Concept explainers

a.

Interpretation: Initial capital outlay, cash flows after tax and terminal cash flow of this project needs to be computed.

Concept introduction:Capital Budgeting technique is the most useful tool for

b.

Interpretation:

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

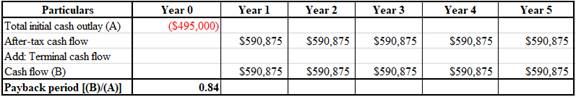

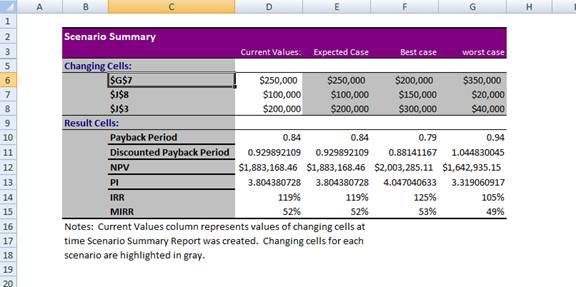

Payback period 0.84

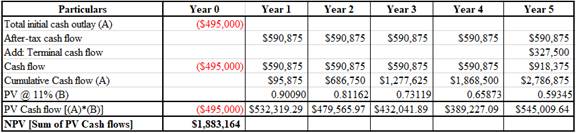

Discounted Payback period 0.9299

NPV $1,883,164

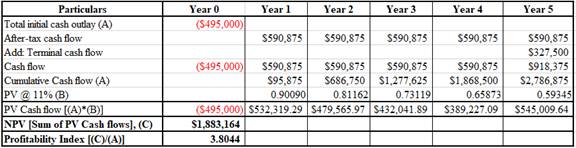

PI 3.8044

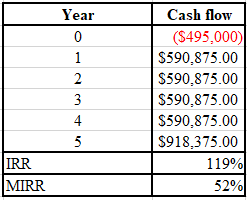

IRR 119%

MIRR 52%

Payback period: It is the period in which cash flow of investment covers the initial investment. It can be computed shown below:

Discounted payback period: It is the period in which discounted cash flow of investment covers the initial investment. It can be computed shown below:

Net present value: NPV is the sum of present value of the cash flows and initial investment when discounted at 11%. It can be computed as:

Profitability Index: It is used to analyze the profitability of an investment wherein its cash flow is divided by the initial investment It can be computed as:

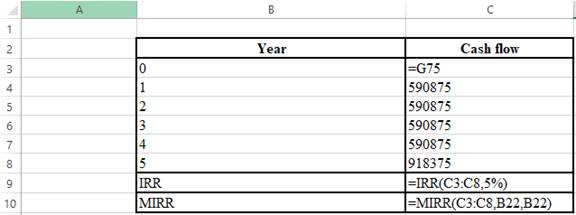

IRR& MIRR:

The formula used to compute IRR and MIRR is as follows:

c.

Interpretation: A scenario analysis is required.

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

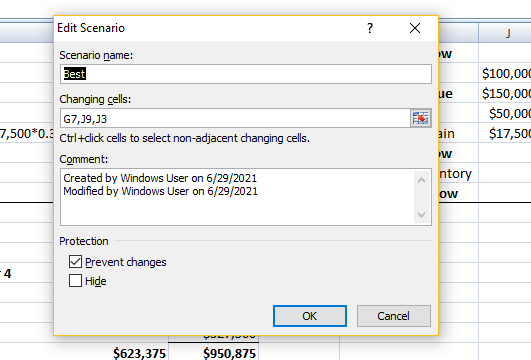

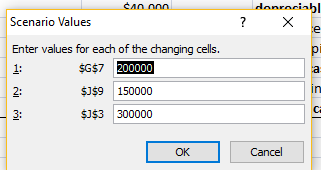

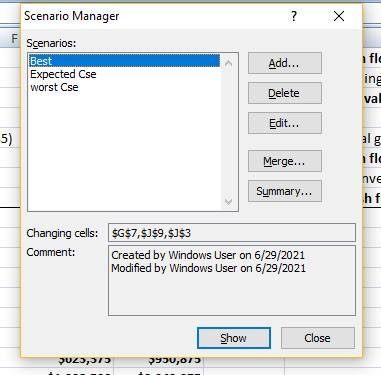

1. Click on “Data” menu and select “scenario Manager” under “what if Analysis” option, then click on “add” option.Then rename the scenario name and select changing cells which need to replace.

2. Enter values which need to be resulted in that scenario, accordingly.

3. Then click on “summary” option to get the various scenario analysis.

4. Scenario Analysis will represent the final output in given scenario.

c.

Interpretation: A scenario analysis is required.

Concept introduction: Capital Budgeting technique is the most useful tool for financial management which helps to understand the investment in project is financially viable or not.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

EBK FINANCIAL ANALYSIS WITH MICROSOFT E

- Hudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forwardShelby Industries has a capacity to produce 45.000 oak shelves per year and is currently selling 40,000 shelves for $32 each. Martin Hardwoods has approached Shelby about buying 1,200 shelves for a new project and is willing to pay $26 each. The shelves can be packaged in bulk; this saves Shelby $1.50 per shelf compared to the normal packaging cost. Shelves have a unit variable cost of $27 with fixed costs of $350,000. Because the shelves dont require packaging, the unit variable costs for the special order will drop from $27 per shelf to $25.50 per shelf. Shelby has enough idle capacity to accept the contract. What is the minimum price per shelf that Shelby should accept for this special order?arrow_forwardScrooge McDuck Safe Limited is considering buying the hinges it uses in the manufacture of vaults from an outside vendor. Currently, Scrooge McDuck Safe Limited makes the hinges in its own manufacturing facility. Scrooge McDuck Safe Limited can buy the hinges for $1.50 each. The company uses 900,000 hinges each year. Fixed cost for Scrooge McDuck Safe Limited would not change if the company stopped making the hinges. Information about Scrooge McDuck Safe Limited's cost to manufacture the 900,000 casters follows: Per Unit $.50 .10 Total Direct material $450,000 90,000 360,000 225.000 $1,125,000 Direct labor Variable overhead Fixed overhead Total .40 25 $1.25 Required: A. Prepare a relevant cost schedule that indicates whether Scrooge McDuck Safe Limited should buy the hinges or continue to make them. B. If Scrooge purchased the hinges, management has approached you that a dial producer wishes to rent the vacant space for $150,000 to produce their dials. Does this change your decision??…arrow_forward

- The Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Calculate the net benefit or cost to The Knot if it adopts JIT production at the Spartanburg plant.arrow_forwardThe Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. What nonfinancial and qualitative factors should The Knot consider when making the decision to adopt JIT production?arrow_forwardA large food-processing corporation is considering using laser technology to speed up and eliminate waste in the potato-peeling process. To implement the system, the company anticipates needing $3.5 million to purchase the industrial-strength lasers. The system will save $1,550,000 per year in labor and materials. However, it will require an additional operating and maintenance cost of $350,000. Annual income taxes will also increase by $150,000. The system is expected to have a 10-year service life and will have a salvage value of about $200,000. If the company's MARR is 18%, use the NPW method to justify the project. Equal Payment Series Sinking Present Compound Amount Factor Fund Single Payment Compound Present Amount Worth Factor (F/P, i, N) 1.1800 Worth Capital Recovery Factor Factor Factor Factor N (P/F, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1 0.8475 1.0000 1.0000 0.8475 1.1800 2 1.3924 0.7182 2.1800 0.4587 1.5656 0.6387 3 1.6430 0.6086 3.5724 0.2799 2.1743 0.4599…arrow_forward

- The Knot manufactures men’s neckwear at its Spartanburg plant. The Knot is considering implementing a JIT production system. The following are the estimated costs and benefits of JIT production: a. Annual additional tooling costs $250,000 annually. b. Average inventory would decline by 80% from the current level of $1,000,000. c. Insurance, space, materials-handling, and setup costs, which currently total $400,000 annually, would decline by 20%. d. The emphasis on quality inherent in JIT production would reduce rework costs by 25%. The Knot currently incurs $160,000 in annual rework costs. e. Improved product quality under JIT production would enable The Knot to raise the price of its product by $2 per unit. The Knot sells 100,000 units each year. The Knot’s required rate of return on inventory investment is 15% per year. Q. Suppose The Knot implements JIT production at its Spartanburg plant. Give examples of performance measures The Knot could use to evaluate and control JIT…arrow_forwardA large food-processing corporation is considering using laser technology to speed up and eliminate waste in the potato-peeling process. To implement the system, the company anticipates needing $3.5 million to purchase the industrial-strength lasers. The system will save $1,550,000 per year in labor and materials. However, it will require an additional operating and maintenance cost of $350,000. Annual income taxes will also increase by $150,000. The system is expected to have a 10-year service life and will have a salvage value of about $200,000. If the company's MARR is 18%, use the NPW method to justify the project. Click the icon to view the interest factors for discrete compounding when MARR = 18% per year. The NPW of the project is $ thousand. (Round to the nearest whole number.) X More Info Single Payment Compound Amount Equal Payment Series Sinking Fund Factor Compound Amount Factor (F/A, i, N) Present Worth Factor Factor (F/P, i, N) (A/F, i, N) (P/A, i, N) 1.1800 1.0000 1.0000…arrow_forwardShue Music Company is considering the sale of a new sound board used in recording studios. The new board would sell for $24,700, and the company expects to sell 1,640 per year. The company currently sells 1,990 units of its existing model per year. If the new model is introduced, sales of the existing model will fall to 1,660 units per year. The old board retails for $23,100. Variable costs are 53 percent of sales, depreciation on the equipment to produce the new board will be $1,035,000 per year, and fixed costs are $3,250,000 per year. If the tax rate is 24 percent, what is the annual OCF for the project? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. OCFarrow_forward

- Two alternative locations are under consideration for a new plant: Jackson, Mississippi, and Dayton, Ohio. The Jackson location is superior in terms of costs. However, management believes that sales volume would decline if this location were chosen because it is farther from the market, and the firm's customers prefer local suppliers. The selling price of the product is $350 per unit in either case. Use the following information to determine which location yields the higher total profit per year: Location Jackson Dayton The annual profit from Jackson is $ Annual Fixed Cost $2,100,000 $3,000,000 Variable Cost per Unit 45 $95 Forecasted Demand per Year 35,000 units 39,000 units (Enter your response as an integer.) ..arrow_forwardMesa Cheese Company has developed a new cheese slicer called Slim Slicer. The company plans to sell this slicer through its catalog, which it issues monthly. Given market research, Mesa believes that it can charge $30 for the Slim Slicer. Prototypes of the Slim Slicer, however, are costing $31. By using cheaper materials and gaining efficiencies in mass production, Mesa believes it can reduce Slim Slicer's cost substantially. Mesa wishes to earn a return of 40% of the selling price. (a) Compute the target cost for the Slim Slicer. Target cost $arrow_forwardInteliSystems needs 79,000 optical switches next year . By outsourcing them, InteliSystems can use its idle facilities to manufacture another product that will contribute $140,000 to operating income, but none of the fixed costs will be avoidable. Should InteliSystems make or buy the switches? Show your analysis based on the information in the table below for making 70,000 switches.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning