Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

The green tree company manufacturers wooden

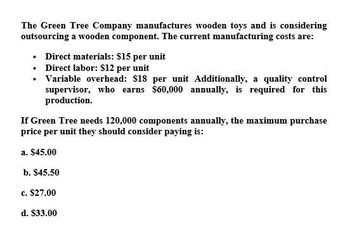

Transcribed Image Text:The Green Tree Company manufactures wooden toys and is considering

outsourcing a wooden component. The current manufacturing costs are:

⚫ Direct materials: $15 per unit

⚫ Direct labor: $12 per unit

⚫ Variable overhead: $18 per unit Additionally, a quality control

supervisor, who earns $60,000 annually, is required for this

production.

If Green Tree needs 120,000 components annually, the maximum purchase

price per unit they should consider paying is:

a. $45.00

b. $45.50

c. $27.00

d. $33.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reubens Deli currently makes rolls for deli sandwiches it produces. It uses 30,000 rolls annually in the production of deli sandwiches. The costs to make the rolls are: A potential supplier has offered to sell Reuben the rolls for $0.90 each. If the rolls are purchased, 30% of the fixed overhead could be avoided, If Reuben accepts the offer, what will the effect on profit be?arrow_forwardRundle Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials. Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rundle for $2.60 each. Required a. Calculate the total relevant cost. Should Rundle continue to make the containers? b. Rundle could lease the space it currently uses in the manufacturing process. If leasing would produce $11,600 per month, calculate the total avoidable costs. Should Rundle continue to make the containers? Answer is complete but not entirely correct. $ a. Total relevant cost a. Should Rundle continue to make the containers? b. Total avoidable cost b. Should Rundle continue to make the containers? 190.650,000 Yes $24,180,000 $ 5,200 6,100 4,000 7,800…arrow_forwardI need Helparrow_forward

- Notson, Inc. produces several models of clocks. An outside supplier has offered to produce the commercial clocks for Notson for $420 each. Notson needs 1,200 clocks annually. Notson has provided the following unit costs for its commercial clocks: Direct materials Direct labor Variable overhead Fixed overhead (40% avoidable) $100 140 80 150 What is the incremental effect on net income if Notson choses to outsource the production of the 1,000 clocks annually? Should Notson make or buy the clocks?arrow_forwardThornton Electronics currently produces the shipping containers It uses to deliver the electronics products It sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 5,100 6,400 3,300 9,900 28,000 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Thornton for $2.60 each. Required a. Calculate the total relevant cost. Should Thornton continue to make the containers? b. Thornton could lease the space it currently uses in the manufacturing process. If leasing would produce $12,100 per month, calculate the total avoidable costs. Should Thornton continue to make the containers? a. Total relevant cost a. Should Thornton continue to make the containers? b. Total avoidable cost b. Should Thornton continue to make the containers?arrow_forwardRooney Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* $ 5,200 6,500 3,600 9,300 26,600 Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rooney for $2.70 each. Required a. Calculate the total relevant cost. Should Rooney continue to make the containers? b. Rooney could lease the space it currently uses in the manufacturing process. If leasing would produce $11,500 per month, calculate the total avoidable costs. Should Rooney continue to make the containers? a. Total relevant cost Should Rooney continue to make the containers? b. Total avoidable cost Should Rooney continue to make the containers?arrow_forward

- Perez Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials $ 6,000 6,900 3,600 8,400 26,500 Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Perez for $2.80 each. Required a. Calculate the total relevant cost. Should Perez continue to make the containers? b. Perez could lease the space it currently uses in the manufacturing process. If leasing would produce $12,800 per month, calculate the total avoidable costs. Should Perez continue to make the containers? a. Total relevant cost Should Perez continue to make the containers? b. Total avoidable cost Should Perez continue to make the containers?arrow_forwardThe Mighty Music Company produces and sells a desktop speaker for $200. The company has the capacity to produce 60,000 speakers each period. At capacity, the costs assigned to each unit are as follows: Unit-level costs Product-level costs Facility-level costs The company has received a special order for 11,000 speakers. If this order is accepted, the company will have to spend $20,000 on additional costs. Assuming that no sales to regular customers will be lost if the order is accepted, at what selling price will the company be indifferent between accepting and rejecting the special order? Multiple Choice O O $96.82 $146.82 $104.32 $95 $25 $15 $107.32arrow_forwardVernon Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $5,700 6,500 3,200 8,400 27,100 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Vernon for $2.60 each. Required a. Calculate the total relevant cost. Should Vernon continue to make the containers? b. Vernon could lease the space it currently uses in the manufacturing process. If leasing would produce $12,700 per month, calculate the total avoidable costs. Should Vernon continue to make the containers? a. Total relevant cost a. Should Vernon continue to make the containers? b. Total avoidable cost b. Should Vernon continue to make the containers?arrow_forward

- Baird Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. $ 6,500 6,400 4,100 9,600 27,900 Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Baird for $2.60 each. Required a. Calculate the total relevant cost. Should Baird continue to make the containers? b. Baird could lease the space it currently uses in the manufacturing process. If leasing would produce $11,200 per month, calculate the total avoidable costs. Should Baird continue to make the containers? a. Total relevant cost Should Baird continue to make the containers? b. Total avoidable cost Should Baird continue to make the containers?arrow_forwardCampbell Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,200 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 6,900 6,400 4,100 9,600 26,600 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Campbell for $2.80 each. Required a. Calculate the total relevant cost. Should Campbell continue to make the containers? b. Campbell could lease the space it currently uses in the manufacturing process. If leasing would produce $12,800 per month, calculate the total avoidable costs. Should Campbell continue to make the containers? a. Total relevant cost Should Campbell continue to make the containers? b. Total avoidable cost Should Campbell continue to make the containers?arrow_forwardJordan Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs Allocated facility-level costs $ 5,700 6,800 3,900 8,100 27,200 One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Jordan for $2.90 each. Required a. Calculate the total relevant cost. Should Jordan continue to make the containers? b. Jordan could lease the space it currently uses in the manufacturing process. If leasing would produce $12.300 per rhonth, calculate the total avoidable costs. Should Jordan continue to make the containers? a. Total relevant cost Should Jordan continue to make the containers? b. Total avoidable cost Should Jordan continue to make the containers?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning