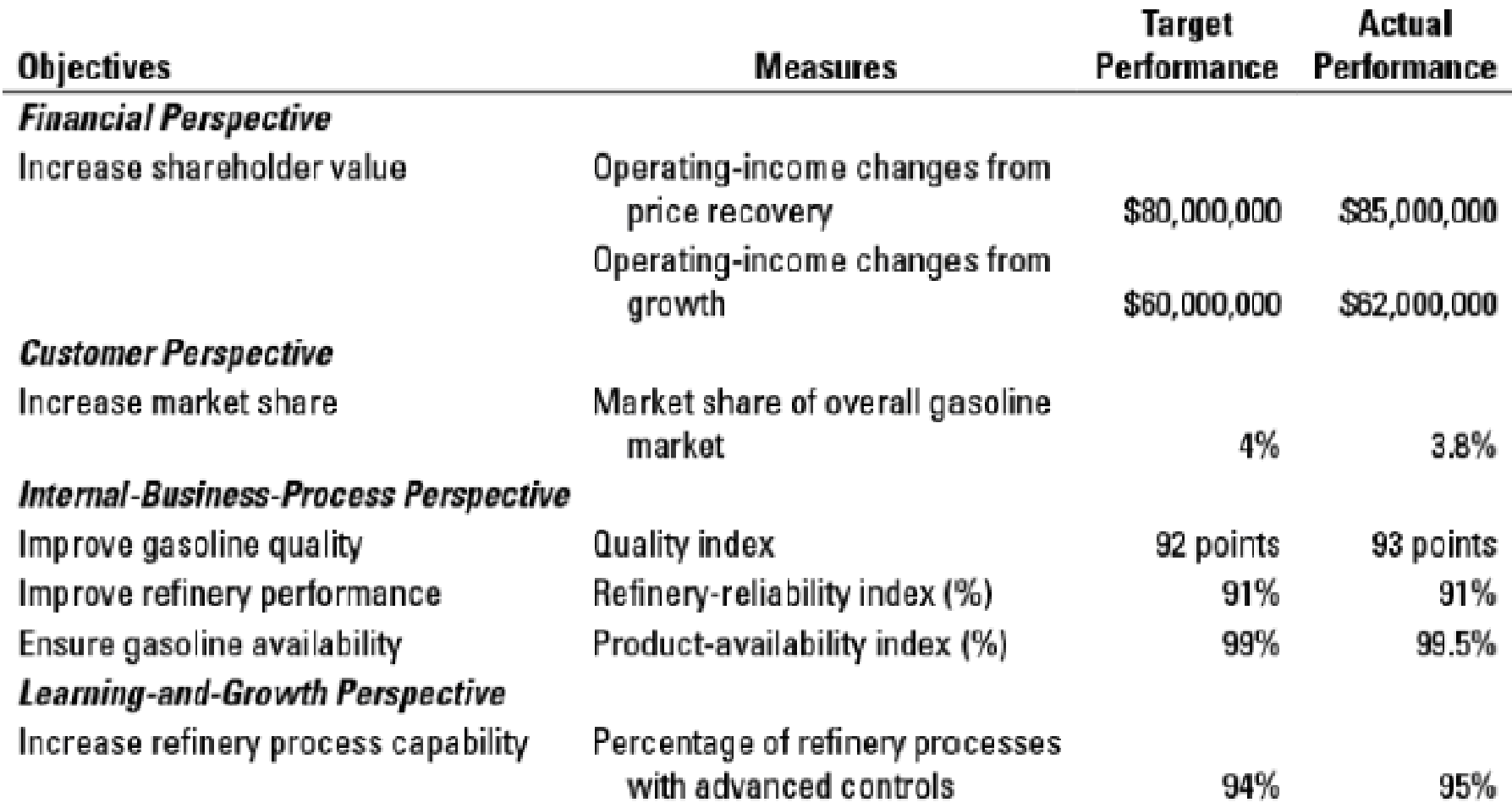

Balanced scorecard. (R. Kaplan, adapted) Petrocal, Inc., refines gasoline and sells it through its own Petrocal gas stations. On the basis of

- 1. Was Petrocal successful in implementing its strategy in 2017? Explain your answer.

- 2. Would you have included some measure of employee satisfaction and employee training in the learning-and-growth perspective? Are these objectives critical to Petrocal for implementing its strategy? Why or why not? Explain briefly.

- 3. Explain how Petrocal did not achieve its target market share in the total gasoline market but still exceeded its financial targets. Is ‘‘market share of overall gasoline marker the correct measure of market share? Explain briefly.

- 4. Is there a cause-and-effect linkage between improvements in the measures in the internal-business-process perspective and the measure in the customer perspective? That is, would you add other measures to the internal-business-process perspective or the customer perspective? Why or why not? Explain briefly.

- 5. Do you agree with Petrocal’s decision not to include measures of changes in operating income from productivity improvements under the financial perspective of the balanced scorecard? Explain briefly.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,