Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 11, Problem 27E

Margin, Turnover,

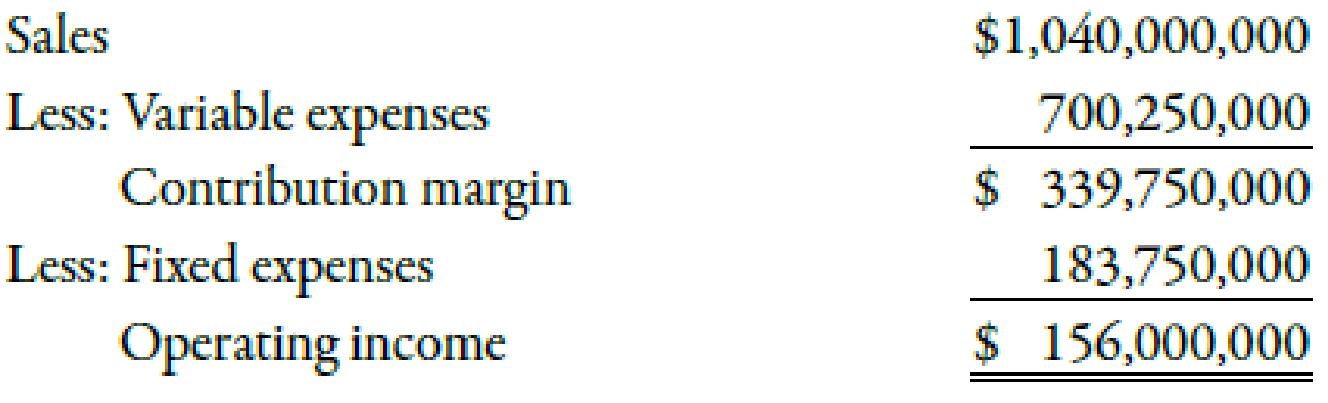

Elway Company provided the following income statement for the last year:

At the beginning of last year, Elway had $28,300,000 in operating assets. At the end of the year, Elway had $23,700,000 in operating assets.

Required:

- 1. Compute average operating assets.

- 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.)

- 3. Compute ROI. (Note: Round answer to two decimal places.)

- 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI.

- 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What would a 5-year projection for a startup Accounting Firm business look like?

Include units, dollars, and assumptions in the projection.

How would a startup Accounting Firm present the sales projection in a narrative that includes the description of the units you plan to sell, the services (amount of them) you plan to provide, and your growth projections of these numbers?

When will a startup Accounting Firm start making a profit and have the break-even point?

None

Kindly help me with general accounting question

Chapter 11 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Ch. 11 - Discuss the differences between centralized and...Ch. 11 - Prob. 2DQCh. 11 - Explain why firms choose to decentralize.Ch. 11 - What are margin and turnover? Explain how these...Ch. 11 - What are the three benefits of ROI? Explain how...Ch. 11 - What is residual income? What is EVA? How does EVA...Ch. 11 - Can residual income or EVA ever be negative? What...Ch. 11 - What is transfer price?Ch. 11 - Prob. 9DQCh. 11 - (Appendix 11A) What is the Balanced Scorecard?

Ch. 11 - (Appendix 11A) Describe the four perspectives of...Ch. 11 - The practice of delegating authority to...Ch. 11 - Which of the following is not a reason for...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - A responsibility center in which a manager is...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - If sales and average operating assets for Year 2...Ch. 11 - The key difference between residual income and EVA...Ch. 11 - It ROI for a division is 15% and the company's...Ch. 11 - Prob. 9MCQCh. 11 - Prob. 10MCQCh. 11 - (Appendix 11A) Which of the following is a...Ch. 11 - (Appendix 11A) The length of time it takes to...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 16BEACh. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Prob. 21BEBCh. 11 - Calculating Transfer Price Teslum Inc. has a...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Use the following information for Brief Exercises...Ch. 11 - Types of Responsibility Centers Consider each of...Ch. 11 - Margin, Turnover, Return on Investment Pelak...Ch. 11 - Margin, Turnover, Return on Investment, Average...Ch. 11 - Return on Investment, Margin, Turnover Data follow...Ch. 11 - Residual Income The Avila Division of Maldonado...Ch. 11 - Economic Value Added Falconer Company had net...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Use the following information for Exercises 11-31...Ch. 11 - Prob. 33ECh. 11 - Use the following information for Exercises 11-33...Ch. 11 - Prob. 35ECh. 11 - (Appendix 11A) Cycle Time and Velocity Prakesh...Ch. 11 - (Appendix 11A) Cycle Time and Velocity Lasker...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - (Appendix 11A) Manufacturing Cycle Efficiency...Ch. 11 - Return on Investment and Investment Decisions...Ch. 11 - Return on Investment, Margin, Turnover Ready...Ch. 11 - Return on Investment for Multiple Investments,...Ch. 11 - Return on Investment and Economic Value Added...Ch. 11 - Transfer Pricing GreenWorld Inc. is a nursery...Ch. 11 - Prob. 45PCh. 11 - Prob. 46PCh. 11 - (Appendix 11A) Cycle Time, Velocity, Conversion...Ch. 11 - (Appendix 11A) Balanced Scorecard The following...Ch. 11 - (Appendix 11A) Cycle Time and Velocity,...Ch. 11 - Prob. 50C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company has beginning inventory of 2,300 units at a cost of $4.4 per unit. During the month, it purchases an additional 3,200 units at $5.8 per unit. If the company uses the weighted average cost method, what is the average cost per unit? A. $4.20 B. $4.60 C. $4.40 D. $5.00 E. $5.21arrow_forwardProvide correct answer general Accountingarrow_forwardNeed help with this accounting questionsarrow_forward

- If a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)? Help me with this financial accounting Queryarrow_forwardThe green tree company manufacturers woodenarrow_forwardIf a company's net income for the year is $115,000 and its total assets at the beginning of the year were $525,000, while its total assets at the end of the year were $710,000, what is the company's return on assets (ROA)?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License