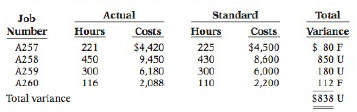

During March 2017, Toby Tool & Die Company worked on four jobs. A review of direct labor costs reveals the following summary data.

Analysis reveals that Job A257 was a repeat job. Job A258 was a rush order that required overtime work at premium rates of pay. Job A259 required a more experienced replacement worker on one shift. Work on Job A260 was done for one day by a new trainee when a regular worker was absent.

Instructions

Prepare a report for the plant supervisor on direct labor cost variances for March. The report should have columns for (1) Job No., (2) Actual Hours, (3) Standard Hours, (4) Quantity Variance, (5) Actual Rate, (6) Standard Rate, (7) Price Variance, and (8) Explanation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Managerial Accounting: Tools for Business Decision Making

- Channel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardCycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forwardCompute the total job cost for each of the following scenarios: a. If the direct labor cost method is used in applying factory overhead and the predetermined rate is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct materials used totaled 5,000 and that the direct labor cost totaled 3,200. b. If the direct labor hour method is used in applying factory overhead and the predetermined rate is 10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, and the number of direct labor hours totaled 250. c. If the machine hour method is used in applying factory overhead and the predetermined rate is 12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, the direct labor hours were 250 hours, and the machine hours were 295 hours.arrow_forward

- Huron Manufacturing Co. uses a job order cost system to cost its products. It recently signed a new contract with the union that calls for time-and-a-half for all work over 40 hours a week and double-time for Saturday and Sunday. Also, a bonus of 1% of the employees earnings for the year is to be paid to the employees at the end of the fiscal year. The controller, the plant manager, and the sales manager disagree as to how the overtime pay and the bonus should be allocated. An examination of the first months payroll under the new union contract provisions shows the following: Analysis of the supporting payroll documents revealed the following: a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime. b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers. The controller believes that the overtime premiums and the bonus should be charged to factory overhead and spread over all production of the accounting period, regardless of when the jobs were completed. The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense. The sales manager states that the overtime premiums and bonus are not factory costs chargeable to regular production but are costs created from administrative policies and, therefore, should be charged only to administrative expense. Required: 1. Evaluate each positionthe controllers, the plant managers, and the sales managers. If you disagree with all of the positions taken, present your view of the appropriate allocation. 2. Prepare the journal entries to illustrate the position you support, including the accrual for the bonus.arrow_forwardJenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April but not sold. Job C was started during April but not completed. The job cost sheets revealed the following costs for April: Cost of Jobs in Process, April 1, Current Year Direct Materials Used Direct Labor Applied Manufacturing Overhead a. Work in Process b. Finished Goods c Cost of Goods Sold S Job A $ 12,300 2,300 10,600 15.675 I 31,100 Job B $ 1,000 8,600 8,600 JOD C Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April: Check my work 9.900 3,300arrow_forwardBright Star Incorporated is a job-order manufacturer. The company uses predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours were 134,000 and estimated factory overhead was $1,085,400. The following information was for September. Job X was completed during September, while Job Y was started but not finished.arrow_forward

- Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April but not sold. Job C was started during April but not completed. The job cost sheets revealed the following costs for April: Cost of Jobs in Process, April 1, Current Year Direct Materials Used Direct Labor Applied Manufacturing Overhead Job A $ 12,200 2,200 10,400 ? a. Work in Process b. Finished Goods c. Cost of Goods Sold Job B $ 1,200 8,400 8,400 ? Job C $0 9,600 3,200 ? Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April:arrow_forwardTownsend Industries Inc. manufactures recreational vehicles. Townsend uses a job order cost system. The time tickets from November jobs are summarized as follows: Job 201 $3,670 Job 202 1,840 Job 203 1,450 Job 204 2,700 Factory supervision 1,260 Factory overhead is applied to jobs on the basis of a predetermined overhead rate of $24 per direct labor hour. The direct labor rate is $14 per hour. If required, round final answers to the nearest dollar. a. Journalize the entry to record the factory labor costs. If an amount box does not require an entry, leave it blank. Work in Process Factory Overhead Wages Payable b. Journalize the entry to apply factory overhead to production for November. If an amount box does not require an entry, leave it blank. Work in Process Factory Overheadarrow_forwardJenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: Job C $ Job A Job B $12,400 2,400 10,800 Cost of Jobs in Process, 4/1/2016 $1,100 Direct Materials Used 8,800 10,200 3,400 Direct Labor 8,800 Applied Manufacturing Overhead ? Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April: a. Work in Process b. Finished Goods c. Cost of Goods Soldarrow_forward

- Jenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: Cost of Jobs in Process, April 1, Current Year Direct Materials Used Direct Labor Applied Manufacturing Overhead Job A $ 12,000 a. Work in Process b. Finished Goods c. Cost of Goods Sold 2,000 10,000 Job B $1,000 8,000 8,000 Splom Job C 50 9,000 3,000 Required: If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April.arrow_forwardJenkins Company uses a job order cost system with overhead applied to jobs on the basis of direct labor hours. The direct labor rate is $20 per hour, and the predetermined overhead rate is $15 per direct labor hour. The company worked on three jobs during April. Jobs A and B were in process at the beginning of April. Job A was completed and delivered to the customer. Job B was completed during April, but not sold. Job C was started during April, but not completed. The job cost sheets revealed the following costs for April: Job A Job B Job C Cost of Jobs in Process, 4/1/2018 $ 12,800 $ 1,200 $ — Direct Materials Used 2,800 9,600 11,400 Direct Labor 11,600 9,600 3,800 Applied Manufacturing Overhead ? ? ? Required:If no other jobs were started, completed, or sold, determine the balance in each of the following accounts at the end of April:arrow_forwardCheung’s Company uses a job-order costing system and a predetermined overhead rate based on machine hours. Estimated manufacturing overhead for the upcoming year was $1,000,000, and estimated machine hours were 25,000. On March 1, the company had only one job in the work in process (Job No. 126) with total costs of $15,000. The following information pertains to the company’s activities for the month of March: 1. Raw materials were purchased on account for $75,000.2. Jobs 127 and 128 were started during the month.3. Raw materials totaling $70,000 were requisitioned for use in production. Of this total,$8,000 was for indirect materials. The direct materials were distributed as follows:Job No. 126 $16,000Job No. 127 $32,000Job No. 128 $14,0004. Factory labor costs for the month totaled $160,000, of which $27,000 was for indirect labor. The direct labor was distributed as follows:Job No. 126 $33,000Job No. 127 $75,000Job No. 128 $25,0005. The company had a depreciation of $13,000 and…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning