Differntial analysis for machine replacement proposal

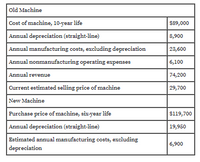

Lexigraphic Printing Company is considering replacing a machine that has been used in its factory for four years.Relevant data associated with the operations of the old machine and the new machine.neither of which has any estimated residual value,are as follows:

Annual nonmanfacturing operating expenses and revenue are not expected to be affected by purchase of the new machine.

Instructions

1. Prepare a differential analysis as of april 30 comparing operations using the present machine (alternative 1 ) with operations using the new machine (alternative 2 ).The analysis should indicate the total differntial income that would result over the six-years period if the new machine is acquired.

2 List other factors that should be considered before a final decision is reached.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Required:1. Is Davis’s general approach to calculating the opportunity cost in terms of the physical units involved, correct? Explain.2. Assuming productive capacity cannot be increased for either machine in December, how many PVRs would WCD have to forgo selling to existing customers to fill the special order from Scottie Barnes Limited ?3. Calculate the opportunity cost of accepting the special order.4. Calculate the net effect on profits of accepting the special order.5. Now assume that WCD is operating at 75% of capacity in December. What is the minimum price WCD should be willing to accept on the special order?arrow_forwardcorrect answer?arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Please do not give solution in image formatarrow_forwardDifferential Analysis for Machine Replacement Proposal Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, eight-year life $38,000 Annual depreciation (straight-line) 4,750 Annual manufacturing costs, excluding depreciation 12,400 Annual nonmanufacturing operating expenses 2,700 Annual revenue 32,400 Current estimated selling price of the machine 12,900 New Machine Cost of machine, six-year life $57,000 Annual depreciation (straight-line) 9,500 Estimated annual manufacturing costs, exclusive of depreciation 3,400 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of November 8 comparing operations…arrow_forwardDifferential Analysis for Machine Replacement Kim Kwon Digital Components Company assembles circuit boards by using a manually operated machine to insert electronic components. The original cost of the machine is $73,400, the accumulated depreciation is $29,400, its remaining useful life is five years, and its residual value is negligible. On May 4 of the current year, a proposal was made to replace the present manufacturing procedure with a fully automatic machine that has a purchase price of $152,700. The automatic machine has an estimated useful life of five years and no significant residual value. For use in evaluating the proposal, the accountant accumulated the following annual data on present and proposed operations: Present Operations Proposed Operations Sales $232,700 $232,700 Direct materials $79,300 $79,300 Direct labor 55,100 — Power and maintenance 5,100 27,200 Taxes, insurance, etc. 1,800 6,100 Selling and administrative expenses…arrow_forward

- Accounting Questionarrow_forwardDifferential Analysis for Machine Replacement Proposal Flint Tooling Company is considering replacing a machine that has been used in its factory for four years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, 10-year life $106,700 Annual depreciation (straight-line) 10,670 Annual manufacturing costs, excluding depreciation 39,100 Annual nonmanufacturing operating expenses 12,900 Annual revenue 94,300 Current estimated selling price of the machine 36,700 New Machine Cost of machine, six-year life $138,000 Annual depreciation (straight-line) 23,000 Estimated annual manufacturing costs, exclusive of depreciation 18,900 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of November 8 comparing operations…arrow_forwardNonearrow_forward

- ex2. Differential Analysis for Machine Replacement Proposal Flint Tooling Company is considering replacing a machine that has been used in its factory for two years. Relevant data associated with the operations of the old machine and the new machine, neither of which has any estimated residual value, are as follows: Old Machine Cost of machine, eight-year life $38,000 Annual depreciation (straight-line) 4,750 Annual manufacturing costs, excluding depreciation 12,400 Annual nonmanufacturing operating expenses 2,700 Annual revenue 32,400 Current estimated selling price of the machine 12,900 New Machine Cost of machine, six-year life $57,000 Annual depreciation (straight-line) 9,500 Estimated annual manufacturing costs, exclusive of depreciation 3,400 Annual nonmanufacturing operating expenses and revenue are not expected to be affected by purchase of the new machine. Required: 1. Prepare a differential analysis as of November 8 comparing…arrow_forwardPlease do not give solution in image format thankuarrow_forwardNeed help pleasearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education