally likely. (Do not round intermediate calculations. Round your percentage answers to 2 decimal places.) X Answer is complete but not entirely correct. Standard deviation of pound-denominated return Standard deviation of dollar-denominated return 12.37 19.68 %arrow_forward

- An international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: Base price level 100 Current U.S. price level 105 Current South African price level 111 Base rand spot exchange rate $ 0.194 Current rand spot exchange rate $ 0.177 Expected annual U.S. inflation 7 % Expected annual South African inflation 5 % Expected U.S. one-year interest rate 10 % Expected South African one-year interest rate 8 % Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively): a. The current ZAR spot rate in USD that would have been forecast by PPP. (Do not round intermediate calculations. Round your answer to 4 decimal places.) b. Using the IFE, the expected ZAR spot rate in USD one year from now. (Do not round intermediate calculations.…arrow_forwardLakonishok Equipment has an investment opportunity in Europe. The project costs €14,750,000 and is expected to produce cash flows of €3,350,000 in Year 1, €4,350,000 in Year 2, and €4,750,000 in Year 3. The current spot exchange rate is $.83/€ and the current risk-free rate in the United States is 3 percent, compared to that in euroland of 2.2 percent. The appropriate discount rate for the project is estimated to be 10 percent, the U.S. cost of capital for the company. In addition, the subsidiary can be sold at the end of three years for an estimated €9,250,000. What is the NPV of the project in U.S. dollars? (Round 2 decimal places) NPV : Sarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education