FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

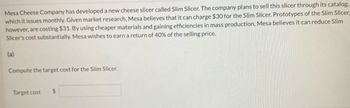

Transcribed Image Text:Mesa Cheese Company has developed a new cheese slicer called Slim Slicer. The company plans to sell this slicer through its catalog,

which it issues monthly. Given market research, Mesa believes that it can charge $30 for the Slim Slicer. Prototypes of the Slim Slicer,

however, are costing $31. By using cheaper materials and gaining efficiencies in mass production, Mesa believes it can reduce Slim

Slicer's cost substantially. Mesa wishes to earn a return of 40% of the selling price.

(a)

Compute the target cost for the Slim Slicer.

Target cost $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- yntech makes digital cameras for drones. Their basic digital camera uses $80 in variable costs and requires $1,600 per month in fixed costs. Syntech sells 100 cameras per month. If they process the camera further to enhance its functionality, it will require an additional $50 per unit of variable costs, plus an increase in fixed costs of $1,200 per month. The current price of the camera is $170. The marketing manager is positive that they can sell more and charge a higher price for the improved version. At what price level would the upgraded camera begin to improve operational earnings?arrow_forwardTesla’s decision to produce a new line of compact and full sized cars resulted in the need to construct either a small plant or a large plant. The best selection of plant size depends on how the marketplace reacts to the new product line. To conduct an analysis, marketing management has decided to view the possible long-run demand as low, medium, or high. The following payoff table shows the projected profit in millions of dollars: Long Run Demand Plant size Low Medium High Small 80 200 350 Large 120 180 190 Construct an influence diagram. Construct a decision tree. Recommend a decision based on the use of the optimistic, conservative, and minimax regret approaches.arrow_forwardUramilabenarrow_forward

- GSU Motor Works needs to select an assembly line for producing their new SUV. They have two options:• Option XYZ is a highly automated assembly line that has a large up-front cost but low maintenancecost over the years. This option will cost $114 million today with a yearly operating cost of $40million. The assembly line will last for 6 years and be sold for $48 million in 6 years.• Option GHI is a cheaper alternative with less technology, a longer life, but higher operating costs.This option will cost $168 million today with an annual operating cost of $32 million. Thisassembly line will last for 10 years and be sold for $23 million in 10 years.The firm’s cost of capital is 16%. Assume a tax rate of zero percent. The equivalent annual cost (EAC) for Option XYZ is $_______ million.The equivalent annual cost (EAC) for Option GHI is $_______ million.arrow_forwardSid's Skins makes a variety of covers for electronic organizers and portable music players. The company's designers have discovered a market for a new clear plastic covering with college logos for a popular music player. Market research indicates that a cover like this would sell well in the market priced at $24.00. Sid's desires an operating profit of 25 percent of costs. Required: What is the highest acceptable manufacturing cost for which Sid's would be willing to produce the cover? (Round your answer to 2 decimal places.)arrow_forwardProvide answerarrow_forward

- B&B has a new baby powder ready to market. If the firm goes directly to the market with the product, there is only a 55 percent chance of success. However, the firm can conduct customer segment research, which will take a year and cost $875,000. By going through research, B&B will be able to better target potential customers and will increase the probability of success to 70 percent. If successful, the baby powder will bring a present value profit (at time of initial selling) of $16.5 million. If unsuccessful, the present value payoff is $7.5 million. The appropriate discount rate is 13 percent. Calculate the NPV for the firm if it conducts customer segment research and if it goes to market immediately. (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89. Should the firm conduct customer segment research or go to the market immediately? multiple choice…arrow_forwardRoboGarden sells a robot lawn aerator. At the current price, RoboGarden's contribution margin is $129.84 per unit. Because of a shortage of silicon chips, RoboGarden expects variable cost to increase by $10.17. In response, RoboGarden is thinking about raising its selling price by $36.36. Calculate the percent profit breakeven metric for this situation. Report the correct sign for the result. Report your answer as a percent. Report -25.5%, for example, as "-25.5". Rounding: tenth of a percent.arrow_forwardApple Incorporated, the worlds leading manufacturer of mobile phones, currently sells their cellphones for 90,000 per unit. This phone costs 60,000 to manufacture. Pineapple Company, the second leading manufacturer of cellphones, revealed that they would be unveiling a new model of phone that will sell for 70,000. This new phone contains all the features and performs at par with Apple’s phones. To keep up with the competition, Apple management believes that they should lower the price to 70,000. The Marketing Department also believes that the new price will cause sales to increase by 10% even with a new cellphone in the market. Apple currently sells 150,000 units of their phones annually. What is the target cost of Apple’s products if the target operating income is 20% of sales?arrow_forward

- Eastern Auto Supply Limited produces and distributes auto supplies. The company is anxious to enter the rapidly growing market for long-life batteries that is based on lithium technology. Management believes that to be full competitive the new battery that the company is planning can’t be priced at more than Tk. 130. At this price management is confident that the company can sell 100,000 batteries per year. The batteries would require an investment of Tk. 5,000,000 and the desired ROI is 20%. Required: Compute the target cost of one battery.arrow_forwardHelp please and thank you!arrow_forwardHow would I do this problem?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education