Cost Allocations: Comparison of Dual and Single Rates

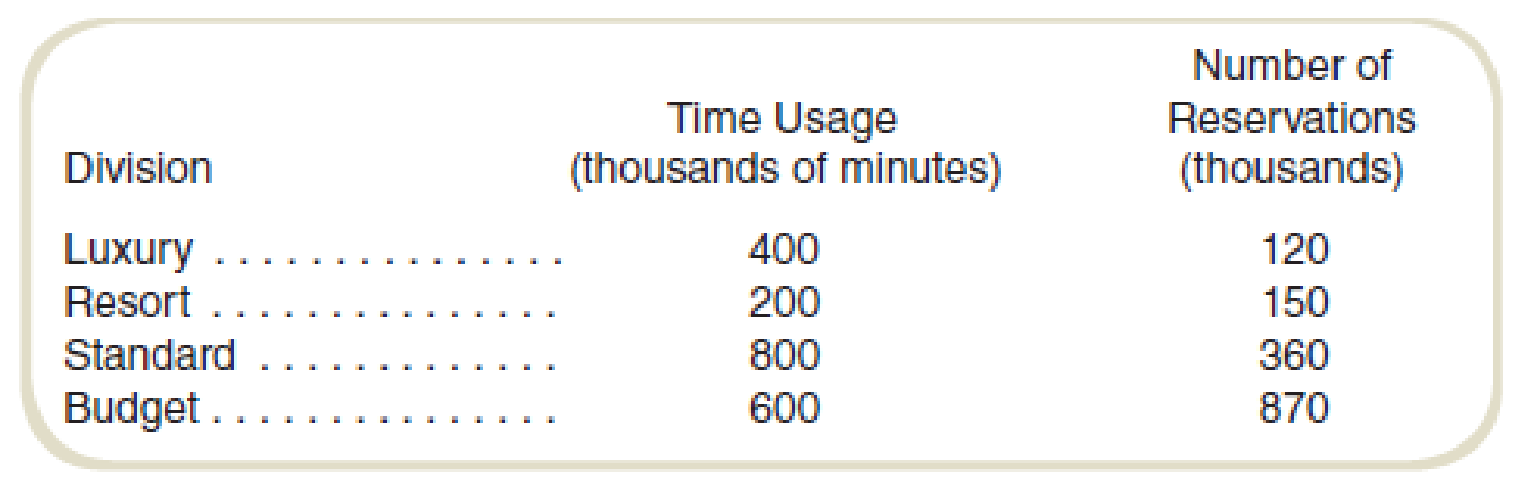

Pacific Hotels operates a centralized call center for the reservation needs of its hotels. Costs associated with use of the center are charged to the hotel group (luxury, resort, standard, and budget) based on the length of time of calls made (time usage). Idle time of the reservation agents, time spent on calls in which no reservation is made, and the fixed cost of the equipment are allocated based on the number of reservations made in each group. Due to recent increased competition in the hotel industry, the company has decided that it is necessary to better allocate its costs in order to price its services competitively and profitably. During the most recent period for which data are available, the use of the call center for each hotel group was as follows:

During this period, the cost of the call center amounted to $840,000 for personnel and $650,000 for equipment and other costs.

Required

- a. Determine the allocation to each of the divisions using the following:

- 1. A single rate based on time used.

- 2. Dual rates based on time used (for personnel costs) and number of reservations (for equipment and other cost).

- b. Write a short report to management explaining whether a single rate or dual rates should be used and why.

a.

Determine the allocation to each of the divisions using the following:

1. A single rate based on the time used.

2. Dual rates based on time used (for personnel costs) and some reservations (for equipment and other cost).

Explanation of Solution

Cost allocation:

Cost allocation is the process of distributing a common cost into the departments that have used the cost. The cost is allocated on the basis of the utilization of the resource.

1.

Allocation of total cost on the basis of a single rate based on time used:

| Particular |

The ratio of time usage (a) |

Amount |

| Luxury | 0.2 (1) | $298,000 |

| Resort | 0.1 (2) | $149,000 |

| Standard | 0.4 (3) | $596,000 |

| Budget | 0.3 (4) | $447,000 |

| Total cost | 1,490,000 |

Table: (1)

Thus, the total cost allocation for luxury, resort, standard and budget is $298,000, $149,000, $596,000 and $447,000.

Working note 1:

Calculate the ratio of time usage for luxury:

Working note 2:

Calculate the ratio of time usage for the resort:

Working note 3:

Calculate the ratio of time usage for standard:

Working note 4:

Calculate the ratio of time usage for luxury:

2.

Calculate the allocation of cost on Dual rates based on time used (for personnel costs) and some reservations (for equipment and other cost):

Allocation of cost for personnel costs:

| Particular |

The ratio of time usage (a) |

Amount |

| Luxury | 0.2 (1) | $168,000 |

| Resort | 0.1 (2) | $84,000 |

| Standard | 0.4 (3) | $336,000 |

| Budget | 0.3 (4) | $252,000 |

| Total cost | 840,000 |

Table: (2)

Thus, the personnel cost allocation for luxury, resort, standard and budget is $168,000, $84,000, $336,000 and $252,000.

Allocation of cost for equipment and other costs:

| Particular |

The ratio of the number of reservations (a) |

Amount |

| Luxury | 0.08 (1) | $52,000 |

| Resort | 0.1 (2) | $65,000 |

| Standard | 0.24 (3) | $156,000 |

| Budget | 0.58 (4) | $377,000 |

| Total cost | $650,000 |

Table: (3)

Thus, the personnel cost allocation for luxury, resort, standard and budget is $168,000, $84,000, $336,000 and $252,000.

Working note 5:

Calculate the ratio of the number of reservations for luxury:

Working note 6:

Calculate the ratio of the number of reservations for the resort:

Working note 7:

Calculate the ratio of the number of reservations for standard:

Working note 8:

Calculate the ratio of the number of reservations for luxury:

b.

Write a short report to management explaining whether a single rate or dual rates should be used and why.

Explanation of Solution

The cost should be allocated on the basis of the dual rate system.

In single rate allocation, the cost of equipment and other cost do not correlate with the time usage. So allocating the cost of equipment and other cost is not reasonable in this case.

Dual rate system has better correlation with the costs and usage. The cost of personnel’s is directly correlated with the time usage, and the cost of equipment and other cost are directly correlated with the number of reservations.

Thus, cost should be allocated on the basis of the dual rate system.

Want to see more full solutions like this?

Chapter 12 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- The amount of gross profit for the year ?arrow_forwardUse the reconciliation approach to determine cash paid for inventory for the Ferris Company for 2012. Assume all inventory is bought on account and the accounts payable account is used only for inventory. Beginning and ending balances of merchandise inventory were $6,200 and $9,400 respectively. Beginning and ending balances of accounts payable were $2000 and $1,400 respectively. Sales revenue amounted to $68, 512 and cost of goods sold was $41,904.arrow_forwardPROVIDE General Accounting Answerarrow_forward

- Stockholders' equity can be described as claims of: a. owners on total assets. b. creditors on total assets. c. customers on total assets. d. debtors on total assets.arrow_forwardQuick answer of this accounting questionsarrow_forwardA production department's output for the most recent month consisted of 20,000 units completed and transferred to the next stage of production and 20,000 units in ending goods in process inventory. The units in ending goods in process inventory were 70% complete with respect to both direct materials and conversion costs. There were 3,000 units in beginning goods in process inventory, and they were 90% complete with respect to both direct materials and conversion costs. Calculate the equivalent units of production for the month, assuming the company uses the weighted average method.arrow_forward

- Hello tutor please provide correct answer general Accountingarrow_forwardWhat is the firm's price earnings ratio? General accountingarrow_forwardCindy's Limo Service provides transportation services in and around Middleville. Its profits have been declining, and management is planning to add a package delivery service that is expected to increase revenue by $275,000 per year. The total cost to lease additional delivery vehicles from the local dealer is $60,000 per year. The present manager will continue to supervise all services. Due to expansion, however, the labor costs and utilities will increase by 40%. Rent and other costs will increase by 15%. Cindys Limo Service Annual Income Statement Before Expansion Sales revenue Costs: Vehicle leases Labor $ 9,60,000 4,00,000 Utilities Rent Other costs Managers salary Total costs 2,90,000 50,000 1,00,000 60,000 1,20,000 $ 10,20,000 -$60,000 Operating profit (loss) What are the total differential costs that will be incurred as a result of the expansion?arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College