Concept explainers

1)

Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

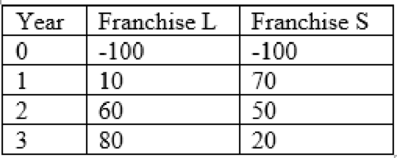

Here are the net cash flows (in thousand $)

To determine: The payback period and its meaning.

2)

To determine: The rationale for the payback period technique and the franchise or franchises must be accepted if the company’s supreme acceptable payback is 2 years and is both franchises are independent or mutually exclusive.

3)

To determine: The variance among the regular and discounted payback periods.

4)

To determine: The main demerit of discounted payback and the payback method of real usefulness in capital budgeting decisions.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management

- Define the term “net present value (NPV).” What is each franchise’s NPV? What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? Would the NPVs change if the cost of capital changed?arrow_forwardOver what range of discount rates would the company choose Project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.arrow_forwardsible If you want to buy a business that is growing rapidly, what is the best valuation method to use to determine a fair price for it? O A. Pay-back method OB. Book value method OC. Future earnings method OD. Market-based approacharrow_forward

- c. (1) Define the term net present value (NPV). What is each franchises NPV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? (3) Would the NPVs change if the cost of capital changed?arrow_forward1.a) What are the issues that a finance manager considers in taking investment decision? b) Suppose a finance manag er believes on maximization of profit, do you agree with the philosophy? If not, what are the reasons? c)A lessor expects some benefits from a lease contract. Explain some benefits. 3. 3 4arrow_forwardHow can sales and lease contracts be effectively structured to align incentives and maximize long-term profitability for both the seller and the lessee?arrow_forward

- Garcia Real Estate is involved in commercial real estate ventures throughout the United States, Some of these ventures are much riskier than other ventures because of market conditions in different regions of the country. If Garcia does not risk-adjust its discount rate for specific ventures properly, which of the following is likely to occur over time? Check all that apply. The firm could potentially reject projects that provide a higher rate of return than the company should require. The firm will increase in value. The firm's overall risk level will increase. How do managers typically deal with within-firm risk and beta risk when they are evaluating a potential project? Quantitatively O Subjectively Consider the case of another company. Turnkey Printing is evaluating two mutually exclusive projects. They both require a $5 million investment today and have expected NPVS of $1,000,000. Management conducted a full risk analysis of these two projects, and the results are shown below.…arrow_forwardKabriel Company must choose between two assets purchases. The annual rate of return and related probabilities given below summarize the firm’s analysis. i. Calculate the expected return ii. Compute the standard deviation of the expected return iii. Which asset should this company select? Justify your answer.arrow_forwardDefine the term “net present value (NPV).”What is each franchise’s NPV?arrow_forward

- The project is accepted اخترأحد الخيارات a. If the profitability index is zero b. if the profitability index is less than one c. If the profitability index is greater than hundred d. If the profitability index is negative e. None of the option What is the limitation of Traditional approach of Financial Management? اخترأحد الخيارات a. All of the option b. More emphasis on long term problems c. Ignores allocation of resources d. One-sided approacharrow_forwardShould companies bid for a project with a price under the "project bid price"? No, this will not make financial sense. It depends on the project payback time. Yes, because they will still have positive profits.arrow_forwardPlease define the factors affecting the duration of planning period of the economic institute - Please define the indifference curve (exchange) risk - return with drawing figure - Please explain two characteristics of the maximum of minimum profits criterion (Maximin method)arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning