Concept explainers

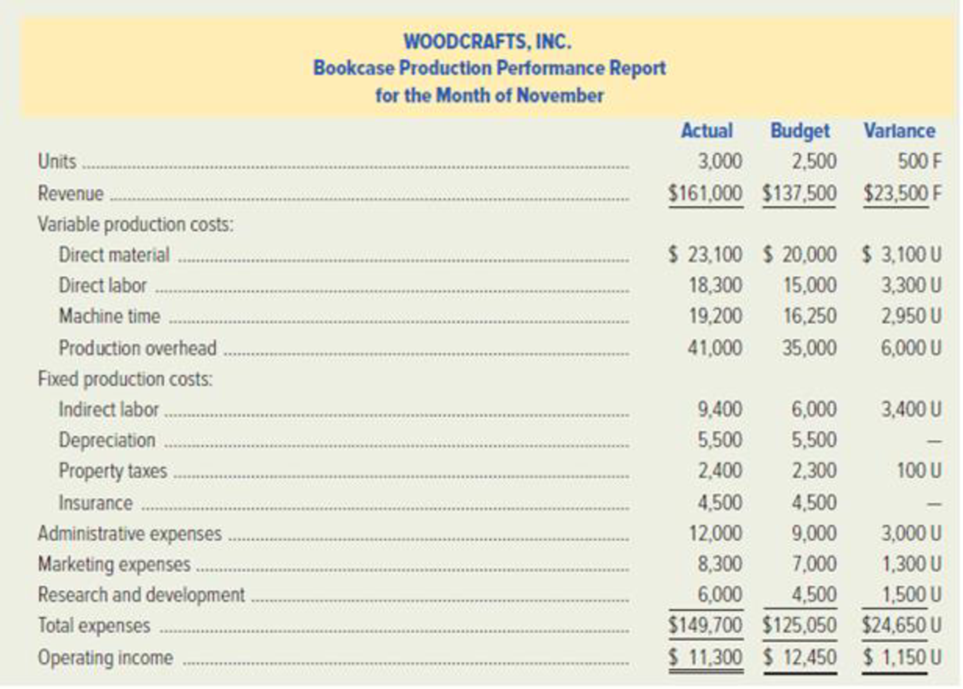

WoodCrafts, Inc. is a manufacturer of furniture for specialty shops throughout the Northeast and has an annual sales volume of $12 million. The company has four major product lines: bookcases, magazine racks, end tables, and bar stools. Each line is managed by a production manager. Since production is spread fairly evenly over the 12 months of operation. Sara McKinley, WoodCrafts’ controller, has pre pared an annual budget divided into 12 periods for monthly reporting purposes.

WoodCrafts uses a standard-costing system and applies variable

While distributing the monthly reports at the meeting, McKinley remarked to Clark, “We need to talk about getting your division back on track. Be sure to see me after the meeting.”

Clark had been so convinced that his division did well in November that McKinlcy’s remark was a real surprise. He spent the balance of the meeting avoiding the looks of his fellow managers and trying to figure out what could have gone wrong. The monthly performance report was no help.

Required:

- 1. a. Identify three weaknesses in WoodCrafts, Inc.’s monthly Bookcase Production Performance Report.

b. Discuss the behavioral implications of Sara McKinley’s remarks to Steve Clark during the meeting.

- 2. WoodCrafts, Inc. could do a better job of reporting monthly performance to the production managers.

- a. Recommend how the report could be improved to eliminate weaknesses, and revise it accordingly.

- b. Discuss how the recommended changes in reporting are likely to affect Steve Clark’s behavior.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Nozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardCarver Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: • Sales are budgeted at $367,000 for November, $337,000 for December, and $317,000 for January. • Collections are expected to be 80% in the month of sale and 20% in the month following the sale. The cost of goods sold is 80% of sales. ● • The company desires to have an ending merchandise inventory equal to 50% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase. • Other monthly expenses to be paid in cash are $26,400. Monthly depreciation is $19,400. Ignore taxes. ● Assets Cash Accounts receivable Inventory Property, plant and equipment, net of $510, 500 accumulated depreciation Total assets Balance Sheet October 31 Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings. Total liabilities and stockholders' equity The net income for…arrow_forward

- Walmart Retail Company has three Departments: Clothing, Household Appliances and Food Store. It has advertising budget of $150,000 that promotes the Company’s businesses. Walmart allocates advertising costs based on the each departmental Sales figures at the end of the year. The annual sales figures for the departments are as follows: Clothing $200,000; Household Appliances $600,000; and Food Stores $400,000. How much advertising budget is allocated to Household Appliances based on its sales figure? $37,500 b. $75,000 c. $45,000 d. $150,000 e. None of the above. 2. Refer to Question 1 above, the allocation for advertising for Food Store Department should be: a. $50,000 b. $37,500 c. $25,000 d. $427,000 e. None of the abovearrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes. Factory administration The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.20g $4,200+ $1.50g $5,700+ $0.60g $1,500+ $0.10g $18,300+ $2.60g $8,600 $2,500 $13,300+ $0.90g Actual Cost Incurred in March $ 66,360 $ 9,680 $ 8,610 $ 2,130 $ 28,700 $ 9,000 $ 2,500 $ 16,310 Required: 1. Prepare the Production…arrow_forwardJohnson Stores is planning its staffing for the upcoming holiday season. From past history, the store determines that it needs one additional sales clerk for each $12,000 in daily sales. The average daily sales is anticipated to increase by $96,000 from Black Friday until Christmas Eve, or 27 shopping days. Each additional sales clerk will work an eight-hour shift and will be paid $14 per hour.a. Determine the amount to budget for additional sales clerks for the holiday season.Holiday staff budget for additional clerks $b. If Johnson Stores has an average 40% gross profit on sales. What is the additional profit generated if a staff is added for the increased sale?Additional profit $arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Direct labor Indirect labor Utilities Supplies Equipment depreciation Cost Formulas The Production Department planned to work 4,300 labor-hours in March; however, it actually worked 4,100 labor-hours during the month. Its actual costs incurred in March are listed below: Factory rent Property taxes Factory administration $16.509 $4,400 $2.00q $5,000 + $0.50q $1,300+ $0.109 $18,500 + $2.60q $8,200 $2,400 $13,500+ $0.50q Actual Cost Incurred in March $ 69,270 $ 12,180 $ 7,540 $ 1,940 $ 29,160 $ 8,600 $ 2,400 $ 14,880 Required: 1. Prepare the Production…arrow_forwardWalmart Retail Company has three Departments: Clothing, Household Appliances and Food Store. It has advertising budget of $150,000 that promotes the Company’s businesses. Walmart allocates advertising costs based on the each departmental Sales figures at the end of the year. The annual sales figures for the departments are as follows:Clothing $200,000; Household Appliances $600,000; and Food Stores $400,000.How much advertising budget is allocated to Household Appliances based on its sales figure?a$37,500 b. $75,000 c. $45,000 d. $150,000 e. None of the above.arrow_forwardCarver Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana. Data regarding the store's operations follow: Sales are budgeted at $350,000 for November, $320,000 for December, and $300,000 for January. Collections are expected to be 90% in the month of sale and 10% in the month following the sale. The cost of goods sold is 75% of sales. The company desires to have an ending merchandise inventory equal to 60% of the following month's cost of goods sold. Payment for merchandise is made in the month following the purchase. Other monthly expenses to be paid in cash are $24,700. Monthly depreciation is $16,000. Ignore taxes. Balance SheetOctober 31 Assets Cash $ 19,000 Accounts receivable 77,000 Inventory 157,500 Property, plant and equipment, net of $502,000 accumulated depreciation 1,002,000 Total assets $ 1,255,500 Liabilities and Stockholders' Equity Accounts payable $ 272,000 Common stock 780,000…arrow_forward

- Weldon Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: • Sales are budgeted at $360,000 for November, $380,000 for December, and $350,000 for January.• Collections are expected to be 75% in the month of sale, 20% in the month following the sale, and 5% uncollectible.• The cost of goods sold is 65% of sales.• The company desires an ending merchandise inventory equal to 60% of the cost of goods sold in the following month.• Payment for merchandise is made in the month following the purchase.• Other monthly expenses to be paid in cash are $21,900.• Monthly depreciation is $20,000.• Ignore taxes. BALANCE SHEET OCTOBER 31 ASSETS Cash 16,000 Accounts Rec.(allowances for uncollected accts) 74,000 mechandise inventory 140,400 Property, plants & equipment (500,000 accumulated depreciation) 1,066,000 TOTAL ASSETS 1,296,400 Liabilities & stockholders equity Accts payable 240,000…arrow_forwardRodger's Cabinet Manufacturers produces one product in a single manufacturing department. It uses flexible budgets that are based on the following manufacturing data for the month of July: Direct materials $8 per unit Direct labor $5 per unit Electric power (variable) $0.30 per unit Electric power (fixed) $4,000 per month Supervisor salaries $25,000 per month Property taxes on factory $4,000 per month Straight-line depreciation $2,900 per month Prepare a flexible manufacturing budget for Rodger's based on production of 10,000, 15,000, and 20,000 units. Rodger's Cabinet Manufacturers Flexible Manufacturing Budget For the Month Ended July 31 Units of production Variable cost: Direct materials ($8 per unit) Direct labor ($5 per unit) Electric power ($0.30 per unit) Total variable costs Fixed cost: Electric power 24 Supervisor salaries Property taxes Depreciation Total fixed costs Total manufacturing costsarrow_forwardWeldon Industrial Gas Corporation supplies acetylene and other compressed gases to industry. Data regarding the store's operations follow: • Sales are budgeted at $360,000 for November, $380,000 for December, and $350,000 for January.• Collections are expected to be 75% in the month of sale, 20% in the month following the sale, and 5% uncollectible.• The cost of goods sold is 65% of sales.• The company desires an ending merchandise inventory equal to 60% of the cost of goods sold in the following month.• Payment for merchandise is made in the month following the purchase.• Other monthly expenses to be paid in cash are $21,900.• Monthly depreciation is $20,000.• Ignore taxes. Balance Sheet October 31 Assets: Cash $16,000 Accounts receivable (net of allowances for uncollectable accounts $74,000 Merchandise inventory $140,400 Property, plant and equipment (net of $500,000 accumulated depreciation) $1,066,000 Total Assets: $1,296,400…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub