Concept explainers

a)

Case summary:

Person X is graduated from large university. He desired to become an entrepreneur. After death of his grandfather he got a business worth of $1million. Then he decided to buy minimum one franchise in the area of fast foods.an issue behind is that he will sell off investment after 3 years and go on to something else.

Person X has two alternatives franchise L and franchise S. Franchise L providing breakfast and lunch while franchise S is providing only dinner. Person X made evaluation of each franchise and find out that both have characteristics of risk and needs

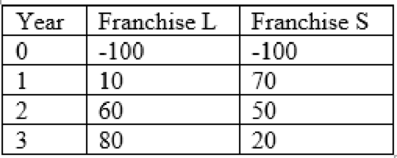

Here are the net cash flows (in thousand $)

To determine: The

b)

To determine: The franchise or franchises would be accepted when they are independent and mutually exclusive and whether the answer is accurate at any cost of capital fewer than 23.6%.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Intermediate Financial Management

- Define the term “net present value (NPV).” What is each franchise’s NPV? What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? Would the NPVs change if the cost of capital changed?arrow_forwardWhat does the profitability index (PI) measure? What are the PIs of Franchises S and L?arrow_forward(1) What is the payback period? Find the paybacks for Franchises L and S. (2) What is the rationale for the payback method? According to the payback criterion, which franchise or franchises should be accepted if the firms maximum acceptable payback is 2 years and if Franchises L and S are independent? If they are mutually exclusive? (3) What is the difference between the regular and discounted payback periods? (4) What is the main disadvantage of discounted payback? Is the payback method of any real usefulness in capital budgeting decisions?arrow_forward

- c. (1) Define the term net present value (NPV). What is each franchises NPV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? (3) Would the NPVs change if the cost of capital changed?arrow_forwardAn investor is consider four different opportunities, A, B, C, or D. The payoff for each opportunity will depend on the economic conditions, represented in the payoff table below. Economic Condition Investment Poor Average Good Excellent (S1) (S2) (S3) (S4) A 50 75 20 30 B 80 15 40 50 C -100 300 -50 10 D 25 25 25 25 What decision would be made under minimax regret?arrow_forwardCalculate for both projects A and B the:(a) Payback period; (b) Net Present Value (NPV); (c) Internal Rate of Return (IRR); (d) State which project you would recommend to Dreamon Corporation if ONE project can be selected (i.e. mutually exclusive). Give reason to support your decision.arrow_forward

- sible If you want to buy a business that is growing rapidly, what is the best valuation method to use to determine a fair price for it? O A. Pay-back method OB. Book value method OC. Future earnings method OD. Market-based approacharrow_forwardOver what range of discount rates would the company choose Project A? Project B? At what discount rate would the company be indifferent between these two projects? Explain.arrow_forwardConsider two investment opportunities A and B. Investment A: Expected return = 0.08, Standard deviation = 0.06 Investment B: Expected return = 0.24, Standard deviation = 0.08 Which investment would you choose A or B? Provide the rationale behind your decision. b. If company is selecting projects with the negative NPV, what impact this decision would have on the share price of the company c. While forecasting future sales, internal sales forecast is more appropriate or external sales forecast? d. Why are dividends the basis for the valuation of common stock? e. When the constant growth dividend valuation model is used to explain a stock's current price, the quantity (ke - g) represents the expected dividend yield. Is this statement right or wrong? Explain.arrow_forward

- A company is considering two alternative investment projects both of which have a positive net present value. The projects have been ranked on the basis of both net present value (NPV) and internal rate of return (IRR). The result of the ranking is shown below: Project A Project B NPV 1st 2nd IRR 2nd 1st Discuss any four (4) potential reasons why the conflict between the NPV and IRR ranking may have arisen B. Kumi Ltd is considering an investment in a project, which requires immediate payment of GHS15,000, followed by a further investment of GHS5,400 at the end of the first year. The subsequent return phase net cash inflows are expected to arise at the end of the following years: Year 1 2 3 4 5 Cash inflow (GHS) 6,500 7,750 5,750 4,750 3,750 You are required to estimate the internal rate of return of this project assuming the company’s cost of capital of 16%.arrow_forwardExplain how you would evaluate the expected rate of return from the investment (purchasing a company) and the method to evaluate the investment decision. Assess the disadvantages and advantages of the investment method and why the method would provide the most accurate measure for the anticipated rate of return requirement. Justify your recommendation.arrow_forwardAssuming yourself to be Anna, narrate what you would have read in the file. Your narrative should include answers to the following: Note: 1 Retention ratio = 1 – Dividend payout ratio d) If Chatterbox Inc. switches to the new dividend policy, what would be the DPS for the next period?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning