FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

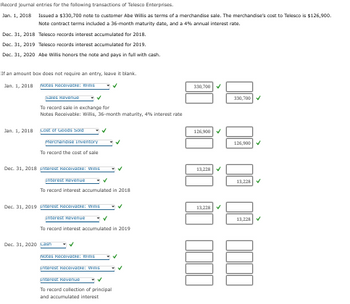

Transcribed Image Text:**Educational Website Content: Accounting Transactions Journal Entries**

**Overview:**

This guide provides a detailed transcription of journal entries related to the financial transactions of Telesco Enterprises with customer Abe Willis. The focus is on recording the issuance of a note, the accumulation of interest over the years, and the eventual repayment of the note. The note terms include a 36-month maturity and a 4% annual interest rate.

### Transactions and Journal Entries:

#### Transaction Date: January 1, 2018

**Description:**

- Telesco Enterprises issues a $330,700 note to customer Abe Willis for merchandise.

- The merchandise had a cost of $126,900 for Telesco.

- The note has a 36-month maturity with a 4% annual interest rate.

**Journal Entries:**

1. **Notes Receivable - Willis**

- Debit: $330,700

2. **Sales Revenue**

- Credit: $330,700

- *To record the sale in exchange for the note from Abe Willis.*

3. **Cost of Goods Sold**

- Debit: $126,900

4. **Merchandise Inventory**

- Credit: $126,900

- *To record the cost of sale.*

#### Transaction Date: December 31, 2018

**Description:**

- Telesco records interest accumulated for 2018.

**Journal Entries:**

1. **Interest Receivable - Willis**

- Debit: $13,228

2. **Interest Revenue**

- Credit: $13,228

- *To record interest accumulated in 2018.*

#### Transaction Date: December 31, 2019

**Description:**

- Telesco records interest accumulated for 2019.

**Journal Entries:**

1. **Interest Receivable - Willis**

- Debit: $13,228

2. **Interest Revenue**

- Credit: $13,228

- *To record interest accumulated in 2019.*

#### Transaction Date: December 31, 2020

**Description:**

- Abe Willis honors the note by paying in full with cash.

**Journal Entries:**

1. **Cash**

- Debit: $356,156

2. **Interest Revenue**

- Credit: $13,228

3. **Interest Receivable - Willis**

- Credit: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Rotel purchased merchandise from TechCom on October 17, 2019. TechCom accepted Rotel's $4,800, 90-day, 10% note as payment. TechCom has a December 31st year end. What entry should TechCom make on January 15, 2020 when the note is honoured? Multiple Choice Cash 4918.36 Interest Earned 19.73 Interest Receivable 98.63 Notes Receivable 4,800 Cash 4918.36 Interest Earned 98.63 Interest Receivable 19.73 Notes Receivable 4,800 Cash 4918.36 Notes Receivable 4918.36 Cash 4918.36 Interest Earned 118.36 Accounts Receivable 4,800 Cash 4918.36 Interest Earned 118.36 Notes Receivable 4,800 The Liccorish Pizza bought $5,000 worth of merchandise from TechCom and signed a 90-day, 10% promissory note for the $5,000. TechCom's journal entry to record the transaction is Multiple Choice Notes Receivable 5,125 Sales 5,125 Accounts…arrow_forwardRequired: Assume credit sales for 2019 were $312,000 and that on December 31, 10% of credit sales are estimated to be uncollectible. Using the percentage of sales method:Determine the amount to be charged to the uncollectible expense account.Prepare the Allowance for uncollectible account. Prepare the balance sheet extract to show the net realizable value of the Accounts Receivable as at December 31 Journal Entries Date Particulars Debit($) Credit($) 10.1.20 Accounts Receivable 11000 To sales 11000 15.5.20 Allowance for uncollectible accounts(2500+400) 2900 To accounts receivable 2900 4.8.20 Cash(70% of 11000) 7700 Allowance for uncollectible accounts(30% of $11000) 3300 To Accounts Receivable 1100 26.10.20 Accounts Receivable(30% of $400) 120 To allowance for uncollectible accounts 120 26.10.20 Cash 120 To accounts receivable 120…arrow_forwardThe transaction below pertains to Boyer Coe Company, whose fiscal year ends December 31. On November 1, 2019 Coe borrowed $25,000 at 6 percent for 6 months. The entry to record the November 1 borrowing transaction would include a: A. Credit to notes payable for $750 B. Credit to notes payable for $24,250 C. Debit to cash for $24,250 D. Debit to cash for $25,000arrow_forward

- 1. Record journal entries for the following transactions of Hansen Bakery Company. Jan. 1, 2020 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Issued a $265,500 note to customer Jack Bullock as terms of a merchandise sale. The merchandise's cost to Hansen Bakery Company is $89,750. Note contract terms included a 36-month maturity date, and a 4.3% annual interest rate. Hansen Bakery Company records interest accumulated for 2020. Hansen Bakery Company records interest accumulated for 2021. Jack Bullock honors the note and pays in full with cash.arrow_forwardBlossom Wholesalers accepts from Gates Stores a $8,000, 4-month, 9% note dated May 31 in settlement of Gates' overdue account. The maturity date of the note is September 30. (a1) Your answer is correct. Calculate the interest payable at maturity. Interest payable at maturity $ eTextbook and Media List of Accounts (a2) 240 Account Titles and Explanation What entry does Blossom make at the maturity date, assuming Gates pays the note and interest in full at that time? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Debit Attempts: 1 of 3 used Creditarrow_forwardPresident Company purchased merchandise from Captain Corporation on September 30, 2024. Payment was made in the form of a noninterest-bearing note requiring President to make six annual payments of $4,200 on each September 30, beginning on September 30, 2027. Required: Calculate the amount at which President should record the note payable and corresponding purchase on September 30, 2024, assuming that an interest rate of 8% properly reflects the time value of money in this situation. Note: Use tables, Can someone please give me the correct answer for this?arrow_forward

- journalize the following entries on the books of the borrower. Assume a 360-day year. January 1 Aggie Co. purchased merchandise on account from Low Co. for $40,000. January 30 Aggie Co. issued a 60-day, 6% note for $40,000 March 29 Aggie Co. paid the amount due at maturity Date Account Title Debit Credit Jan 1 Jan 30 March 29arrow_forwardDo a journal entry based on this transections, round interest amounts to the nearest dollar,arrow_forwardRecord journal entries for the following transactions of Piano Wholesalers. Jan. 1, 2018 Issued a $1,241,650 note to customer Arrowstar as terms of a merchandise sale. The merchandise’s cost to Piano Wholesalers is $608,000. Note contract terms included a 24-month maturity date and a 3.4% annual interest rate. Dec. 31, 2018 Piano Wholesalers records interest accumulated for 2018. Dec. 31, 2019 Piano Wholesalers converts Arrowstar’s dishonored note into account receivable. This includes accumulated interest for the 24-month period. April 12, 2020 Piano Wholesalers sells the outstanding debt from Arrowstar to a collection agency at 40% of the accounts receivable value. Jan. 1, 2018 Notes Receivable: Arrowstar fill in the blank 2 fill in the blank 3 Sales Revenue fill in the blank 5 fill in the blank 6 To record sale in exchange for Notes Receivable: Arrowstar Jan. 1, 2018 Cost of Goods Sold fill in the blank 8 fill in the blank 9 Merchandise Inventory fill in…arrow_forward

- Journalize the following entries on the books of the borrower and creditor. Label accordingly. (Assume a 360-day year is used for interest calculations.) June 1 James Co. purchased merchandise on account from O’Leary Co., $90,000, terms n/30. The cost of merchandise sold was $54,000. 30 James Co. issued a 60-day, 5% note for $90,000 on account. Aug. 29 James Co. paid the amount due.arrow_forwardEntries for notes payable Bennett Enterprises issues a $504,000, 30-day, 8 %, note to Spectrum Industries for merchandise inventory. Assume a 360-day year. If required, round your answers to the nearest dollar. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize Bennett Enterprises' entries to record: the issuance of the note. the payment of the note at maturity. 1. 2. Question Content Area b. Journalize Spectrum Industries' entries to record: the receipt of the note. the receipt of the payment of the note at maturity. 1. 2.arrow_forwardTitle Gorilla Supply Company received a 120-day, 5% note for $150,000, dated March 27 from a customer on.. Description Gorilla Supply Company received a 120-day, 5% note for $150,000, dated March 27 from a customer on account.a. Determine the due date of the note.b. Determine the maturity value of the note.c. Journalize the entry to record the receipt of the payment of the note at maturity.View Solution:Gorilla Supply Company received a 120 day 5 note for 150 000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education