Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Quick answer of this accounting questions

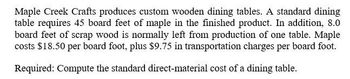

Transcribed Image Text:Maple Creek Crafts produces custom wooden dining tables. A standard dining

table requires 45 board feet of maple in the finished product. In addition, 8.0

board feet of scrap wood is normally left from production of one table. Maple

costs $18.50 per board foot, plus $9.75 in transportation charges per board foot.

Required: Compute the standard direct-material cost of a dining table.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cayuga Hardwoods produces handcrafted jewelry boxes. A standard-size box requires 14 board feet of hardwood in the finished product. In addition, 8.0 board feet of scrap lumber are normally left from the production of one box. Hardwood costs $5.00 per board foot, plus $2.50 in transportation charges per board foot. Required: Compute the standard direct-material cost of a jewelry box. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Standard direct-material costarrow_forwardPlease given correct answerarrow_forwardSnow Ride manufactures snowboards. Its cost of making 1,900 bindings is as follows: Direct materials $ 17,590 Direct laabor 3,200 Variable overhead 2,080 Fixed overhead 6,300 Total manufacturing cost for 1,900 bindings $ 29,170 Suppose Livingston will sell bindings to Snow Ride for $13 each. Snow Ride would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.50 per binding. Requirments: 1. Snow Ride's accountants predict that purchasing the bindings from livingston will enable the company to avoid $2,100 of fixed overhead. Prepare an analysis to show whether Snow Ride should make or buy the bindings. 2. The facilities freed by purchasing bindings from…arrow_forward

- Reyarrow_forwardOak Valley Company, a custom cabinet manufacturing company, is setting standard costs for one of its products. The main material is cedar wood, sold by the square foot. The current cost of cedar wood is $8 per square foot from the supplier. Delivery costs are $0.20 per square foot. Carpenters' wages are $30 per hour. Payroll costs are $3.00 per hour, and benefits are $5 per hour. How much is the direct materials standard cost per square foot? A. $8.20 B. $11.20 C. $13.20 D. $8.00arrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,320 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Cost $ 67,080 $ 56,760 $ 30,960 $ 51,600 $ 206,400 Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,640 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,640 can be avoided and Frannie could rent out the factory space no longer in use for $20,640?arrow_forward

- Summer company manufactures beach chairs. $ 4.00 of direct materials are needed for each chair. Labor is $ 15 an hour. The company manufactures 3 chairs per hour. Indirect costs are $ 9.00 per hour. Commissions to sellers are $ 2.00 per unit sold. The cost of a chair will be:arrow_forwardMake versus buy, activity-based costing, opportunity costs. The Lexington Company produces gas grills. This year’s expected production is 20,000 units. Currently, Lexington makes the side burners for its grills. Each grill includes two side burners. Lexington’s management accountant reports the following costs for making the 40,000 burners: Lexington has received an offer from an outside vendor to supply any number of burners Lexington requires at $14.80 per burner. The following additional information is available: Inspection, setup, and materials-handling costs vary with the number of batches in which the burners are produced. Lexington produces burners in batch sizes of 1,000 units. Lexington will produce the 40,000 units in 40 batches. Lexington rents the machine it uses to make the burners. If Lexington buys all of its burners from the outside vendor, it does not need to pay rent on this machine. Assume that if Lexington purchases the burners from the outside vendor, the facility…arrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,340 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Cost $ 67,210 $ 56,870 $ 31,020 $ 51,700 $ 206,800 Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,680 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,680 can be avoided and Frannie could rent out the factory space no longer in use for $20,680? Complete this question by entering your answers in the tabs below. Required 1 Required 2…arrow_forward

- 1. SportsHaven’s garden department produces bags of mulch. Fixed cost is $17,300. Each bag sells for $3.21 with a unit cost of $1.48. How many bags of mulch must be sold to breakeven?arrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.55 feet of leather and predicts leather will cost $2.60 per foot. Suppose Perfect Pet made 50 collars during February. For these 50 collars, the company actually averaged 1.85 feet of leather per collar and paid $2.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. 6. Calculate the direct materials price and quantity variances. Required 1: Calculate the standard direct materials cost per unit. (Round your answer to 2 decimal places.) Standard Direct Materials : _________________ per collar Required 2 & 3 : 2. Without performing any calculations, determine whether…arrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.55 feet of leather and predicts leather will cost $2.60 per foot. Suppose Perfect Pet made 50 collars during February. For these 50 collars, the company actually averaged 1.85 feet of leather per collar and paid $2.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Calculate the standard direct materials cost per unit. Note: Round your answer to 2 decimal places. Standard Direct Materials per Collararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning