Horngren's Accounting (12th Edition)

12th Edition

ISBN: 9780134486444

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem E11.21E

Accounting for warranty expense and warranty payable

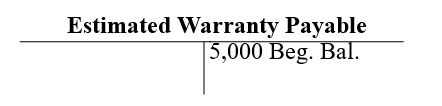

The accounting records of Sculpted Ceramics included the following at January 1, 2018:

In the past, Sculpted’s warranty expense has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satisfy warranty claims.

Requirements

1. Journalize Sculpted’s warranty expense and warranty payments during 2018. Explanations are not required.

2. What balance of Estimated Warranty Payable will Sculpted report on s balance sheet at December 31, 2018?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kimber Sales offers warranties on all their electronic goods. Warranty expense is estimated at 3.5% of sales revenue. In 2018, Kimber had $333,000 of sales. In the same year, Kimber paid out $8,750 of warranty payments. Provide the journal entry to record the warranty expense. What is the balance of the liability account?

Account name

Debit

Credit

Accounting for warranty expense and warranty payable

The accounting records of Sculpted Ceramics included the following at January 1,2018:

In the past, Sculpted’s warranty expense has been 9% of sales. During 2018, Sculpted made sales of $113,000 and paid $7,000 to satisfy warranty Claims.

Requirements

Journalize Sculpted’s warranty expense and warranty payments during 2018. Explanations are not required.

What balance of Estimated Warranty Payable will Sculpted report on its balance sheet at December 31, 2018?

PHAGE COMPANY estimates its annual warranty expense at 4% of net sales. The following

balances are given by EUSTASS: Net sales – 1,500,000; warranty liability – balance 12/31/2021

debit (before adjustment) of 10,000; warranty liability - balance 12/31/2021 credit (after

adjustment) of 50,000. Which of the following entries was made to record the 2021 estimated

warranty expense?

a. Warranty expense

60,000

10,000

Retained earnings

Warranty liability

50,000

b. Warranty expense

Retained earnings

Warranty liability

50,000

10,000

60,000

c. Warranty expense

Warranty liability

40,000

40,000

d. Warranty expense

Warranty liability

60,000

60,000

Chapter 11 Solutions

Horngren's Accounting (12th Edition)

Ch. 11 - On January 1, 2018, a business borrowed $18,000 on...Ch. 11 - Prob. 2QCCh. 11 - Prob. 3QCCh. 11 - Prob. 4QCCh. 11 - Prob. 5QCCh. 11 - Prob. 6QCCh. 11 - Prob. 7QCCh. 11 - Prob. 8QCCh. 11 - Prob. 9QCCh. 11 - McDaniel and Associates reported the following...

Ch. 11 - Prob. 1RQCh. 11 - Prob. 2RQCh. 11 - Prob. 3RQCh. 11 - Prob. 4RQCh. 11 - What do short-term notes payable represent?Ch. 11 - 6. Coltrane Company has a $5,000 note payable that...Ch. 11 - Prob. 7RQCh. 11 - Prob. 8RQCh. 11 - Prob. 9RQCh. 11 - Prob. 10RQCh. 11 - Prob. 11RQCh. 11 - Prob. 12RQCh. 11 - Prob. 13RQCh. 11 - Prob. 14RQCh. 11 - Prob. 15RQCh. 11 - Prob. S11.1SECh. 11 - Prob. S11.2SECh. 11 - Prob. S11.3SECh. 11 - Prob. S11.4SECh. 11 - Prob. S11.5SECh. 11 - Prob. S11.6SECh. 11 - Prob. S11.7SECh. 11 - Prob. S11.8SECh. 11 - Prob. S11.9SECh. 11 - Prob. S11.10SECh. 11 - Prob. S11.11SECh. 11 - Prob. S11.12SECh. 11 - Prob. S11.13SECh. 11 - Prob. E11.14ECh. 11 - Prob. E11.15ECh. 11 - Recording and reporting current liabilities...Ch. 11 - Prob. E11.17ECh. 11 - Prob. E11.18ECh. 11 - Prob. E11.19ECh. 11 - Recording employee and employer payroll taxes...Ch. 11 - Accounting for warranty expense and warranty...Ch. 11 - Prob. E11.22ECh. 11 - Prob. E11.23ECh. 11 - Prob. E11.24ECh. 11 - Journalizing and posting liabilities Learning...Ch. 11 - Prob. P11.26APGACh. 11 - Prob. P11.27APGACh. 11 - Prob. P11.28APGACh. 11 - Prob. P11.29APGACh. 11 - Prob. P11.30BPGBCh. 11 - Prob. P11.31BPGBCh. 11 - Prob. P11.32BPGBCh. 11 - Prob. P11.33BPGBCh. 11 - Prob. P11.34BPGBCh. 11 - Prob. P11.35CTCh. 11 - Prob. P11.36CPCh. 11 - Before you begin this assignment, review Tying it...Ch. 11 - Prob. 11.1DCCh. 11 - Prob. 11.2DCCh. 11 - Ethical Issue 11-1 Many small businesses have to...Ch. 11 - Prob. 11.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 11. Record journal entries for the following transactions of Telesco Enterprises. Jan. 1, 2018 Issued a $330,700 note to customer Abe Willis as terms of a merchandise sale. The merchandise's cost to Telesco is $120,900. Note contract terms included a 36-month maturity date, and a 4% annual interest rate. Dec. 31, 2018 Telesco records interest accumulated for 2018. Dec. 31, 2019 Telesco records interest accumulated for 2019. Dec. 31, 2020 | Abe Willis honors the note and pays in full with cash.arrow_forwardCharm Company estimates its annual warranty expense as 2% of annual net sales. The following data relate to calendar year 2019. Net Sales P 3,200,000 Warranty Liability account: Balance, Jan. 1, 2019 10,000 debit before adjustment Balance , Dec. 31, 2019 54,000 credit after adjustment. Which of the following entries was made to record the 2019 estimated warranty expense? * A.Debit Warranty Expense 64,000 and Credit Estimated liability under warranties 64,000 B.Debit warranty Expense 64,000 Credit Accumulated profits/losses 10,000 and Estimated liability under warranties 54,000 C.Debit Warranty Expense 54,000 and Accumulated profits/losses 10,000 and Credit Estimated liability under warranties 64,000 D.Debit Warranty Expense 44,000 and Credit Estimated liability under warranties 44,000arrow_forwardMcNamara Industries completed the following transactions during 2024: (Click the icon to view the transactions.) Journalize the transactions. Explanations are not required. Round to the nearest dollar. (Record debits first, then credits. Exclude explanations from journal entries.) Nov. 1: Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Date Accounts Debit Credit Nov. 1 More info Nov. 1 Nov. 20 Dec. 31 Dec. 31 ← Made sales of $16,000. McNamara estimates that warranty expense is 5% of sales. (Record only the warranty expense.) Paid $500 to satisfy warranty claims. Estimated vacation benefits expense to be $3,500. McNamara expected to pay its employees a 4% bonus on net income after deducting the bonus. Net income for the year is $25,000. Prin Done Xarrow_forward

- Record journal entries for the following transactions of Piano Wholesalers. Jan. 1, 2018 Dec. 31, 2018 Dec. 31, 2019 Plano Wholesalers records interest accumulated for 2018. Piano Wholesalers converts Arrowstar's dishonored note into account receivable. This includes accumulated interest for the 24-month period. April 12, 2020 Plano Wholesalers sells the outstanding debt from Arrowstar to a collection agency at 40% of the accounts receivable value. an amount box does not require an entry, leave it blank. If required, round your answers to two decimal places. Jan. 1, 2018 Jan. 1, 2018 Dec. 31, 2018 Issued a $1,236,650 note to customer Arrowstar as terms of a merchandise sale. The merchandise's cost to Plano Wholesalers is $605,000. Note contract terms included a 24-month maturity date and a 3.4% annual interest rate. Dec. 31, 2019 April 12, 2020 To record sale in exchange for Notes Receivable: Arrowstar To record the cost of sale To record interest accumulated in 2018 To record…arrow_forward1. Otis Company sells calculators that carry a one-year warranty against manufacturer's defects. Based on company experience, warranty costs are estimated at P300 per calculator. During 2017, Otis sold 24,000 calculators, and paid warranty costs of P170,000. In its income statement for the year ended December 31, 2017, how much should Otis report as warranty expense? a. 1,700,000 b. 2,400,000 c. 5,500,000 d. 7,200,000 2. In May 2017, Maive Company filed suit against Wiley, Inc. seeking P850,000 damages for patent infringement. A court verdict in November 2017 awarded Maive P600,000 in damages, but Wiley's appeal is not expected to be decided before 2017. Maive's counsel believes it is probable but not virtually certain that Maive will be successful against Wiley for an estimated amount in the range between P300,000 and P450, 000, with P400,000 considered the most likely amount. What amount should Maive record as contingent asset from lawsuit in the year ended December 31, 2017? a. None…arrow_forwardDuring the month, Inline Industries paid $582 to settle warranty claims. Inline uses an estimated warranty account. The journal entry to record the payment would have been: A. debit Warranty expense, $582; credit Cash, $582. B. debit Warranty expense, $582; credit Estimated Warranty payable, $582 C. debit Estimated warranty payable, $582; credit Warranty expense, $582 D. debit Estimated warranty payable, $582, credit Cash, $582arrow_forward

- Record journal entries for the following transactions of Telesco Enterprises. Jan. 1, 2018 Issued a $330,700 note to customer Abe Willis as terms of a merchandise sale. The merchandise’s cost to Telesco is $126,900.Note contract terms included a 36-month maturity date, and a 4% annual interest rate. Dec. 31, 2018 Telesco records interest accumulated for 2018. Dec. 31, 2019 Telesco records interest accumulated for 2019. Dec. 31, 2020 Abe Willis honors the note and pays in full with cash. If an amount box does not require an entry, leave it blank. Jan. 1, 2018 Notes Receivable: Willis Notes Receivable: Willis Sales Revenue Sales Revenue To record sale in exchange forNotes Receivable: Willis, 36-month maturity, 4% interest rate Jan. 1, 2018 Cost of Goods Sold Cost of Goods Sold Merchandise Inventory Merchandise Inventory To record the cost of sale Dec. 31, 2018 Interest Receivable: Willis Interest Receivable: Willis…arrow_forwardVolvo Group reported the following information in a recent year for its product warranty costs along withprovisions and utilizations of warranty liabilities (amounts in millions). Beginning product warranty liabilities, January 1 . SEK 9,881Additional provisions to product warranty liabilities 7,836Utilizations and reductions of product warranty liabilities (7,134)Ending product warranty liabilities, December 31 . . . . . . . . . . . . . . . . . . . . . SEK 10,583 1. Prepare Volvo’s journal entry to record its estimated warranty liabilities (provisions) for the year. 2. Prepare Volvo’s journal entry to record its costs (utilizations) related to its warranty program for the year. Assume those costs involve replacements taken out of inventory, with no cash involved. 3. How much warranty expense does Volvo report for the year?arrow_forwardNance Company estimates its annual warranty expense as 2% of annual net sales. The following data relate to the calendar year 2012: Net sales $1,500,000 Warranty liability account Balance, Dec. 31, 2012 $10,000 debit before adjustment Balance, Dec. 31, 2012 50,000 credit after adjustment Which one of the following entries was made to record the 2012 estimated warranty expense? Group of answer choices DR. Warranty Expense 30,000 CR. Retained Earnings (prior-period adjustment) 5,000 CR. Warranty Liability 25,000 DR. Warranty Expense 25,000 DR. Retained Earnings (prior-period adjustment) 5,000 CR. Warranty Liability 30,000 DR. Warranty Expense 20,000 CR. Warranty Liability 20,000 DR. Warranty Expense 30,000 CR. Warranty Liability 30,000arrow_forward

- The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $1,090. During the period a customer returned a product that cost $818 to repair. Required a. Show the effects of these transactions on the financial statements using a horizontal statements model like the example shown here. Use a + to indicate increase or a – for decrease. if the element is not affected, leave the cell blank. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). (Not all cells will require entry.) CHAIR COMPANY Horizontal Statements Model Balance Sheet Income Statement Statement of Stockholder's Equity Event Assets Liabilities + Revenue Expense = Net Income Cash Flow Estimates Paidarrow_forwardRecord journal entries for the following transactions of Telesco Enterprises. Jan. 1, 2018 Issued a $330,700 note to customer Abe Willis as terms of a merchandise sale. The merchandise's cost to Telesco is $126,900. Note contract terms included a 36-month maturity date, and a 4% annual interest rate. Telesco records interest accumulated for 2018. Dec. 31, 2018 Dec. 31, 2019 Telesco records interest accumulated for 2019. Dec. 31, 2020 Abe Willis honors the note and pays in full with cash. If an amount box does not require an entry, leave it blank. Jan. 1, 2018 Notes Receivable: Willis Jan. 1, 2018 Sales Revenue To record sale in exchange for Notes Receivable: Willis, 36-month maturity, 4% interest rate Cost of Goods Sold Merchandise Inventory To record the cost of sale Dec. 31, 2018 interest Receivable: Willis interest Revenue To record interest accumulated in 2018 Dec 31, 2019 interest Receivable: Willis interest Revenue ✓ To record interest accumulated in 2019 Dec 31, 2020 Cash Notes…arrow_forwardOther accrued liabilities—warranties The balance of the Estimated Warranty Liability account was $25,000 on January 1, 2016, and $34,400 on December 31, 2016. Based on an analysis of warranty claims during the past several years, this year’s warranty provision was established at 1.5% of sales, and sales during the year were $2,600,000.Required:What amount of warranty expense will appear on the income statement for the year ended December 31, 2016?What were the actual costs of servicing products under warranty during the year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

7.2 Ch 7: Notes Payable and Interest, Revenue recognition explained; Author: Accounting Prof - making it easy, The finance storyteller;https://www.youtube.com/watch?v=wMC3wCdPnRg;License: Standard YouTube License, CC-BY