Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.2.2P

Differential analysis report for machine replacement proposal

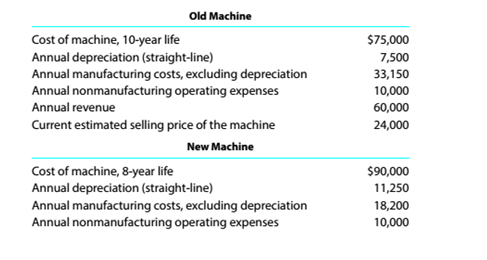

Catalina Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by the purchase of the new machine.

Instructions

List other factors that should be considered before a final decision is reached.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Differential Analysis Report for Machine Replacement Proposal

(PLEASE SEE QUESTION OVERVIEW IN ATTACHMENT)

Franklin Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

Old Machine

Cost of machine, 10-year life

$107,800

Annual depreciation (straight-line)

10,780

Annual manufacturing costs, excluding depreciation

37,600

Annual nonmanufacturing operating expenses

12,500

Annual revenue

95,100

Current estimated selling price of the machine

35,700

New Machine

Cost of machine, six-year life

$138,000

Annual depreciation (straight-line)

23,000

Estimated annual manufacturing costs, exclusive of depreciation

19,000

Annual nonmanufacturing operation expenses

10,000

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of…

Differential analysis for machine replacement proposal

Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

Old Machine

Cost of machine, eight-year life

$38,000

Annual depreciation (straight- line)

4,750

Annual manufacturing costs, excluding depreciation

12,400

Annual nonmanufacturing operating expenses

2,700

Annual revenue

32,400

Current estimated selling price of the machine

12,900

New Machine

Cost of machine, six-year life

$57,000

Annual depreciation (straight-line)

9,500

Estimated annual manufacturing costs, exclusive of depreciation

3,400

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine.

Instructions

1. Prepare a differential ananlysis as of November 8 comparing operations using…

Differential Analysis for Machine Replacement Proposal

Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows:

Old Machine

Cost of machine, eight-year life

$38,000

Annual depreciation (straight-line)

4,750

Annual manufacturing costs, excluding depreciation

12,400

Annual nonmanufacturing operating expenses

2,700

Annual revenue

32,400

Current estimated selling price of the machine

12,900

New Machine

Cost of machine, six-year life

$57,000

Annual depreciation (straight-line)

9,500

Estimated annual manufacturing costs, exclusive of depreciation

3,400

Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine.

Required:

1. Prepare a differential analysis as of November 8 comparing operations…

Chapter 12 Solutions

Survey of Accounting (Accounting I)

Ch. 12 - Mario Company is considering discontinuing a...Ch. 12 - Victor Company is considering disposing of...Ch. 12 - Prob. 3SEQCh. 12 - For which cost concept used in applying (he...Ch. 12 - Prob. 5SEQCh. 12 - Prob. 1CDQCh. 12 - Prob. 2CDQCh. 12 - A company could sell a building for $650,000 or...Ch. 12 - Prob. 4CDQCh. 12 - Prob. 5CDQ

Ch. 12 - A company fabricates a component at a cost of...Ch. 12 - Prob. 7CDQCh. 12 - Prob. 8CDQCh. 12 - Prob. 9CDQCh. 12 - Prob. 10CDQCh. 12 - Prob. 11CDQCh. 12 - Prob. 12CDQCh. 12 - Lease or sell decision Orwell Industries is...Ch. 12 - Prob. 12.2ECh. 12 - Prob. 12.3ECh. 12 - Prob. 12.4ECh. 12 - Prob. 12.5ECh. 12 - Make-or-buy decision Watts Technologies Company...Ch. 12 - Make-or-buy decision Wisconsin Arts of Milwaukee...Ch. 12 - Machine replacement decision Creekside Products...Ch. 12 - Differential analysis report for machine...Ch. 12 - Sell or process further St. Paul Lumber Company...Ch. 12 - Prob. 12.11ECh. 12 - Decision on accepting additional business Madison...Ch. 12 - Accepting business at a special price Palomar...Ch. 12 - Prob. 12.14ECh. 12 - Total cost concept of product costing Willis...Ch. 12 - Product cost concept of product pricing Based on...Ch. 12 - Variable cost concept of product pricing Based on...Ch. 12 - Target costing Toyota Motor Corporation (TM) uses...Ch. 12 - Differential analysis report involving opportunity...Ch. 12 - Prob. 12.1.2PCh. 12 - Prob. 12.1.3PCh. 12 - Differential analysis report for machine...Ch. 12 - Differential analysis report for machine...Ch. 12 - Differential analysis report for sales promotion...Ch. 12 - Differential analysis report for sales promotion...Ch. 12 - Differential analysis report for further...Ch. 12 - Prob. 12.4.2PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.5.2PCh. 12 - Prob. 12.5.3PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.5.5PCh. 12 - Product pricing using the cost-plus approach...Ch. 12 - Prob. 12.1MBACh. 12 - Prob. 12.2MBACh. 12 - Prob. 12.3.1MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.3.3MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.4.2MBACh. 12 - Contribution margin per constraint Using the data...Ch. 12 - Prob. 12.5.1MBACh. 12 - Prob. 12.5.2MBACh. 12 - Prob. 12.5.3MBACh. 12 - Product pricing Bev Frazier is a cost accountant...Ch. 12 - Prob. 12.2CCh. 12 - Prob. 12.3CCh. 12 - Cost-plus and target costing concepts The...Ch. 12 - Cost-plus and target costing concepts The...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Differential analysis for machine replacement proposal Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Instructions 1. Prepare a differential analysis as of November 8 comparing operations using the present machine (Alternative 1) with operations using the new machine (Alternative 2). The analysis should indicate the differential profit that would result over the six-year period if the new machine is acquired. 2. List other factors that should be considered before a final decision is reached.arrow_forwardDifferntial analysis for machine replacement proposal Lexigraphic Printing Company is considering replacing a machine that has been used in its factory for four years.Relevant data associated with the operations of the old machine and the new machine.neither of which has any estimated residual value,are as follows: Annual nonmanfacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Instructions 1. Prepare a differential analysis as of april 30 comparing operations using the present machine (alternative 1 ) with operations using the new machine (alternative 2 ).The analysis should indicate the total differntial income that would result over the six-years period if the new machine is acquired. 2 List other factors that should be considered before a final decision is reached.arrow_forwardAt times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $1,800,000, and it will be depreciated on a straight-line basis over a period of six years (years 1–6). • The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of $50,000 that will be recovered at the end…arrow_forward

- Differential Analysis Report for Machine Replacement Proposal (PLEASE SEE ORIGINAL QUESTION OVERVIEW IN ATTACHMENT) Franklin Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, 10-year life $107,800 Annual depreciation (straight-line) 10,780 Annual manufacturing costs, excluding depreciation 37,600 Annual nonmanufacturing operating expenses 12,500 Annual revenue 95,100 Current estimated selling price of the machine 35,700 New Machine Cost of machine, six-year life $138,000 Annual depreciation (straight-line) 23,000 Estimated annual manufacturing costs, exclusive of depreciation 19,000 Annual nonmanufacturing operation expenses 10,000 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by…arrow_forwardDifferential Analysis for Machine Replacement ProposalFlint Tooling Company is considering replacing a machine that has been used in its factory for two years.Relevant data associated with the operations of the old machine and the new machine, neither of whichhas any estimated residual value, are as follows:Old MachineCost of machine, eight-year life $38,000Annual depreciation (straight-line) 4,750Annual manufacturing costs, excluding depreciation 12,400Annual nonmanufacturing operating expenses 2,700Annual revenue 32,400Current estimated selling price of the machine 12,900New MachineCost of machine, six-year life $57,000Annual depreciation (straight-line) 9,500Estimated annual manufacturing costs, exclusive of depreciation 3,400Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase ofthe new machine.Required:1. Prepare a differential analysis as of November 8 comparing operations using the present machine(Alternative 1) with operations using…arrow_forwardDifferential Analysis for Machine Replacement Proposal Flint Tooling Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, 10-year life $106,700 Annual depreciation (straight-line) 10,670 Annual manufacturing costs, excluding depreciation 39,100 Annual nonmanufacturing operating expenses 12,900 Annual revenue 94,300 Current estimated selling price of the machine 36,700 New Machine Cost of machine, six-year life $138,000 Annual depreciation (straight-line) 23,000 Estimated annual manufacturing costs, exclusive of depreciation 18,900 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of November 8 comparing operations…arrow_forward

- Differential Analysis for Machine Replacement Proposal Lexigraphic Printing Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, 10-year life $89,000 Annual depreciation (straight-line) 8,900 Annual manufacturing costs, excluding depreciation 23,600 Annual nonmanufacturing operating expenses 6,100 Annual revenue 74,200 Current estimated selling price of machine 29,700 New Machine Purchase price of machine, six-year life $119,700 Annual depreciation (straight-line) 19,950 Estimated annual manufacturing costs, excluding depreciation 6,900 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: Prepare a differential…arrow_forwardIt is desired to determine how much longer a forklift truck should remain in service before it is replaced by the new truck (challenger) for which data were given in the shown Table. The defender in this case is two years old, originally cost $19,500, and has a present realizable MV of $7,500. If kept, its MVs and annual expenses are expected to be as follows: Determine the most economical period to keep the defender before replacing it (if at all) with the present challenger of Example. The before -tax cost of capital (MARR) is 10% per year. A new forklift truck will require an investment of $30,000 and is expected to have year-end MVs and annual expenses as shown in columns 2 and 5, respectively, of Table. If the before-tax MARR is 10% per year,arrow_forwardCH Kilo Inc. is evaluating a proposal to supply warehouse space to a potential customer as well as maintain all the required warehouse records. Kilo has a storage barn not currently in use; however, it will require the installation of additional shelving and a special concrete pad for delivery truck access Kilo's existing accountant will assume the additional accounting duties and receive an additional $8,000 per annum. The potential customer will pay a fee to Kilo based on the volume of product stored. Required: Which of the following items is not a relevant consideration in deciding whether Kilo should provide the warehouse space to the potential customer? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer, Any boxes left with a question mark will be automatically graded as incorrect.) Original purchase price of the storegeben…arrow_forward

- Metal Recycling and Salvage receives the opportunity to salvage scrap metal and other materials from an old industrial site. The current owners of the site will sign over the site to Enviro at no cost. Enviro intends to extract scrap metal at the site for 24 months and then will clean up the site, return the land to useable condition, and sell it to a developer. Projected costs associated with the project follow: Read the requirements2. Requirement 1. Assuming that Enviro expects to salvage 70,000tons of metal from the site, what is the total project life cycle cost? Total Life-Cycle Costs Variable costs: Metal extraction and processing Fixed costs: Metal extraction and processing Rent on temporary buildings Administration Clean-up Land restoration Selling land Total life-cycle cost Requirement 2. Suppose Enviro can sell the metal for $110 per ton and wants to earn a…arrow_forwardAssume that a company is choosing between two alternatives-keep an existing machine or replace it with a new machine. The costs associated with the two alternatives are summarized as follows: Purchase cost (new) Remaining book value Overhaul needed now Multiple Choice Annual cash operating costs Salvage value (now) Salvage value (eight years from now) Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. If the company overhauls its existing machine, it will be usable for eight more years. If it buys the new machine, it will be used for eight years. Assuming a discount rate of 16%, what is the net present value of the cash flows associated with keeping the existing machine? O $(52,651) O O O $(69,651) $(48,651) Existing Machine New Machine $ 22,000 $(54,651) $ 15,000 $ 6,000 $5,000 $ 11,500 $ 2,000 $ 1,000 $ 7,000 $ 6,000arrow_forwardCetec Aviation Services has cost estimates associated with operating and maintaining the currently owned filter analysis system as shown below. It isconsidering the acquisition of a replacement system that can identify residual particles in industrial filters, report its findings, and archive images and information for future retrieval. Determine the cost of keeping the current system one more year at an interest rate of 10% per year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License