Concept explainers

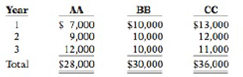

Doug's Custom Construction Company is considering three new projects, each requiring an equipment investment of $22,000. Each project will last for 3 years and produce the following net annual

The equipment's salvage value is zero, and Doug uses straight-line depreciation. Doug will not accept any project with a cash payback period over 2 years. Doug's required

Instructions

(a) Compute each project's payback period, indicating the most desirable project and the least desirable project using this method. (Round to two decimals and assume in your computations that cash flows occur evenly throughout the year.)

(b) Compute the

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Tools for Business Decision Making

- Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardDauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardJasmine Manufacturing is considering a project that will require an initial investment of $52,000 and is expected to generate future cash flows of $10,000 for years 1 through 3, $8,000 for years 4 and 5, and $2,000 for years 6 through 10. What is the payback period for this project?arrow_forward

- Roberts Company is considering an investment in equipment that is capable of producing more efficiently than the current technology. The outlay required is 2,293,200. The equipment is expected to last five years and will have no salvage value. The expected cash flows associated with the project are as follows: Required: 1. Compute the projects payback period. 2. Compute the projects accounting rate of return. 3. Compute the projects net present value, assuming a required rate of return of 10 percent. 4. Compute the projects internal rate of return.arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardAlmendarez Corporation is considering the purchase of a machine that would cost $150,000 and would last for 5 years. At the end of 5 years, the machine would have a salvage value of $18,000. By reducing labor and other operating costs, the machine would provide annual cost savings of $39,000. The company requires a minimum pretax return of 13% on all investment projects. (Ignore income taxes.) Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using the tables provided. The net present value of the proposed project is closest to: (Round your intermediate calculations and final answer to the nearest whole dollar amount.) Multiple Choice $(45,000) Q Search (((( |個個arrow_forward

- Ginny Trueblood is considering an investment, which will cost her $120,000. The investment produces no cash flows for the first year. In the second year, the cash inflow is $35,000. This inflow will increase to $55,000, and then $75,000 for the following two years before ceasing permanently. Ginny requires a 10% rate of return and has a required discounted payback period of three years. Should the project be accepted?arrow_forwardAlpha Zeta is considering purchasing some new equipment costing $390,000. The equipment will be depreciated on a straight line basis to zero book value over the four year life of the project. Projected net income for the four years is $18,900; $21,300; $26,700; and $25,000. What is the average accounting rate of return?arrow_forwardMountain Frost is considering a new project with an initial cost of $205,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $20,000, $20,900, $24,600, and $16,900, respectively. What is the average accounting return? Please make sure its correctarrow_forward

- Tempura, Inc., is considering two projects. Project A requires an investment of $50,000. Estimated annual receipts for 20 years are $20,000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $75,000, has annual receipts for 20 years of $28,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 12%/year.a. What is the present worth of each project? b. Which project should be recommended?arrow_forwardTempura, Inc., is considering two projects. Project A requires an investment of $50,000. Estimated annual receipts for 20 years are $20,000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $75,000, has annual receipts for 20 years of $28,000, and has annual costs of $18,000. Assume both projects have zero salvage value and that MARR is 12%/year.a. What is the annual worth of each project? b. Which project should be recommended?arrow_forwardBill plans to open a service center. The equipment will cost $50,000. Bill expects the after-tax cash inflows to be $15,000 annually for 8 years, after which he plans to scrap the equipment and retire. Assume the required return is 10.00%. What is the project's Pl?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning