Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 30SP

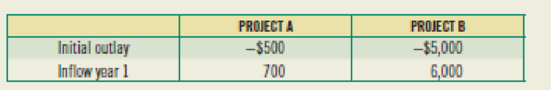

(Size-disparity problem) The D. Dorner Farms Corporation is considering purchasing one of two fertilizer-herbicides for the upcoming year. The mom expensive of the two is better and will produce a higher yield. Assume these projects are mutually exclusive and that the required

- a. Calculate the

NPV of each project. - b. Calculate the PI of each project.

- c. Calculate the

IRR of each project. - d. If there is no capital-rationing constraint, which project should be selected? If there is a capital-rationing constraint, how should the decision be made?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please answer the following questions using the information below:

NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected?

PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?

Consider the following cash flows:

Year 0 1 2 3 4 5 6

Cash Flow -$8,000 $3,000 $3,600 $2,700 $2,500 $2,100 $1,600

Payback. The company requires all projects to payback within 3 years. Calculate the payback period. Should it be accepted or rejected?

Discounted Payback. Calculate the discounted payback using a discount rate of 10%. Should it be accepted or rejected?

IRR. Calculate the IRR for this project. The company’s required rate of return is 10%. Should it be accepted or rejected?

NPV. Using a 10% required rate of return, calculate the NPV for this project. Should it be accepted or rejected?

PI. Calculate the Profitability Index (PI) for this project. Should it be accepted or rejected?…

Consider two investment projects, which both require an upfront investment of $9 million, and both of which pay a constant positive amount each year for the next 9

years. Under what conditions can you rank these projects by comparing their IRRS?

(Select the best choice below.)

O A. There are no conditions under which you can use the IRR to rank projects.

O B. Ranking by IRR will work in this case so long as the projects' cash flows do not decrease from year to year.

O C. Ranking by IRR will work in this case so long as the projects' cash flows do not increase from year to year.

O D. Ranking by IRR will work in this case so long as the projects have the same risk.

A company that manufactures magnetic flow meters expects to undertake a project that will have the cash flows below. At an interest rate of 10% per year, what is the equivalent annual cost of the project? Find the AW value using (a) tabulated factors, (b) calculator functions, and (c) a spreadsheet. Which method did you find the easiest to use?

Chapter 10 Solutions

Foundations Of Finance

Ch. 10 - Why is capital budgeting such an important...Ch. 10 - What are the disadvantages of using the payback...Ch. 10 - Prob. 4RQCh. 10 - What are mutually exclusive projects? Why might...Ch. 10 - Prob. 6RQCh. 10 - When might two mutually exclusive projects having...Ch. 10 - Prob. 1SPCh. 10 - Prob. 2SPCh. 10 - Prob. 3SPCh. 10 - Prob. 4SP

Ch. 10 - (NPV, PI, and IRR calculations) Fijisawa Inc. is...Ch. 10 - (Payback period, NPV, PI, and IRR calculations)...Ch. 10 - (NPV, PI, and IRR calculations) You are...Ch. 10 - (Payback period calculations) You are considering...Ch. 10 - (NPV with varying required rates of return)...Ch. 10 - Prob. 10SPCh. 10 - (NPV with varying required rates of return) Big...Ch. 10 - (NPV with different required rates of return)...Ch. 10 - (IRR with uneven cash flows) The Tiffin Barker...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (MIRR calculation) Calculate the MIRR given the...Ch. 10 - (PI calculation) Calculate the PI given the...Ch. 10 - (Discounted payback period) Gios Restaurants is...Ch. 10 - (Discounted payback period) You are considering a...Ch. 10 - (Discounted payback period) Assuming an...Ch. 10 - (IRR) Jella Cosmetics is considering a project...Ch. 10 - (IRR) Your investment advisor has offered you an...Ch. 10 - (IRR, payback, and calculating a missing cash...Ch. 10 - (Discounted payback period) Sheinhardt Wig Company...Ch. 10 - (IRR of uneven cash-flow stream) Microwave Oven...Ch. 10 - (MIRR) Dunder Mifflin Paper Company is considering...Ch. 10 - (MIRR calculation) Arties Wrestling Stuff is...Ch. 10 - (Capital rationing) The Cowboy Hat Company of...Ch. 10 - Prob. 29SPCh. 10 - (Size-disparity problem) The D. Dorner Farms...Ch. 10 - (Replacement chains) Destination Hotels currently...Ch. 10 - Prob. 32SPCh. 10 - Prob. 33SPCh. 10 - Why is the capital-budgeting process so important?Ch. 10 - Prob. 2MCCh. 10 - What is the payback period on each project? If...Ch. 10 - What are the criticisms of the payback period?Ch. 10 - Prob. 5MCCh. 10 - Prob. 6MCCh. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Determine the IRR for each project. Should either...Ch. 10 - How does a change in the required rate of return...Ch. 10 - Caledonia is considering two investments with...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 Year 3 Year 4 A −$51 $25 $19 $19 $17 B −$98 $19 $40 $51 $60 a. What are the IRRs of the two projects? b. If your discount rate is 4.8%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently?arrow_forwardConsider the following projects, X and Y where the firm can only choose one. Project X costs $600 and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Which investment should the firm choose if the cost of capital is 15 percent? Project X, since it has a higher NPV than Project Y Project Y, since it has a higher NPV than Project X neither, since both the projects have negative NPV neither, since both the projects have positive NPVarrow_forwardYou are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRs of the two projects? b. If your discount rate is 4.7%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 Project A Year 1 - -$51 $27 B - $101 $22 Year 2 $21 $42 Year 3 $20 Year 4 $13 $51 $59 - ☑arrow_forward

- Tyler, Inc., is considering switching to a new production technology. The cost of the required equipment will be $3,529,783 . The discount rate is 13.99 percent. The cash flows that the firm expects the new technology to generate are as follows. a. Compute the payback and discounted payback periods for the project. b. What is the NPV for the project? Should the firm go ahead with the project? c. What is the IRR, and what would be the decision based on the IRR? Years CF 0 $(3,529,783) 1-2 0 3-5 $916,204 6-9 $1,590,056arrow_forwardEach of the following scenarios is independent. Assume that all cash flows are after-tax cash flows. a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per year. The system costs $2,950,000 and will last 10 years. b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $280,000. She estimates that the return from owning her own shop will be $45,000 per year. She estimates that the shop will have a useful life of 6 years. c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8 years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce annual after-tax cash flows of $135,000. Required: 1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value calculations to the nearest dollar. Use the minus sign to indicate a…arrow_forwardConsider the following projects, X and Y where the firm can only choose one. Project X costs $600 and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Sketch a net present value profile for each of these projects. Which project should the firm choose if the cost of capital is 10 percent? What if the cost of capital is 25 percent? Show all work.arrow_forward

- Consider two investment projects, which both require an upfront investment of $8 million, and both of which pay a constant positive amount each year for the next 11 years. Under what conditions can you rank these projects by comparing their IRRs? (Select the best choice below.) A. Ranking by IRR will work in this case so long as the projects' cash flows do not increase from year to year. B. Ranking by IRR will work in this case so long as the projects have the same risk. C. There are no conditions under which you can use the IRR to rank projects. D. Ranking by IRR will work in this case so long as the projects' cash flows do not decrease from year to year.arrow_forward( NPV and Pl calculations ) You are considering two independent projects in Birmingham and Manchester, respectively. The initial cash outlay associated with the Birmingham project is $550,000, and the initial cash outlay associated with the Manchester project is $750,000. The required rate of return on both projects is 13 percent. The expected annual free cash inflows from each project are as follows: Calculate the NPV and PI for each project and indicate if the project should be accepted. MANCHESTER BIRMINGHAM -$550,000 -$750,000 Initial outlay Inflow year 1 Inflow year 2 170,000 170,000 170,000 120,000 120,000 Inflow year 3 Inflow year 4 Inflow year 5 Inflow year 6 120,000 120,000 120,000 170,000 170,000 120,000 170,000arrow_forward1. Comparing all methods. Given the following after-tax cash flow on a new toy for Tyler's Toys, find the project's payback period, NPV, and IRR. The appropriate discount rate for the project is 14%. If the cutoff period is 6 years for major projects, determine whether management will accept or reject the project under the three different decision models. (Click on the following icon in order to copy its contents into a spreadsheet.) Initial cash outflow: $11,700,000 Years one through four cash inflow: $2,925,000 each year Year five cash outflow: $1,170,000 Years six through eight cash inflow: $503,000 each year What is the payback period for the new toy at Tyler's Toys? years (Round to two decimal places.) Under the payback period, this project would be (1) What is the NPV for the new toy at Tyler's Toys? $ (Round to the nearest cent.) Under the NPV rule, this project would be (2) What is the IRR for the new toy at Tyler's Toys? % (Round to two decimal places.) Under the IRR rule,…arrow_forward

- You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 Year 3 Year 4 - $51 - $102 $25 $19 $18 $40 $21 $48 $14 $59 A В a. What are the IRRS of the two projects? b. If your discount rate is 5.3%, what are the NPVS of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRS of the two projects? The IRR for project A is %. (Round to one decimal place.) The IRR for project B is %. (Round to one decimal place.) b. If your discount rate is 5.3%, what are the NPVS of the two projects? If your discount rate is 5.3%, the NPV for project A is $ million. (Round to two decimal places.) If your discount rate is 5.3%, the NPV for project B is $ million. (Round to two decimal places.) c. Why do IRR and NPV rank the two projects differently? (Select from the drop-down menus.) NPV and IRR rank the two projects differently because they are measuring different things. is…arrow_forwardUse the following data to answer questions (a) to (d). A company is considering the purchase of a copier that costs RM 50,000. Assume the required rate of return is 10% and the following is cash flow schedule: Year 1: RM 20,000 Year 2: RM 30,000 Year 3: RM 20,000 What is the project’s payback period? What is the project’s NPV? What is the project’s IRR? What is the project’s profitability index (PI)?arrow_forwardYour division is considering two projects. The required rate of return for both projects is 12%. Below are the cash flows of both the projects: (Note: show all computations) Projects Initial investment Year 1 Year 2 Year 3 Year 4 A -$50 $7 $12 $17 $25 B -$50 $20 $18 $12 $11 Calculate the Payback period and discounted payback period. Why are they different? Calculate the NPV for both the projects Which projects should be accepted on the basis of IRR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License