Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 11, Problem 49P

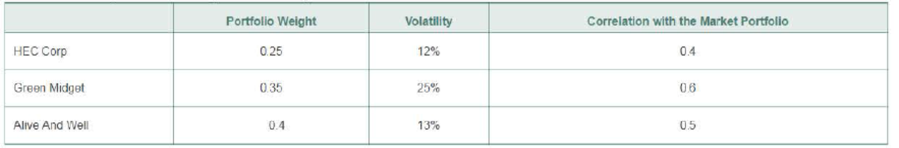

Consider a portfolio consisting of the following three stocks:

The volatility of the market portfolio is 10% and it has an expected return of 8%. The risk-free rate is 3%.

- a. Compute the beta and expected return of each stock.

- b. Using your answer from part a, calculate the expected return of the portfolio.

- c. What is the beta of the portfolio?

- d. Using your answer from part c, calculate the expected return of the portfolio and verify that it matches your answer to part b.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider a portfolio consisting of the following three stocks:

an expected return of 8%. The risk-free rate is 3%.

a. Compute the beta and expected return of each stock.

▪

The volatility of the market portfolio is 10% and it has

b. Using your answer from part a, calculate the expected return of the portfolio.

c. What is the beta of the portfolio?

d. Using your answer from part c, calculate the expected return of the portfolio and verify that it matches your answer to

part b.

Consider a portfolio consisting of the following three stocks: E The volatility of the market portfolio is 10% and it has an expected return of 8%. The risk-free rate is 3%.

a. Compute the beta and expected return of each stock.

b. Using your answer from part (a), calculate the expected return of the portfolio.

c. What is the beta of the portfolio?

d. Using your answer from part (c), calculate the expected return of the portfolio and verify that it matches your answer to part (b).

a. Compute the beta and expected return of each stock. (Round to two decimal places.)

TITLT

Data table

Portfolio Weight

(A)

Volatility

(B)

Correlation

(C)

Expected Return

(E)

%

Beta

(D)

НЕС Согр

0.28

13%

0.33

Green Widget

(Click on the following icon a in order to copy its contents into a spreadsheet.)

0.39

27%

0.61

%

Portfolio Weight

Alive And Well

0.33

14%

0.43

Volatility

13%

Correlation with the Market Portfolio

НЕС Согр

Green Widget

0.28

0.33

b. Using your answer from part (a), calculate the expected…

Consider a portfolio consisting of the following three stocks:

LOADING...

.

The volatility of the market portfolio is

10%

and it has an expected return of

8%.

The risk-free rate is

3%.

a. Compute the beta and expected return of each stock.

b. Using your answer from part

a,

calculate the expected return of the portfolio.

c. What is the beta of the portfolio?

d. Using your answer from part

c,

calculate the expected return of the portfolio and verify that it matches your answer to part

b.

Question content area bottom

Part 1

a. Compute the beta and expected return of each stock. (Round to two decimal places.)

Portfolio Weight

(A)

Volatility

(B)

Correlation

(C)

Beta

(D)

Expected Return

(E)

HEC Corp

0.27

11%

0.33

enter your response here

enter your response here%

Green Widget

0.33

29%

0.71

enter your response here

enter your response here%

Alive And Well

0.40

11%

0.53

enter your response here

enter…

Chapter 11 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 11.1 - What is a portfolio weight?Ch. 11.1 - How do we calculate the return on a portfolio?Ch. 11.2 - What does the correlation measure?Ch. 11.2 - How does the correlation between the stocks in a...Ch. 11.3 - Prob. 1CCCh. 11.3 - Prob. 2CCCh. 11.4 - Prob. 1CCCh. 11.4 - Prob. 2CCCh. 11.4 - Prob. 3CCCh. 11.5 - What do we know about the Sharpe ratio of the...

Ch. 11.5 - If investors are holding optimal portfolios, how...Ch. 11.6 - When will a new investment improve the Sharpe...Ch. 11.6 - Prob. 2CCCh. 11.7 - Prob. 1CCCh. 11.7 - Prob. 2CCCh. 11.8 - Prob. 1CCCh. 11.8 - According to the CAPM, how can we determine a...Ch. 11 - You are considering how to invest part of your...Ch. 11 - You own three stocks: 600 shares of Apple...Ch. 11 - Consider a world that only consists of the three...Ch. 11 - There are two ways to calculate the expected...Ch. 11 - Using the data in the following table, estimate...Ch. 11 - Use the data in Problem 5, consider a portfolio...Ch. 11 - Using your estimates from Problem 5, calculate the...Ch. 11 - Prob. 8PCh. 11 - Suppose two stocks have a correlation of 1. If the...Ch. 11 - Arbor Systems and Gencore stocks both have a...Ch. 11 - Prob. 11PCh. 11 - Suppose Avon and Nova stocks have volatilities of...Ch. 11 - Prob. 13PCh. 11 - Prob. 14PCh. 11 - Prob. 16PCh. 11 - What is the volatility (standard deviation) of an...Ch. 11 - Prob. 18PCh. 11 - Prob. 19PCh. 11 - Prob. 20PCh. 11 - Suppose Ford Motor stock has an expected return of...Ch. 11 - Prob. 22PCh. 11 - Prob. 23PCh. 11 - Prob. 24PCh. 11 - Prob. 25PCh. 11 - Prob. 26PCh. 11 - A hedge fund has created a portfolio using just...Ch. 11 - Consider the portfolio in Problem 27. Suppose the...Ch. 11 - Prob. 29PCh. 11 - Prob. 30PCh. 11 - You have 10,000 to invest. You decide to invest...Ch. 11 - Prob. 32PCh. 11 - Prob. 33PCh. 11 - Prob. 34PCh. 11 - Prob. 35PCh. 11 - Prob. 36PCh. 11 - Assume all investors want to hold a portfolio...Ch. 11 - In addition to risk-free securities, you are...Ch. 11 - You have noticed a market investment opportunity...Ch. 11 - Prob. 40PCh. 11 - When the CAPM correctly prices risk, the market...Ch. 11 - Prob. 45PCh. 11 - Your investment portfolio consists of 15,000...Ch. 11 - Suppose you group all the stocks in the world into...Ch. 11 - Prob. 48PCh. 11 - Consider a portfolio consisting of the following...Ch. 11 - Prob. 50PCh. 11 - What is the risk premium of a zero-beta stock?...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a portfolio consisting of the following three stocks: The volatility of the market portfolio is 10% and it has an expected return of 8%. The risk-free rate is 3%. (1)Compute the beta and expected return of each stock. (2)Using your answer from part a, calculate the expected return of the portfolio. (3)What is the beta of the portfolio? (4)Using your answer from part c, calculate the expected return of the portfolio and verify that it matches your answer to part b.arrow_forwardAn investiment portfolio consists of two securities, X and Y. The weight of X is 30%. Asset X's expected return is 15% and the standard deviation is 28%. Asset Y's expected return is 23% and the standard deviation is 33%. Assume the correlation coefficient between X and Y is 0.37. A. Calcualte the expected return of the portfolio. B. Calculate the standard deviation of the portfolio return. C. Suppose now the investor decides to add some risk free assets into this portfolio. The new weights of X, Y and risk free assets are 0.21, 0.49 and 0.30. What is the standard deviation of the new portfolio?arrow_forwardYou invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: 0.8, -1.3, 0.95, 1.2, and 1.4. The risk-free return is 3% and the market return is 7%. a. Compute the beta of the portfolio. b. Compute the required return of the portfolio.arrow_forward

- You invest in a portfolio of 5 stocks with an equal investment in each one. The betas of the 5 stocks are as follows: .8, -1.3, .95, 1.2 and 1.4. The risk-free return is 3% and the market return is 7%. A. Compute the beta of the portfolio.B. Compute the required return of the portfolio.arrow_forwardShow detailed steps to solve the following question. Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta. a.) What is the portfolios beta? b.) Wht is the portfolios expected return?arrow_forwardSuppose Stock A has B = 1 and an expected return of 11%. Stock B has a B = 1.5. The risk- free rate is 5%. Also consider that the covariance between B and the market is 0.135. Assume the CAPM is true. Answer the following questions: a) Calculate the expected return on share B. b) Find the equation of the Capital Market Line (CML). c) Build a portfolio Q with B = 0 using actions A and B. Indicate weights (interpret your result) and expected return of portfolio Q.arrow_forward

- You are given the following information concerning three portfolios, the market portfolio, and the risk-free asset: 8p 1.70 1.30 0.85 1.00 Portfolio X Y Z Market Risk-free Rp 11.5% 10.5 7.2 10.9 4.6 R-squared op 38.00% 33.00 23.00 28.00 0 Assume that the correlation of returns on Portfolio Y to returns on the market is 0.76. What percentage of Portfolio Y's return is driven by the market? Note: Enter your answer as a decimal not a percentage. Round your answer to 4 decimal places.arrow_forwardAssume that using the Security Market Line the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on the market portfolio is denoted by RM. Find the ratio of beta of A (bA) to beta of B (bB).arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A(A) to beta of B(B).arrow_forward

- You form a portfolio by investing equally in four securities: stock A, stock B, the risk-free security, and the market portfolio. What is the beta of your portfolio if bA = .8 and bB = 1.2?arrow_forwardConsider the following information for four portfolios, the market, and the risk-free rate (RFR): Portfolio Return Beta SD A1 0.15 1.25 0.182 A2 0.1 0.9 0.223 A3 0.12 1.1 0.138 A4 0.08 0.8 0.125 Market 0.11 1 0.2 RFR 0.03 0 0 Refer to Exhibit 18.6. Calculate the Jensen alpha Measure for each portfolio. a. A1 = 0.014, A2 = -0.002, A3 = 0.002, A4 = -0.02 b. A1 = 0.002, A2 = -0.02, A3 = 0.002, A4 = -0.014 c. A1 = 0.02, A2 = -0.002, A3 = 0.002, A4 = -0.014 d. A1 = 0.03, A2 = -0.002, A3 = 0.02, A4 = -0.14 e. A1 = 0.02, A2 = -0.002, A3 = 0.02, A4 = -0.14arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A(A) to beta of B(B).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY