Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 32FE

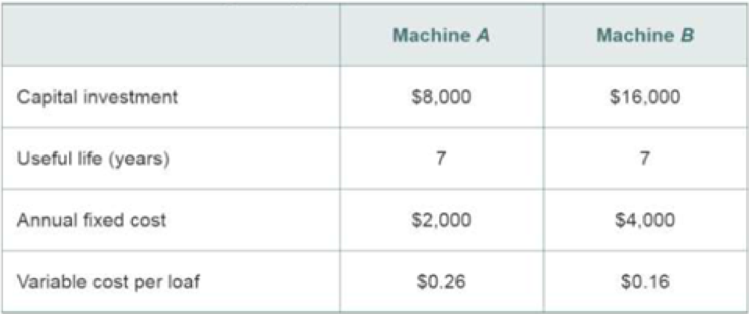

A supermarket chain buys loaves of bread from its supplier at $0.50 per loaf. The chain is considering two options to bake its own bread.

Neither machine has a market value at the end of seven years, and MARR is 12% per year. Use this information to answer Problems 11-32, 11-33, and 11-34. Select the closest answer.

11-32. What is the minimum number of loaves that must be sold per year to justify installing Machine A instead of buying the loaves from the supplier?

- a. 7,506

- b. 22,076

- c. 37,529

- d. 75,059

- e. 15,637

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Snip & Sketch

Sales price

Equipment cost

Overhead cost

Operating and maintenance cost

Production time per 1,000 units

Study period (planning horizon)

MARR

New

44

I

$12.50 per unit

$200,000

$50,000 per year

5 years

15% per year

0

$25 per operating hour

100 hours

x

An electronics firm is planning to manufacture a new handheld

gaming device for the preteen market. The data have been

estimated for the product. Assuming a negligible market (salvage)

value for the equipment at the end of five years, determine the

breakeven annual sales volume for this product.

Click the icon to view the data estimated for the product.

Click the icon to view the interest and annuity table for

discrete compounding when i= 15% per year.

The breakeven annual sales volume is

nearest whole number.)

units. (Round to the

Present Worth of Alternative A (Round off answer to 2 decimal places)

Engineering Economics

Bawal gumamit ng excel( Don't use Excel)

A small company has P20,000 in surplus capital that it wishes to invest in new revenue producing projects. Three independent sets of mutually exclusive projects have been developed. The useful life of each is five years and all market values are zero. You have been asked to perform an IRR analysis to select the best combination of projects. If the MARR is 12% per year, which combination of projects would you recommend?

Chapter 11 Solutions

Engineering Economy (17th Edition)

Ch. 11 - Prob. 1PCh. 11 - Refer to Example 11-2. Assuming gasoline costs...Ch. 11 - Prob. 3PCh. 11 - Prob. 4PCh. 11 - Prob. 5PCh. 11 - Prob. 6PCh. 11 - Prob. 7PCh. 11 - Prob. 8PCh. 11 - Prob. 9PCh. 11 - Prob. 10P

Ch. 11 - Prob. 11PCh. 11 - Prob. 12PCh. 11 - Prob. 13PCh. 11 - Prob. 14PCh. 11 - Prob. 15PCh. 11 - Prob. 16PCh. 11 - Prob. 17PCh. 11 - Prob. 18PCh. 11 - Prob. 19PCh. 11 - A bridge is to be constructed now as part of a new...Ch. 11 - An aerodynamic three-wheeled automobile (the Dart)...Ch. 11 - Prob. 23PCh. 11 - Prob. 24SECh. 11 - Prob. 25SECh. 11 - Prob. 26SECh. 11 - Prob. 27SECh. 11 - Prob. 28SECh. 11 - Prob. 29SECh. 11 - Prob. 30FECh. 11 - Prob. 31FECh. 11 - A supermarket chain buys loaves of bread from its...Ch. 11 - A supermarket chain buys loaves of bread from its...Ch. 11 - Prob. 34FECh. 11 - Prob. 35FECh. 11 - Prob. 36FECh. 11 - Prob. 37FECh. 11 - Prob. 38FECh. 11 - Prob. 39FECh. 11 - Prob. 40FECh. 11 - Prob. 41FECh. 11 - Prob. 42FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Options for iii are "knows" and "doesn't know"arrow_forwardA new manufacturing line is being built and your team has narrowed it down to 2 options. Which one is the best option using a 20% rate to evaluate each option? Answer the question by entering the amount of savings by choosing the best option. Margin of error: +/- 10 Enter your answer as a positive number representing savings from one option to another. Hint: When you use Net present Worth Analysis you must must LCM of the lives to assess each option over the same period. Option A B Operating First and Salvage Cost Maintenance Value Cost/Yr $18M $5M $25M $3M 501,025 $4M $6M Life 10 years 20 yearsarrow_forwardMore than one correct options are possiblearrow_forward

- I see some mistakes on solve equations for x2. Please review so is a grade-3 polinomic equation: 0,08/(x2)2 + 12x2 = 15.000 Confirm, Thanksarrow_forwardA recent graduate who wants to start an excavation/earth-moving business is trying todetermine which size of used dump truck to buy. As the bed size increases, new incomeincreases; however, the graduate is uncertain whether the incremental expenditure requiredfor larger truck is justified. The cash flows associated with each size truck are estimated below.The contractor has established a MARR of 18% per year, and all trucks are expected to have aremaining economic life of 5 years. Using a Do Nothing (DN) option, using SPREADSHEET only,a. Determine which size truck should be purchased.b. If two trucks are to be purchased, what should be size of the second truck?arrow_forwardWhich one of the following descriptions is correct according to this extensive form? (I think it's 3rd option but unsure)arrow_forward

- A firm is considering the “make vs. buy” question for a subcomponent. If the part is made in-house, the production data would be: first cost = $350, 000; annual costs for operation = $45, 000; salvage value = $15, 000; project life = 5 years; interest = 10%; and material cost per unit = $8.50. If annual production is 10,000 units, the maximum amount that the firm should be willing to pay to an outside vendor for the subcomponent is nearest? (a) $10 per unit (b) $16 per unit (c) $22 per unit (d) $28 per unit?arrow_forwardAs supervisor of a facilities engineering department, you consider mobile cranes to be critical equipment. The purchase of a new, medium-sized truck-mounted crane is being evaluated. The economic estimates for the two best alternatives are shown in the following table. MARR is at 15% per year. You can use the assumption of repeatability in this case. Show that the same selection is made for the following methods:a. RORAI method b. AWC method c. PW methodarrow_forwardA company with a MARR of 15% must install one of two production machines that provide equivalent service (same benefits). Machine X has an initial cost of $40,000 with an annual operating and maintenance (O&M) cost of $30,000 and a salvage value of $5,000 after its 5-year life. Machine Y has an initial cost of $60,000 with an annual operating and maintenance (O&M) cost of $20,000 and a salvage value of $12,000 after its 5-year life. The net present worth (NPW) for machine X is:arrow_forward

- Bawal gumamit ng excel( Don't use Excel) A small company has P20,000 in surplus capital that it wishes to invest in new revenue producing projects. Three independent sets of mutually exclusive projects have been developed. The useful life of each is five years and all market values are zero. You have been asked to perform an IRR analysis to select the best combination of projects. If the MARR is 12% per year, which combination of projects would you recommend?arrow_forwardonly need options d) and e)arrow_forwardA gold mining area in Lanao contains on average, 1 ounce of gold per ton. Two methods of processing are available; method A costs P1.5M per ton and recovers 90% of gold; method B costs P1.3M per ton and recovers 80% of the gold. If gold can be sold for P2.4M per ounce , which method is better and by how much?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

The growing economy of the electric car industry; Author: TRT World;https://www.youtube.com/watch?v=Qh2jXn_akmk;License: Standard Youtube License