Concept explainers

Exercise 4-5A Allocating

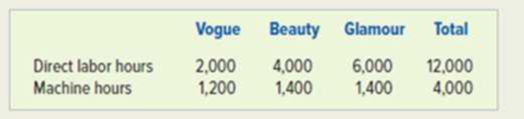

Tyson Hats Corporation manufactures three different models of hats: Vogue. Beauty, and Glamour. Tyson expects to incur $480,000 of overhead cost during the next fiscal year. Other budget information follows:

Required

a. Use direct labor hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

b. Use machine hours as the cost driver to compute the allocation rate and the budgeted overhead cost for each product.

c. Describe a set of circumstances where it would be more appropriate to use direct labor hours as the allocation base.

d. Describe a set of circumstances where it would be more appropriate to use machine hours as the allocation base.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Survey Of Accounting

- Factory overhead cost budget Nutty Candy Company budgeted the following costs for anticipated production for August: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only factory fixed costs.arrow_forwardBudget performance report for a cost center Sneed Industries Company sells vehicle parts to manufacturers of heavy construction equipment. The Crane Division is organized as a cost center. The budget for the Crane Division for the month ended August 31, 20Y6, is as follows (in thousands): During August, the costs incurred in the Crane Division were as follows: Instructions Prepare a budget performance report for the director of the Crane Division for the month of August.arrow_forwardRefer to Cornerstone Exercise 8.6. Required: 1. Calculate the total budgeted cost of units produced for Play-Disc for the coming year. Show the cost of direct materials, direct labor, and overhead. 2. Prepare a cost of goods sold budget for Play-Disc for the year. 3. What if the beginning inventory of finished goods was 75,200 (for 16,000 units)? How would that affect the cost of goods sold budget? (Assume Play-Disc uses the FIFO method.) Play-Disc makes Frisbee-type plastic discs. Each 12-inch diameter plastic disc has the following manufacturing costs: For the coming year, Play-Disc expects to make 300,000 plastic discs, and to sell 285,000 of them. Budgeted beginning inventory in units is 16,000 with unit cost of 4.75. (There are no beginning or ending inventories of work in process.) Required: 1. Prepare an ending finished goods inventory budget for Play-Disc for the coming year. 2. What if sales increased to 290,000 discs? How would that affect the ending finished goods inventory budget? Calculate the value of budgeted ending finished goods inventory.arrow_forward

- Budget performance report for a cost center Sneed Industries Company sells vehicle parts to manufacturers of heavy construction equipment. The Crane Division is organized as a cost center. The budget for the Crane Division for the month ended August 31, 20Y6, is as follows (in thousands): During August, the costs incurred in the Crane Division were as follows: Instructions For which costs might the director be expected to request supplemental reports?arrow_forwardHart Manufacturing makes three products. Each product requires manufacturing operations in three departments: A, B, and C. The labor-hour requirements, by department, are as follows: During the next production period the labor-hours available are 450 in department A, 350 in department B, and 50 in department C. The profit contributions per unit are 25 for product 1, 28 for product 2, and 30 for product 3. a. Formulate a linear programming model for maximizing total profit contribution. b. Solve the linear program formulated in part (a). How much of each product should be produced, and what is the projected total profit contribution? c. After evaluating the solution obtained in part (b), one of the production supervisors noted that production setup costs had not been taken into account. She noted that setup costs are 400 for product 1, 550 for product 2, and 600 for product 3. If the solution developed in part (b) is to be used, what is the total profit contribution after taking into account the setup costs? d. Management realized that the optimal product mix, taking setup costs into account, might be different from the one recommended in part (b). Formulate a mixed-integer linear program that takes setup costs provided in part (c) into account. Management also stated that we should not consider making more than 175 units of product 1, 150 units of product 2, or 140 units of product 3. e. Solve the mixed-integer linear program formulated in part (d). How much of each product should be produced and what is the projected total profit contribution? Compare this profit contribution to that obtained in part (c).arrow_forwardRefer to Exercise 8.27. At the end of the year, Meliore, Inc., actually produced 310,000 units of the standard model and 115,000 of the deluxe model. The actual overhead costs incurred were: Required: Prepare a performance report for the period. In an attempt to improve budgeting, the controller for Meliore, Inc., has developed a flexible budget for overhead costs. Meliore, Inc., makes two types of products, the standard model and the deluxe model. Meliore expects to produce 300,000 units of the standard model and 120,000 units of the deluxe model during the coming year. The standard model requires 0.05 direct labor hour per unit, and the deluxe model requires 0.08. The controller has developed the following cost formulas for each of the four overhead items: Required: 1. Prepare an overhead budget for the expected activity level for the coming year. 2. Prepare an overhead budget that reflects production that is 10 percent higher than expected (for both products) and a budget for production that is 20 percent lower than expected.arrow_forward

- (Appendix) Calculating factory overhead: four variances Atlanta Adhesives Inc. budgets 15,000 direct labor hours for the year. The total overhead budget is expected to amount to 42,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forwardFactory overhead cost budget Sweet Tooth Candy Company budgeted the following costs for anticipated production for August: Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs.arrow_forwardQuestion 9: Anjan Paints manufactures two high-quality base paints: an oil-based paint and a lotex paint. Both are house paints and are manufactured in neutral white color only. After analyzing the company's entire operations, Anjan's accountants and production managers have identified activity cost pools and accumulated annual budgeted overhead costs by pool as follows. Activity Cost Pools Purchasing Processing Packaging Testing Storage and Inventory Control Washing and Cleaning equipment Total annual budgeted overhead Following further analysis, activity cost drivers were identified and their expected use by product and activity were scheduled as follows. Cost Drivers Activity Cost Pools Purchasing Purchase orders Gallons processed Processing Packaging Testing Containers filled Storage Washing Number of tests Average gallons on hand Number of batches Estimated Overhead $ 260,000 $1,500,000 $ 600,000 $ 250,000 $ 200,000 $ 590,000 $3,400,000 Expected Cost Drivers per Activity 1,500…arrow_forward

- Question Content Area Production, Direct Labor, Direct Materials, Sales Budgets, Budgeted Contribution Margin Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 25 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 35,600 34,600 40,400 39,600 Sales price per…arrow_forwardQuestion Content Area Production, Direct Labor, Direct Materials, Sales Budgets, Budgeted Contribution Margin Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiner’s master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer’s share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company’s union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 25 percent of the following month’s projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 35,600 34,600 40,400 39,600 Sales price per…arrow_forwardQuestion Content Area Production, Direct Labor, Direct Materials, Sales Budgets, Budgeted Contribution Margin Laghari Company makes and sells high-quality glare filters for microcomputer monitors. John Tanaka, controller, is responsible for preparing Laghari's master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employer's share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the company's union contract calls for an increase in direct labor wages that is included in the direct labor rate. Laghari expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: January February March April Estimated unit sales 36,000 34,500 39,000 38,600 Sales price per unit…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning