FUNDAMENTALS OF COST ACCT.-CONNECT CARD

6th Edition

ISBN: 9781260852349

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 12, Problem 40E

Alternative Allocation Bases

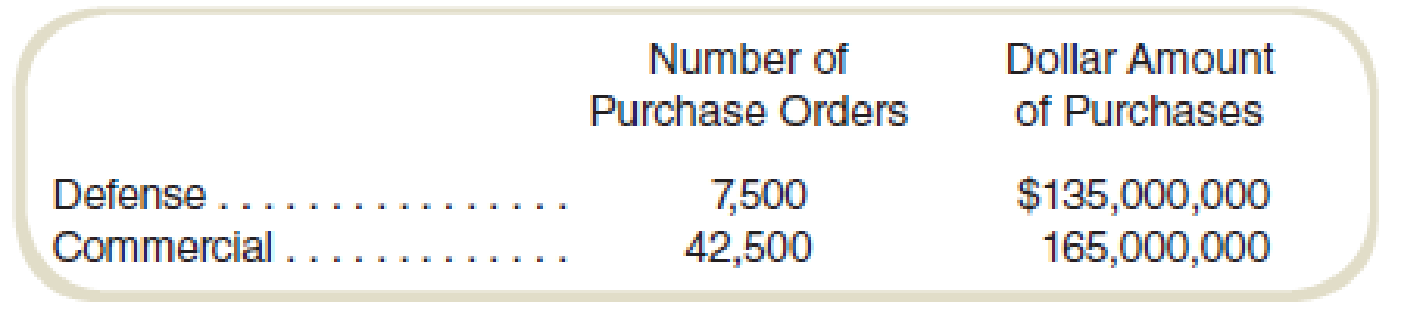

Thompson Aeronautics repairs aircraft engines. The company’s Purchasing Department supports its two departments, Defense and Commercial. The Defense division has contracts with the Department of Defense and the Commercial division works primarily with domestic airlines and air freight companies. The cost of the Purchasing Department is $6 million annually.

Information on the activity of the Purchasing Department for the last year follows:

Required

- a. What is the cost charged to each division if Thompson allocates Purchasing Department costs based on the number of purchase orders?

- b. What is the cost charged to each division if Thompson allocates Purchasing Department costs based on the dollar amount of the purchases?

- c. Contracts with the Defense Department are on a cost-plus fixed fee basis, meaning the price is based on the cost of repairing an engine, including any overhead assigned to the division. Contracts with commercial airlines and air freight companies are almost all fixed price, meaning the price does not depend directly on the cost. Will this affect Thompson’s choice of an allocation base? Should it?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Assigning Costs to Activities, Resource Drivers

The Receiving Department has three activities: unloading, counting goods, and inspecting. Unloading uses a forklift that is leased for $21,000 per year. The forklift is used only for unloading. The fuel for the forklift is $3,700 per year. Other operating costs (maintenance) for the forklift total $1,500 per year. Inspection uses some special testing equipment that has depreciation of $1,750 per year and an operating cost of $1,750. Receiving has three employees who have an average salary of $50,000 per year. The work distribution matrix for the receiving personnel is as follows:

Activity

Percentage of Time on Each Activity

Unloading

40%

Counting

25%

Inspecting

35%

No other resources are used for these activities.

Required:

1. Calculate the cost of each activity.

Unloading

$fill in the blank 1

Counting

$fill in the blank 2

Inspecting

$fill in the blank 3

2. Explain the two methods used to assign costs to activities.…

Assigning Costs to Activities, Resource Drivers

The receiving department has three activities: unloading, counting goods, and inspecting. Unloading uses a forklift that is leased for $15,000 per year. The forklift is used only for unloading. The fuel for the forklift is $3,600 per year. Other operating costs (maintenance) for the forklift total $1,500 per year. Inspection uses some special testing equipment that has depreciation of $1,200 per year and an operating cost of $750. Receiving has three employees who have an average salary of $50,000 per year. The work distribution matrix for the receiving personnel is as follows:

Activity

Percentage of Time on Each Activity

Unloading

40%

Counting

25

Inspecting

35

No other resources are used for these activities.

Required:

1. Calculate the cost of each activity.

Unloading

$fill in the blank 1

Counting

$fill in the blank 2

Inspecting

$fill in the blank 3

2. Explain the two methods used to assign costs to activities.

Corazon Manufacturing Company has a purchasing department staffed by five purchasingagents. Each agent is paid $28,000 per year and is able to process 4,000 purchase orders. Lastyear, 17,800 purchase orders were processed by the five agents.Required:1. Calculate the activity rate per purchase order.2. Calculate, in terms of purchase orders, the:a. total activity availabilityb. unused capacity3. Calculate the dollar cost of:a. total activity availabilityb. unused capacity4. Express total activity availability in terms of activity capacity used and unused capacity.

5. What if one of the purchasing agents agreed to work half time for $14,000? How many pur-chase orders could be processed by four and a half purchasing agents? What would unused

capacity be in purchase orders?

Chapter 12 Solutions

FUNDAMENTALS OF COST ACCT.-CONNECT CARD

Ch. 12 - What does decentralization mean in the context of...Ch. 12 - Why is performance measurement an important...Ch. 12 - Prob. 3RQCh. 12 - What does dysfunctional decision making refer to?Ch. 12 - Prob. 5RQCh. 12 - What are the five basic kinds of decentralized...Ch. 12 - What is goal congruence? How is it different from...Ch. 12 - Prob. 8RQCh. 12 - What is relative performance evaluation?Ch. 12 - Prob. 10RQ

Ch. 12 - Prob. 11RQCh. 12 - Prob. 12RQCh. 12 - The management control system collects information...Ch. 12 - Salespeople are often paid a commission based on...Ch. 12 - Prob. 15CADQCh. 12 - Prob. 16CADQCh. 12 - On December 30, a manager determines that income...Ch. 12 - Prob. 18CADQCh. 12 - Prob. 19CADQCh. 12 - The manager of an operating department just...Ch. 12 - In the previous chapters, we considered different...Ch. 12 - A company has a bonus plan that states that...Ch. 12 - Prob. 23CADQCh. 12 - Prob. 24CADQCh. 12 - Prob. 25CADQCh. 12 - Prob. 26CADQCh. 12 - Prob. 27CADQCh. 12 - Prob. 28CADQCh. 12 - Prob. 29ECh. 12 - Evaluating Management Control SystemsEthical...Ch. 12 - Prob. 31ECh. 12 - Management Control Systems and Incentives A...Ch. 12 - Prob. 33ECh. 12 - Prob. 34ECh. 12 - Prob. 35ECh. 12 - Alternative Allocation Bases: Service Bartolo...Ch. 12 - Prob. 37ECh. 12 - Single versus Dual Rates: Ethical Considerations A...Ch. 12 - Single versus Dual Rates

Using the data for the...Ch. 12 - Alternative Allocation Bases Thompson Aeronautics...Ch. 12 - Tone at the Top, Ethics Once upon a time, a major...Ch. 12 - Prob. 42ECh. 12 - Prob. 43ECh. 12 - Internal Controls Commonly in many organizations,...Ch. 12 - Evaluating Management Control Systems SPG Company...Ch. 12 - Analyze Performance Report for Decentralized...Ch. 12 - Divisional Performance Measurement: Behavioral...Ch. 12 - Prob. 48PCh. 12 - Prob. 49PCh. 12 - Cost Allocations: Comparison of Dual and Single...Ch. 12 - Cost Allocation for Travel Reimbursement Your...Ch. 12 - Incentives, Illegal Activities, and Ethics An...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Corazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardThe cost of operating the Maintenance Department is to be allocated to four production departments based on the floor space each occupies. Department A occupies 600 m²; Department B, 900 m²; Department C, 1200 m²; and Department D, 600 m². If the July cost was $17,600, how much of the cost of operating the Maintenance Department should be allocated to each production department? The operating cost for Department A is $ (Simplify your answer.) The operating cost for Department B is $ (Simplify your answer.) The operating cost for Department C is $ (Simplify your answer.) The operating cost for Department D is $ (Simplify your answer.)arrow_forwardHessel Corporation has two operating departments (Domestic and Global) and three service departments: Human Resources (HR), Legal, and Testing. In the most recent period, the following costs and service department usage ratios were recorded: Supplying Department Human Resources Legal Testing Direct cost From: Human Resources Legal Testing Total Human Resources Costs 10% 10% $ 264,500 $ Allocated to: Domestic Legal 0 $ 15% 0 0 $ 190,000 Required: Allocate the service department costs to the two operating departments using the reciprocal method. Note: Do not round intermediate calculations. Global Using Department Testing 0 10% 0 0 $ 90,000 Domestic 50% 60% 45% $ 541,000 Global 25% 30% 45% $ 490,000arrow_forward

- Founder Consulting Corporation has its headquarters in Memphis and operates from three branch offices in Nashville, Atlanta, and Louisville. Two of the company's activity cost pools are Administrative Service and Development Service. These costs are allocated to the three branch offices using an activity-based costing system. Information for next year follows: Activity Cost Pool Activity Measure Estimated Cost Administrative service % of time devoted to branch $ 1,680,000 Development service Computer time $ 630,000 Estimated branch data for next year is as follows: Time to branch Computer time Nashville 70 % 1,600,000 minutes Atlanta 20 % 1,200,000 minutes Louisville 10 % 400,000 minutes Total 100 % 3,200,000 minutes How much of the headquarters cost allocation should Nashville expect to receive next year?arrow_forwardThe expected costs for the Maintenance Department of Stazler, Inc., for the coming year include: Fixed costs (salaries, tools): 64,900 per year Variable costs (supplies): 1.35 per maintenance hour Estimated usage by: Actual usage by: Required: 1. Calculate a single charging rate for the Maintenance Department. 2. Use this rate to assign the costs of the Maintenance Department to the user departments based on actual usage. Calculate the total amount charged for maintenance for the year. 3. What if the Assembly Department used 4,000 maintenance hours in the year? How much would have been charged out to the three departments?arrow_forwardProduct costing and decision analysis for a service company Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month: Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs: The size of the companys ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation: Three recent representative flights have been selected for the profitability study. Their characteristics are as follows: Instructions Determine the fuel, crew, and depreciation cost per mile flown. Determine the cost per arrival or departure by terminal city. Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.arrow_forward

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardThe activity of moving materials uses four forklifts, each leased for 18,000 per year. A forklift is capable of making 5,000 moves per year, where a move is defined as a round trip from the plant to the warehouse and back. During the year, a total of 18,000 moves were made. What is the cost of the unused capacity for the moving goods activity? a. 5,400 b. 1,800 c. 7,200 d. 3,600arrow_forwardHow would each of the following costs be classified if units produced is the activity base? a. Salary of factory supervisor ($120,000 per year) b. Straight-line depreciation of plant and equipment c. Property rent of $11,500 per month on plant and equipmentarrow_forward

- Blue-Pool Company is an electric utility which has two service departments, Accounting and Maintenance. It also has two operating departments, Generation and Transmission. Maintenance Department costs are allocated based on maintenance hours of service. Accounting Department costs are allocated based on accounting hours of service provided. Budgeting costs and other data for the following year are as follows: Accounting Maintenance Generation Transmission Budgeted costs R100 000 R200 000 R600 000 R400 000 Maintenance hours of service 600 7 200 4 800 Accounting hours of service 500 2 000 4 500 3 500 The step method is used to allocate service department costs, with the accounting department being allocated first. Calculate the amount of accounting department costs that needs to be allocated to the generation department. A. R42 860 B. R38 000 C. R57 143 D. R45…arrow_forwardThe Merchant Manufacturing Company has two service departments - purchasing and maintenance, and two production departments -fabrication and assembly. The distribution of each service department's efforts to the other departments is shown below: FROM TO Purchasing Maintenance Fabrication Assembly Purchasing Maintenance 55% 30% 55% 15% 20% 25% The direct operating costs of the departments (including both variable and fixed costi) were as follows: $114,000 36,000 98, 000 66,000 Purchasing Maintenance Fabrication Assembly The total cost accumulated in the fabrication department using the step method is (assume the purchasing department goes first calculate all ratios and percentages to 4 decimal places, for example 33.3333%, and round all dollar amounts to the nearest whole dollarjarrow_forwardAccounting Selecting an Allocation Base for Service Costs. Winstead, Inc., is looking for an appropriate allocation base to allocate personnel costs totaling $5,000,000. Service department costs are allocated to three production departments: Assembly, Sanding, and Finishing. Management is considering two allocation bases. Possible Allocation Base Assembly Sanding Finishing Number of employees 30 20 50 Square feet of space occupied 25,000 15,000 10,000 Required: Calculate the amount of personnel department costs allocated to production departments using each allocation base. Which allocation base do you think is most reasonable? Why?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

What is Cost Allocation? Definition & Process; Author: FloQast;https://www.youtube.com/watch?v=hLhvvHvZ3JM;License: Standard Youtube License