Analyze Performance Report for Decentralized Organization

Hall O’ Fame Products is a nationwide sporting goods manufacturer. The company operates with a widely based manufacturing and distribution system that has led to a highly decentralized management structure. Each division manager is responsible for producing and distributing corporate products in one of eight geographical areas of the country.

Division managers are evaluated using a performance measure that is calculated as the division’s contribution to corporate profits before taxes less a 20 percent investment charge on the division’s investment base. The investment base of each division is the sum of its year-end balances of accounts receivable, inventories, and net plant fixed assets (cost less

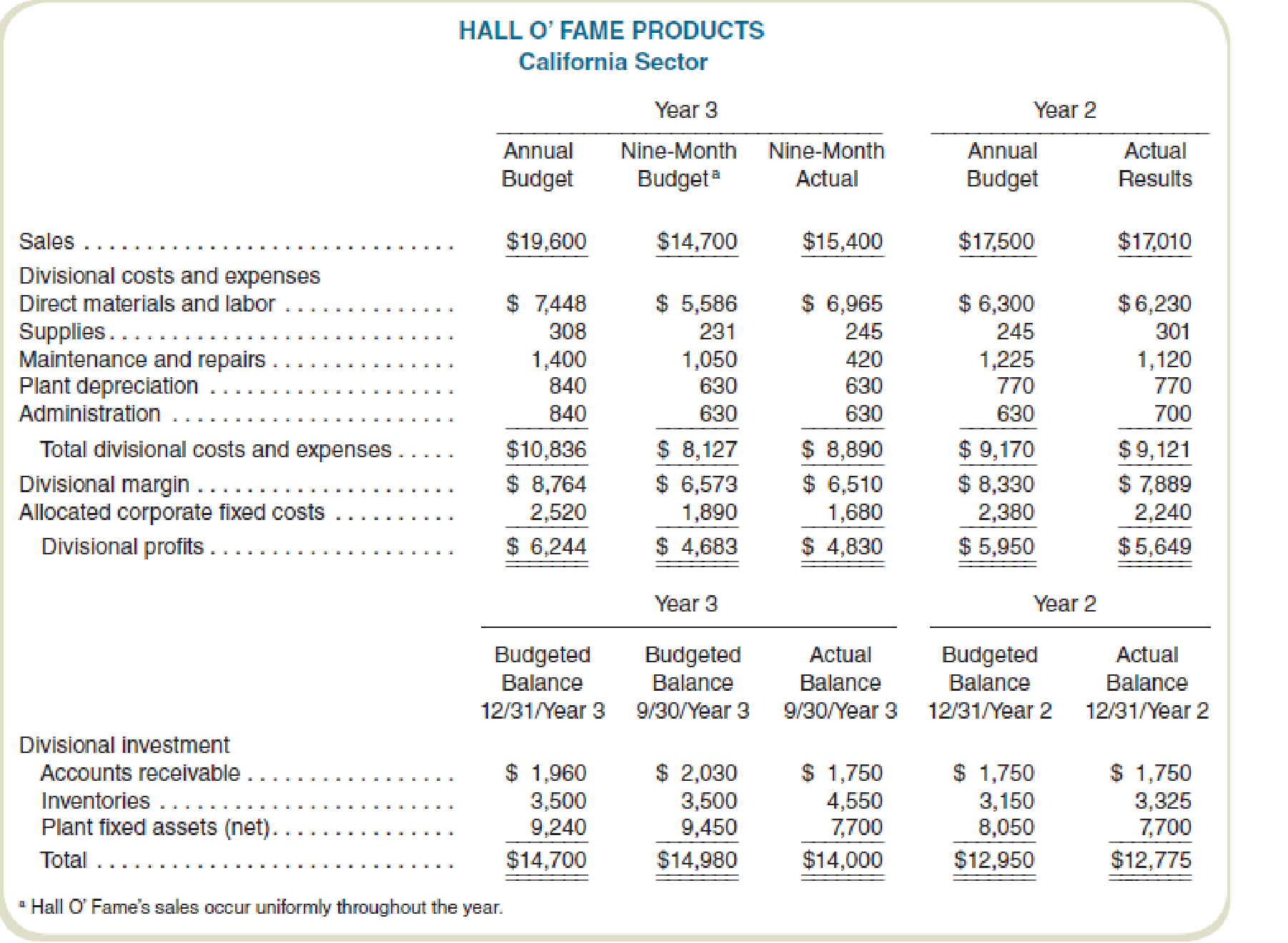

James Davenport, division manager for the California sector, prepared the year 2 and preliminary year 3 budgets for his division late in year 1. Final approval of the year 3 budget took place in late year 2 after adjustments for trends and other information developed during year 2. Preliminary work on the year 4 budget also took place at that time. In early October of year 3, Davenport asked the division controller to prepare a report that presents performance for the first nine months of year 3. The report follows:

Required

- a. Evaluate the performance of James Davenport for the nine months ending September 30, year 3. Support your evaluation with pertinent facts from the problem.

- b. Identify the features of Hall O’ Fame’s division performance measurement reporting and evaluation system that need to be revised if it is to effectively reflect the responsibilities of the divisional managers.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

FUNDAMENTALS OF COST ACCT.-CONNECT CARD

- Profit center responsibility reporting for a service company Red Line Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using operating income as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31: The company operates three support departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is a cost driver for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is a cost driver for this work. The following additional information has been gathered: Instructions 1. Prepare quarterly income statements showing operating income for the three divisions. Use three column headings: East, West, and Central. 2. Identify the most successful division according to the profit margin. Round to the nearest whole percent. 3. Provide a recommendation to the CEO for a better method for evaluating the performance of the divisions. In your recommendation, identify the major weakness of the present method.arrow_forwardGrate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of ROI performance. Only those managers who produce the best ROIs are selected to receive bonuses and to fill higher-level managerial positions. Fred Olsen, manager of the Hair Products Division, has always been one of the top performers. For the past two years, Freds division has produced the largest ROI; last year, the division earned an operating income of 2.56 million and employed average operating assets valued at 16 million. Fred is pleased with his divisions performance and has been told that if the division does well this year, he will be in line for a headquarters position. For the coming year, Freds division has been promised new capital totaling 1.5 million. Any of the capital not invested by the division will be invested to earn the companys required rate of return (9 percent). After some careful investigation, the marketing and engineering staff recommended that the division invest in equipment that could be used to produce a crimping and waving iron, a product currently not produced by the division. The cost of the equipment was estimated at 1.2 million. The divisions marketing manager estimated operating earnings from the new line to be 156,000 per year. After receiving the proposal and reviewing the potential effects, Fred turned it down. He then wrote a memo to corporate headquarters, indicating that his division would not be able to employ the capital in any new projects within the next eight to 10 months. He did note, however, that he was confident that his marketing and engineering staff would have a project ready by the end of the year. At that time, he would like to have access to the capital. Required: 1. Explain why Fred Olsen turned down the proposal to add the capability of producing a crimping and waving iron. Provide computations to support your reasoning. 2. Compute the effect that the new product line would have on the profitability of the firm as a whole. Should the division have produced the crimping and waving iron? 3. Suppose that the firm used residual income as a measure of divisional performance. Do you think Freds decision might have been different? Why? 4. Explain why a firm like Grate Care might decide to use both residual income and return on investment as measures of performance. 5. Did Fred display ethical behavior when he turned down the investment? In discussing this issue, consider why he refused to allow the investment.arrow_forwardTwo departments within Cougar Gear Inc. are Production and Sales. Each department has a unique scorecard, as follows: The Production Department scorecard focuses on the learning and growth and internal processes perspectives. The Sales Department scorecard focuses on the learning and growth and customer perspectives. Both scorecards have the learning and growth performance metrics of median training hours per employee and average employee tenure. The Production scorecard has the unique metrics of production time per unit and number of production shutdowns. The Sales scorecard has the unique metrics of percentage of customers who shop again and online customer satisfaction rating. The performance targets for each metric are shown in the tan boxes just under the performance metrics. The actual achieved metrics are shown in the red boxes just below the tan boxes. When evaluating both departments, Cougar Gears management looks at the median training hours per employee and average employee tenure metrics and subsequently decides to give the Sales Department a large bonus while giving the Production Department a minimal bonus. a. Determine and define the type of cognitive bias Cougar Gears management has exhibited in this instance. b. Determine which department would have received the larger bonus had the companys management not been biased in the evaluation. c. Discuss one advantage and one disadvantage of using unique balanced scorecards for different departments or divisions of a company.arrow_forward

- Communication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forwardClassify each of the following performance measures into the balanced scorecard perspective to which it relates: financial perspective, internal operations perspective, learning and growth perspective, or customer perspective. A. Employee satisfaction surveys B. Units of waste per production process, uniformity of products and inventory control C. Number of energy-efficient bulbs replaced D. Management training course certificates awarded E. Divisional profit F. Number of customer referralsarrow_forwardAssume you work as an accountant in the merchandising division of a large public company thatmakes and sells athletic clothing. To encourage the merchandising division to earn as much profiton each individual sale as possible, the division manager’s pay is based, in part, on the division’sgross profit percentage. To encourage control over the division’s operating expenses, the manager’s pay also is based on the division’s net income.You are currently preparing the division’s financial statements. The division had a good year,with sales of $100,000, cost of goods sold of $50,000, sales returns and allowances of $6,000, salesdiscounts of $4,000, and salaries and wages expenses of $30,000. (Assume the division does notreport income taxes.) The division manager stresses that “ it would be in your personal interest ” toclassify sales returns and allowances and sales discounts as selling expenses rather than as contrarevenues on the division’s income statement. He justifies this “friendly…arrow_forward

- Zuds, Helpful Hardware's manufacturing division of lawn-mowing and snow removal equipment, segments its business according to customer type: Professional and Residential. The following divisional information was available for the past year. View the divisional information. Requirements Round all of your answers to four decimal places. 1. Calculate each division's ROI. 2. Calculate each division's profit margin. Interpret your results. 3. Calculate each division's asset turnover. Interpret your results. 4. Use the expanded ROI formula to confirm your results from Requirement 1. What can you conclude?arrow_forwardRaddington Industries produces tool and die machinery for manufacturers. The company expanded vertically in 20x1 by acquiring one of its suppliers of alloy steel plates, Keimer Steel Company. To manage the two separate businesses, the operations of Keimer are reported separately as an investment center. Raddington monitors its divisions on the basis of both unit contribution and return on average investment (ROI), with investment defined as average operating assets employed. Management bonuses are determined on ROI. All investments in operating assets are expected to earn a minimum return of 13 percent before income taxes. Keimer's cost of goods sold is considered to be entirely variable, while the division's administrative expenses are not dependent on volume. Selling expenses are a mixed cost with 40 percent attributed to sales volume. Keimercontemplated a capital acquisition with an estimated ROI of 14.5 percent;however, division management decided against the investment because…arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: erences Mc. Graw H&M Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Total Company $ 825,000 555,500 269,500 260,000 $9,500 Commercial Residential $ 275,000 $ 550,000 154,000 401,500 121,000 148,500 114,000 146,000 $ 7,000 $ 2,500 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $79,500 of common fixed expenses that would continue to be incurred even if the Commercial or…arrow_forward

- Elsinore Electronics is a decentralized organization that evaluates divisional management based on measures of divisional contribution margin. Home Audio (Home) Division and Mobile Electronics (Mobile) Division both sell electronic equipment, primarily for video and audio entertainment. Home focuses on home and personal equipment; Mobile focuses on components for automobile and other, nonresidential equipment. Home produces an audio player that it can sell to the outside market for $72 per unit. The outside market can absorb up to 89,000 units per year. These units require 3 direct labor-hours each. If Home modifies the units with an additional hour of labor time, it can sell them to Mobile for $81 per unit. Mobile will accept up to 77,000 of these units per year. If Mobile does not obtain 77,000 units from Home, it purchases them for $84 each from the outside. Mobile incurs $36 of additional labor and other out-of-pocket costs to convert the player into one that fits in the…arrow_forwardDivisional Performance Analysis and Evaluation The vice president of operations of Free Ride Bike Company is evaluating the performance of two divisions organized as investment centers. Invested assets and condensed income statement data for the past year for each division are as follows: Mountain Bike Division Road Bike Division Sales Cost of goods sold Operating expenses Invested assets Required: 1. Prepare condensed divisional income statements for the year ended December 31, 20Y7, assuming that there were no support department allocations. Free Ride Bike Company Divisional Income Statements For the Year Ended December 31, 20Y7 Sales Cost of goods sold Gross profit Operating expenses Operating income $ Road Bike Division Road Bike Division $3,410,000 1,500,000 1,330,300 3,100,000 $ Road Bike Division Mountain Bike Division 2. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and rate of return on investment for each division. If…arrow_forwardEthics and the Manager, Understanding the Impact of Percentage Completion on Profit—Weighted-Average Method Gary Stevens and Mary James are production managers in the Consumer Electronics Division of General Electronics Company, which has several dozen plants scattered in locations throughout the world. Mary manages the plant located in Des Moines, Iowa, while Gary manages the plant in El Segundo, California. Production managers are paid a salary and gel an additional bonus equal to 5% of their base salary if the entire division meets or exceeds its target profits for the year. The bonus is determined in March after the company’s annual report has been prepared and issued to stockholders. Shortly after the beginning of the new year, Mary received a phone call from Gary that went like this: The final processing department in Mary’s production facility began the year with no work in process inventory. During the year, 210,000 units were transferred in from the prior processing department…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning