Concept explainers

Foreign Sales

Tex Hardware sells many of its producers overseas. The following are some selected transactions.

- Tex sold electronic subassemblies to a firm in Denmark for 120,000 Danish kroner (Dkr) on June 6, when the exchange rate was Dkr 1 = $0.1750. Collection was made on July 3 when the rate was Dkr 1 = $0.1753.

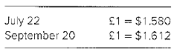

- On July 22, Tex sold copper fillings to a company in London for £30,000 with payment due on September 20. Also, on July 22, Tex entered into a 60-day forward contract to sell £30,000 at a forward rate of £ 1 = $1.630. The forward contract is not designated as a hedge. The spot rates follow:

Required

Prepare

Introduction: Foreign exchange rate is the rate at which currency of one country is changed to currency of another country is called foreign exchange rate. Mainly there are two rate, i.e. direct exchange rate and indirect exchange rate.

Foreign exchange gain or loss: Foreign exchange gain or loss arises when there is selling or buying of any goods and services in foreign currency.

The recording of the journal entries related to the sale made by T company, use of forward contract and entries regarding the settlement.

Explanation of Solution

- Journal entries to record sale of electronic subassemblies to a firm in Denmark is as follows:

- Journal entries to record sale of copper fittings to a firm in London is as follows:

- Journal entries to record sale of storage devices to a firm in Canada is as follows:

| Date | Particulars | Debit ($) | Credit ($) |

| Jun-06 | Accounts receivables | 21,000 | |

| To Sales account (Dkr120,000*0.1750$) | 21,000 | ||

| (Recording entry for the sale of electronic subassemblies by T company at exchange rate of Dkr1=$0.1750) | |||

| Jul-03 | Accounts receivable | 36 | |

| To Foreign currency transaction gain [($0.1753-$0.1750) *120,000] | 36 | ||

| (Recording entry for revaluing foreign currency receivable to U.S dollar) | |||

| Jul-03 | Foreign currency units (Dkr) | 21,036 | |

| To Accounts receivables ($0.1753*Dkr120,000) | 21,036 | ||

| (Recording entry for collection of accounts receivable in Dkr i.e. Danish kroner) |

| Date | Particulars | Debit ($) | Credit ($) |

| Jul-22 | Accounts receivable | 47,400 | |

| To sales account (£30,000*1.580) | 47,400 | ||

| (Recording entry for sale of copper fittings to a company in London) | |||

| Jul-22 | Dollars receivable from broker | 48,900 | |

| To Foreign currency payable to broker (£30,000*1.630) | |||

| (Recoding entry for entering into the 60-day forward contract @1.630) | 48,900 | ||

| Sep-20 | Accounts receivable | 960 | |

| To foreign currency transaction gain [(1.612-1.580) *£30,000] | 960 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Sep-20 | Foreign currency payable to broker | 540 | |

| To foreign currency transaction gain [(1.612-1.630) *£30,000] | 540 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Sep-20 | Foreign currency units | 48,360 | |

| To Accounts receivable (£30,000*1.612) | 48,360 | ||

| (Recording entry for receipt of British pounds from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 48,360 | |

| To foreign currency units (£30,000*1.612) | 48,360 | ||

| (Recording entry for payment of pounds to broker) | |||

| Sep-20 | Cash | 48900 | |

| To Dollars receivable from broker (£30000*1.630) | 48900 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

| Date | Particulars | Debit ($) | Credit ($) |

| Oct-11 | Accounts receivable | 51,450 | |

| To sales account (C$70,000*0.7350) | 51,450 | ||

| (Recording entry for sale of storage device to a company in Canada) | |||

| Oct-11 | Dollars receivable from broker | 51,100 | |

| To Foreign currency payable to broker (C$70,000*0.730) | 51,100 | ||

| (Recoding entry for entering into the 30-day forward contract @) | |||

| Nov-10 | Foreign currency transaction loss | 210 | |

| To Accounts receivable [(0.7350-0.7320) *C$70,000] | 210 | ||

| (recording entry for revaluing the accounts receivable at settlement date) | |||

| Nov-10 | Foreign currency transaction loss | 140 | |

| To Foreign currency payable to broker [(0.7300-0.7320) *C$70,000] | 140 | ||

| (Recording entry for revaluing the forward contract value at settlement date) | |||

| Nov-10 | Foreign currency units | 51,240 | |

| To Accounts receivable (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for receipt of Canadian dollar from accounts receivable) | |||

| Sep-20 | Foreign currency payable to broker | 51,240 | |

| To foreign currency units (C$70,000*0.7320) | 51,240 | ||

| (Recording entry for payment of Canadian dollar to broker) | |||

| Sep-20 | Cash | 51,100 | |

| To Dollars receivable from broker (C$70,000*0.730) | 51,100 | ||

| (Recording entry for receipt of U.S dollar from broker as per forward contract) |

Want to see more full solutions like this?

Chapter 11 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Iberico plc, a Spanish firm whose functional currency is EUR, bought goods from a British supplier at a cost of 10,000 GBP paid in cash. The exchange rate on the date of sale was 1 GBP = 1.2 EUR. Which the journal entry shall Iberico plc prepare regarding the purchase? Select one: a. DR Inventories 12,000 EUR, CR Cash 10,000 GBP b. DR Inventories 12,000 EUR, CR Cash 12,000 EUR C. DR Inventories 12,000 GBP, CR Cash 12,000 GBP d. DR Inventories 10,000 GBP, CR Cash 10,000 GBP Clear my choicearrow_forwardPeerless Corporation (a U.S. company) made a sale to a foreign customer on December 15, 20X1 for 125,000 crowns. It received payment on January 15, 20X2. The following exchange rates for 1 crown apply: December 15 $ 0.61 December 31 0.65 January 15 0.60 How does the fluctuation in exchange rates affect Peerless’s 20X1 income statement?arrow_forward1. On May 1, Harris purchased parts from a Japanese company for a U.S. dollar-equivalent value of $8,400 to be paid on June 20. The exchange rates were May 1 June 20 2. On July 1, Harris sold products to a Brazilian customer for a U.S. dollar equivalent of $10,000, to be received on August 10. Brazil's local currency unit is the real. The exchange rates were July 1 August 10 Required: a. Assume that the two transactions are denominated in U.S. dollars. Prepare the entries required for the dates of the transactions and their settlement in U.S. dollars. b. Assume that the two transactions are denominated in the applicable LCUs of the foreign entities. Prepare the entries required for the dates of the transactions and their settlement in the LCUs of the Japanese company (yen) and the Brazilian customer (real). Answer is not complete. Complete this question by entering your answers in the tabs below. No Required A Required B Assume that the two transactions are denominated in the…arrow_forward

- Peerless Corporation (a U.S. company) made a sale to a foreign customer on December 15, 20X1 for 125,000 crowns. It received payment on January 15, 20X2. The following exchange rates for 1 crown apply: December 15 $ 0.61 December 31 0.65 January 15 0.60 How does the fluctuation in exchange rates affect Peerless’s 20X1 income statement? $5,000 loss $5,000 gain $6,250 loss $6,250 gainarrow_forwardExample 1: Kennedy Inc. is a US based MNC that conduct a part of its business in Oman. Its Omani sales are denominated in Omani Riyal. Its income statement from Oman business at the year-end is shown below: Income Statement Particulars Amount in OMR Sales 25000 Less: Cost of goods sold 8000 Gross Profit 17000 Operating expenses 11000 EBIT 6000 Interest Expenses 2000 EBT 4000 Exchange Rates: (a) The spot exchange rate = OMR 0.3850/USD (b) The average exchange rate = OMR 0.3780/USD (c) The historical exchange rate = OMR 0.3820/USD Requirement: Translate income statement into reporting currency by using the current rate method and temporal method.arrow_forwardABC Corp. imported a machine from the US for $50,000 on October 10, 20x1. A letter of credit was opened with a local bank based on the commercial invoice for $50,000, on which ABC Corp. made a 100% deposit cover based on the exchange rate of $1 to P27.50. Shipment of the machine was effected on December 3, 20x1, at which time the exporter collected the proceeds of the letter of credit when the prevailing exchange rate was $1 to P28.00. From the exchange rate fluctuation, ABC Corp. realized how much gain or loss or no gain, no loss? AU Co. acquired a fixed asset for $36,000 on November 1, 20x1 when the exchange rate was $1 = P23.00. At December 31, 20x1, the entity's year-end, the supplier of the fixed asset has not been paid and the exchange rate at that time was $1 = P25.00. On the December 31, 20x1 statement of financial position, what will be the values for the fixed asset and the creditor who was unpaid? On January 1, 20x6, the Riza Co. purchased equipment for P300,000. The…arrow_forward

- Amazing Corporation, a U.S. enterprise, sold product to a customer in Wales on October 1, 20x1 for £200,000 with payment required on April 1, 20x2. Relevant exchange rates are: October 1, 20x1 April 1, 20x2 Spot rate December 31, 20x1 1.86 $1.87 O Liability $1,880 O Asset $1,880 O Asset $3,880 O Liability $3,880 1.90 Forward rate (to 4/1/x2) $1.85 $1.84 The discount factor corresponding to the company's incremental borrowing rate for 3 months is 0.94. Assume that Amazing Corporation enters a forward contract on October 1, 20x1 to sell £200,000 six months hence, on April 1, 20x2. How should Amazing Corporation report the forward contract on its December 31, 20x1 financial statements?arrow_forwardDow Chemical receives quotes from a foreign currency trader of USD 0.1642 -0.1657 / PLZ and USD 0.2618-0.2646/DKK. How many DKK will Dow Chemical pay the trader for a purchase of 100 million PLZ? [Note: Show calculations for this cross currency exchange] 63.3 million DKK 62.7 million DKK 161.14 million DKK 158 million DKKarrow_forwardPhillips NV produces DVD players and exports them to the United States. Last year the exchange rate was $1.25/euro and Phillips charged 120 euro per player in Euroland and $150 per DVD player in the United States. Currently the spot exchange rate is $1.65/euro and Phillips is charging $180 per DVD player. What is the degree of pass through by Phillips NV on their DVD players? 32% 62.5% O 4.1% O 20.0%arrow_forward

- Jarvis Corporation transacts business with a number of foreign vendors and customers. These transactions are denominated in FC, and the company uses a number of hedging strategies to reduce the exposure to exchange rate risk. Several such transactions are as follows:Transaction A: On November 30, the company purchased inventory from a vendor in the amount of 100,000 FC with payment due in 60 days. Also on November 30, the company purchased a forward contract to buy FC in 60 days. Assume a fair value hedge.Transaction B: On November 1, the company committed to provide services to a foreign customer in the amount of 100,000 FC. The services will be provided in 30 days. On November 1, the company also purchased a forward contract to sell 100,000 FC in 30 days. Changes in the value of the commitment are based on changes in forward rates.Transaction C: On November 1, the company forecasted a purchase of equipment in 30 days. The forecasted cost is 100,000 FC, and the equipment is to be…arrow_forwardStuff Inc., a U.S. company, imported goods for 50,000 euro on Dec. 10, Year 1 and paid for them on Jan. 10. Year 2. The following exchange rates were applicable in Years 1 and 2: Exchange Rate Date Dec. 10, Yr. 1 Dec 31, Yr 1 Jan 10, Yr. 2 What approximate gain or loss will Stuff book on Jan. 10, Year 2? OA gain of $3,000. OA loss of $3,000 O Again of $5,500 OA loss of $5,500. 0.79 € 0.82 € 0.75 €arrow_forwardDuring December of the current year, Exide company based in America, entered into the following transactions; Dec 10 Sold machinery to company located in Colombia for 6,500,000 pesos. On this date, the spot rate was 365 pesos per U.S. Dollar. Dec 12 Purchased Machine parts from a company domiciled in Japan. The contract was denominated in 600,000 Japan yen. The direct exchange spot rate on this date was $.0392. Dec 15 Purchase other machine from same company. The contract was denominated in 550,000 yen. The direct exchange spot rate on this date was 0.411 Required: A) Prepare journal entries to record the transactions above on the books of Exide company. The company uses a periodic inventory system. B) Prepare journal entries necessary to adjust the accounts as of December 31. Assume that on December 31 the direct exchange rates were as follows: Colombia pesO $.00265 Japan yen .0353 C) Prepare journal entries to record settlement of both open accounts on January 10. Assume that the…arrow_forward