Sell or Process Further Decision

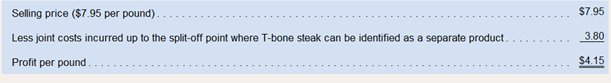

(Prepared from a situation suggested by Professor John W. Hardy) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T. bone steaks as they are initially cut or to process them further into filet mignon and the New York cut If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit:

If the company were to further process the 1-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-osmce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut, the remaining ounces e waste. It costs $0.55 to further process one 1-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $12.00 per pound, and the New York cut can be sold for $8.80 per pound.

Required:

1. What is the financial advantage (disadvantage) of further processing one 1-bone steak into filet mignon and New York cut steaks?

2. Would you recommend that the 1-bone steaks be sold as initially cut or processed further? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Introduction To Managerial Accounting

- (Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.40 per pound). Less joint costs incurred up to the split-off point where T- bone steak can be identified as a separate product Profit per pound If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.15 to further process one…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: $ 2.30 Selling price ($2.30 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product 1.60 Profit per pound $ 0.70 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.12 to…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.20 per pound) Less joint costs incurred up to the split-off point where 1-bone steak can be identified as a separate product Profit per pound If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.17 to further process onc…arrow_forward

- (Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.20 per pound) $ 2.20 Less joint costs incurred up to the split-off point whereT-bone steak can be identified as a separate product 1.35 Profit per pound $ 0.85 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.40 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound $ 2.40 1.45 $ 0.95 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.11 to…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.20 per pound) $ 2.20 Less joint costs incurred up to the split-off point whereT-bone steak can be identified as a separate product 1.60 Profit per pound $ 0.60 As mentioned above, instead of being sold as initially cut, the T-bone steaks could be further processed into filet mignon and New York cut steaks. Cutting one side of a T-bone steak provides the filet mignon, and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will…arrow_forward

- (Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: Selling price ($2.20 per pound) $ 2.20 Less joint costs incurred up to the split-off point whereT-bone steak can be identified as a separate product 1.60 Profit per pound $ 0.60 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are initially cut or to process them further into filet mignon and the New York cut If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit Selling price ($2.00 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound $ 2.00 1.30 $ 0.70 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut, the remaining ounces are waste. It costs $0.17 to…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1-pound T-bone steak yields the following profit: Selling price ($8.88 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8-ounce New York cut, and two ounces of waste. It costs $0.16 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $14.00 per pound, and the New York cut can be sold for $9.65 per pound. $8.80 1.65 $…arrow_forward

- Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1-pound T-bone steak yields the following profit: Selling price ($8.80 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound $ 8.80 1.20 $ 7.60 If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8-ounce New York cut, and two ounces of waste. It costs $0.13 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $13.00 per pound, and the New York cut can be sold for $9.65 per…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1 - pound T-bone steak yields the following profit: Selling price ($8.15 per pound) $ 8.15 Less joint costs incurred up to the split - off point where T-bone steak can be identified as a separate product 1.35 Profit per pound $ 6.80 If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8 - ounce New York cut, and two ounces of waste. It costs $0.14 to further process one T - bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $14.00 per pound, and the New York cut can be sold for…arrow_forward(Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand and is deciding whether to sell the T-bone steaks as they are initially cut or process them further into filet mignon and the New York cut. If the T-bone steaks are sold as initially cut, the company figures a 1-pound T-bone steak yields the following profit: Selling price ($8.40 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound If the company further processes the T-bone steaks, then one 16-ounce T-bone steak will yield one 6-ounce filet mignon, one 8-ounce New York cut, and two ounces of waste. It costs $0.12 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $12.00 per pound, and the New York cut can be sold for $9.25 per pound. Complete this…arrow_forward

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning