Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 19, Problem 17E

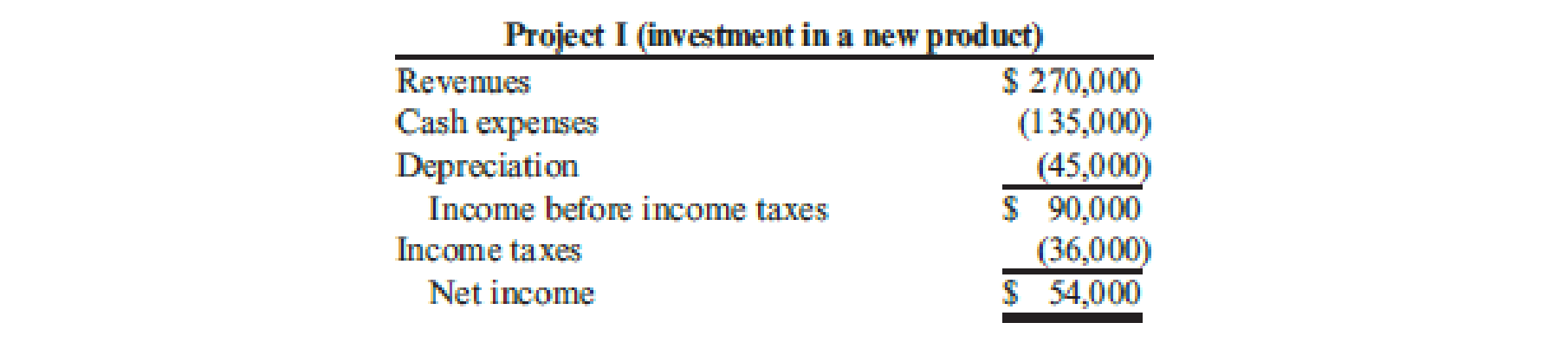

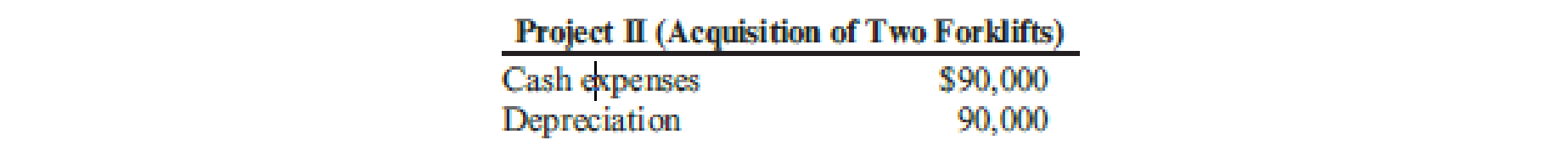

Postman Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of forklifts for the Materials Handling Department. The projected annual operating revenues and expenses are as follows:

Required:

Compute the after-tax cash flows of each project. The tax rate is 40 percent and includes federal and state assessments.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Jacob’s Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year’s capital budget. The projects are independent. The cash outlay for the truck is $39,500, and that for the pulley system is $94,800. The firm’s cost of capital is 14%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1

$12,500

$31,000

2

12,500

31,000

3

12,500

31,000

4

12,500

31,000

5

12,500

31,000

Requirements:

Calculate the IRR, the NPV, Payback and Discounted Payback Periods for each project and indicate the correct accept/reject decision for each.

2. You are the project manager for Becker Enterprises, LTD. and have been asked to analyze two alternatives for the company’s newest plastics The two alternatives, A and B, will perform the same task, but Alternative A will cost $80,000 to purchase while Alternative B will cost only $55,000. Moreover, the two alternatives…

Edelman Engineering is considering including two pieces of equipment, a truck and an overhead pulley system, in this year's capital budget. The projects are independent. The cash outlay for the truck is $17,100, and that for the

pulley system is $22,430. The firm's cost of capital is 14%. After-tax cash flows, including depreciation, are as follows:

Year

Truck

Pulley

1.

$5,100

$7,500

5,100

7,500

5,100

7,500

5,100

7,500

5

5,100

7,500

Calculate the IRR, the NPV, and the MIRR for each project, and indicate the correct accept/reject decision for each. Do not round intermediate calculations. Round the monetary values to the nearest dollar and percentage values to

two decimal places. Use a minus sign to enter negative values, if any.

Truck

Pulley

Value

Decision

Value

Decision

IRR

%

Аcсept

%

Reject

%24

$

NPV

-Select- V

|-Select- v

MIRR

-Select- v

%

|-Select- v

The Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of a special equipment for the Materials Handling Department. The projected annual operating revenues and expenses are as follows:

1. How much is the after tax cash flows of Project 1?

2. How much is the net benefit of investing in Project 2?

Chapter 19 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 19 - Explain the difference between independent...Ch. 19 - Explain why the timing and quantity of cash flows...Ch. 19 - Prob. 3DQCh. 19 - Prob. 4DQCh. 19 - What is the accounting rate of return?Ch. 19 - What is the cost of capital? What role does it...Ch. 19 - Prob. 7DQCh. 19 - Explain how the NPV is used to determine whether a...Ch. 19 - Explain why NPV is generally preferred over IRR...Ch. 19 - Prob. 10DQ

Ch. 19 - Prob. 11DQCh. 19 - Prob. 12DQCh. 19 - Prob. 13DQCh. 19 - Prob. 14DQCh. 19 - Prob. 15DQCh. 19 - Jan Booth is considering investing in either a...Ch. 19 - Prob. 2CECh. 19 - Carsen Sorensen, controller of Thayn Company, just...Ch. 19 - Manzer Enterprises is considering two independent...Ch. 19 - Keating Hospital is considering two different...Ch. 19 - Prob. 6CECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Each of the following scenarios is independent....Ch. 19 - Roberts Company is considering an investment in...Ch. 19 - NPV A clinic is considering the possibility of two...Ch. 19 - Refer to Exercise 19.11. 1. Compute the payback...Ch. 19 - Buena Vision Clinic is considering an investment...Ch. 19 - Consider each of the following independent cases....Ch. 19 - Gina Ripley, president of Dearing Company, is...Ch. 19 - Covington Pharmacies has decided to automate its...Ch. 19 - Postman Company is considering two independent...Ch. 19 - Prob. 18ECh. 19 - Prob. 19ECh. 19 - Prob. 20ECh. 19 - Assume there are two competing projects, X and Y....Ch. 19 - Prob. 22ECh. 19 - Assume that an investment of 100,000 produces a...Ch. 19 - Prob. 24PCh. 19 - Prob. 25PCh. 19 - Prob. 26PCh. 19 - Kent Tessman, manager of a Dairy Products...Ch. 19 - Friedman Company is considering installing a new...Ch. 19 - Okmulgee Hospital (a large metropolitan for-profit...Ch. 19 - Mallette Manufacturing, Inc., produces washing...Ch. 19 - Jonfran Company manufactures three different...Ch. 19 - Prob. 32P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Anderson Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales Revenue: 5 million Operating Cost: 4 million Interest Expense: 3 million The company has a 25% tax rate, and its WACC is 11%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 1. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. 2. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $arrow_forwardShell Camping Gear, , is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table. Determine the payback period of each project.arrow_forwardColsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 1 million The company has a 25% tax rate, and its WACC is 14%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $arrow_forward

- Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 20 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 13%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. 1. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ 2. If this project would cannibalize other projects by $0.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $.arrow_forwardColsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues Operating costs Interest expense The company has a 25% tax rate, and its WACC is 12%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. $ $20 million 16 million 1 million b. If this project would cannibalize other projects by $1 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $arrow_forwardThe Company is considering two independent projects. One project involves a new product line, and the other involves the acquisition of a special equipment for the Materials Handling Department. The projected annual operating revenues and expenses are as follows: Project 1 ( Investment in a new product) P 750,000 Revenues Expected annual cash expenses Depreciation 325,000 30,000 Income tax – 30% Required investment outlay, P1,200,000. The equipment is expected to be used for 5 years then to be disposed at its estimated salvage value of P50,000. The income trend is expected to continue for the next 5 years. Project 2 ( Acquisition of a special equipment) P 800,000 250,000 Cost of special equipment Expected cash savings from overhead expenses The equipment has an estimated life of 8 years but will be used only for 6 years then to be sold at book value.arrow_forward

- Kelly, Inc. management is considering purchasing a new machine at a cost of $4,133,250. They expect this equipment to produce cash flows of $814,322, $863,275, $937,250, $1,017,112, $1,212,960, and $1,225,000 over the next six years. If the appropriate discount rate is 15 percent, compute the NPV of this investment and explain how the tax imposition would affect your NPV.arrow_forwardA company with a WACC of 14% is evaluating two projects for this year. The following is the estimated cash flow after deducting tax, including depreciation, as follows: (on the image below) a. Calculate the NPV, IRR, and payback, for each of these projects.b. If it were assumed that the two projects were independent, which project would you recommend?c. If the two projects were mutually exclusive, which project would you recommend?arrow_forwardLaurel’s Lawn Care Limited has a new mower line that can generate revenues of $132,000 per year. Direct production costs are $44,000, and the fixed costs of maintaining the lawn mower factory are $17,000 a year. The factory originally cost $1.10 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%. Operating Cash Flow = _________arrow_forward

- Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $25 million Operating costs 22.5 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 10%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar.$ ____ b. If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar.The firm's OCF would now be $ ____arrow_forwardHypore Darby Park Department is considering a new capital investment. The following information is available on the investment. The cost of the machine will be $348,400. The annual cost savings if the new machine is acquired will be $80,000. The machine will have a 6-year life, at which time the terminal disposal value is expected to be zero. Hypore Park Department is assuming no tax consequences. What is the internal rate of return for Hypore Park Department? Question 6 options: 11% 9% 5% 10%arrow_forwardPulaski Starlight Inc. is evaluating a project. The project is expected to generated new sales of $1,718,798 and incur costs of $606,990 annually. The project will be depreciated using the MACRS approach. The equipment needed for the project will cost $4,495,137 and is considered to be a five year MACRS class. The company's tax rate is 28%. Given this information, what would be the project's third year operating cash flow? Answer in dollars and cents.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License