Concept explainers

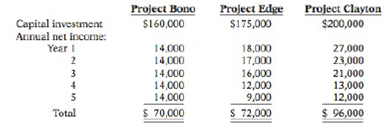

U3 Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows.

Instructions

(a) Compute the cash payback period for each project. (Round to two decimals.)

(b) Compute the

(c) Compute the annual

(d) Rank the projects on each of the foregoing bases. Which project do you recommend?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Managerial Accounting: Tools for Business Decision Making

- Consolidated Aluminum is considering the purchase of a new machine that will cost $308,000 and provide the following cash flows over the next five years: $88,000, 92,000, $91,000, $72,000, and $71,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel, see Appendix C.arrow_forwardGarnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the following cash flows over the next five years: $99,000, $88,000, $92,000. $87,000, and $72,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel. see Appendix C.arrow_forwardDock Company is considering a capital investment in machinery: E (Click the icon to view the data.) 8. Calculate the payback. 9. Calculate the ARR. Round the percentage to two decimal places. 10. Based on your answers to the above questions, should Dock invest in the machinery? 8. Calculate the payback. Payback years - X Data Table Initial investment $ 1,500,000 Residual value 350,000 Expected annual net cash inflows 500,000 Expected useful life 4 years Required rate of return 9% Print Donearrow_forward

- Oriental Corporation has gathered the following data on a proposed investment project: Investment in depreciable equipment $ 450,000 $ 90,000 Annual net cash flows Life of the equipment 10 years Salvage value Discount rate 53 $ 0 7% The company uses straight-line depreciation on all equipment. Assume cash flows occur uniformly throughout a year except for the initial investment. The payback period for the investment would be: (Round your answer to 1 decimal place.) Multiple Choice 0.2 years < Prev 5 of 5 Lavext a nere to search acer 立arrow_forwardD Company is evaluating three projects. Each project has a useful life of 5 years. Relevantdata on each project are as follows. Depreciation is computed by the straight-line method with no salvage value. The company’scost of capital/interest rate is 15%. (Assume that cash flows occur evenly throughout the year.)a. Compute the cash payback period for each project. (Round to two decimals.) (25%)b. Compute the net present value for each project. (Round to nearest dollar.) (25%)arrow_forwardWindsor Company is considering two capital expenditures. Relevant data for the projects are as follows: Project Initial investment Annual cash inflow Life of project Salvage value A $202,003 $41,080 6 years $0 B $306,910 $49,130 9 years $0 Windsor Company uses the straight-line method to depreciate its assets. Calculate the internal rate of return for each project. (For calculation purposes, use 5 decimal places as displayed in the facto provided, e.g. 1.25125. Round answers to O decimal places, e.g. 15%.)arrow_forward

- A project requires an increase in inventories, accounts payable, and accounts receivable of $105,000, $70,000, and $80,000, respectively. If opportunity cost of capital is 4% and the project has a life of 9 years, and the working capital investments will be recovered at the end of the life of the project, what is the effect on the NPV of the project? Enter your answer rounded to two decimal places. Enter your response below. Numberarrow_forwardCompany A has provided figures for two investment projects, only one of which may be chosen. These are the calculations based on the figures: Payback Period The Accounting Rate of Return / Return on Capital Employed Net Present Value Project A 2 years 4 months 27.08% £63,705 Project B 2 years 7 months 39.47% £74.971 Analyse and provide recommendations as to what project needs to be chosen based on the calculations above.arrow_forwardAn investment project provides cash inflows of $950 per year for eight years. a. What is the project payback period if the initial cost is $3,450? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the project payback period if the initial cost is $4,500? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) c. What is the project payback period if the initial cost is $8,600? (Enter 0 if the project never pays back. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forward

- Nicholson Roofing Materials, Inc., is considering two mutually exclusive projects, that both cost $170,000. The company's board of directors has set a 4-year payback requirement the cost of capital is 11%. The project cash flows are shown in the following table attached. a. Calculate the payback period for each project. Rank the projects by payback period. b. Calculate the NPV of each project. Rank the project by NPV. c. Calculate the IRR of each project. Rank the project by IRR. d. Make a recommendation.arrow_forwardAnswer each independent question, (a) through (e), below. a. Project D costs $10,000 and will generate sales of $5,800 each year for 5 years. The cash expenditures will be $2,400 per year. The firm uses straight-line depreciation with an estimated salvage value of $500 and has a tax rate of 20%. (1) What is the accounting (book) rate of return based on the original investment? (Round your answer to 2 decimal places.) (2) What is the book rate of return based on the average book value? (Round your answer to 2 decimal places.) (3)What is the NPV of project D? Assume that the firm requires a minimum after-tax return of 8% on investment.arrow_forwardA project requires an initial investment of $322,990 and its expected life is 7 years. Net operating income from the project is expected to be $28,100 each year, including depreciation of $42,270. The salvage value of the assets is expected to be $27,100 at the end of the life of the project. Ignoring income taxes, the payback period is: (Round your answer to 2 decimal places.) Payback period yearsarrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College