FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

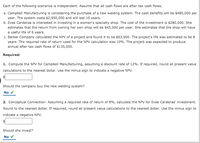

Transcribed Image Text:Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Campbell Manufacturing is considering the purchase of a new welding system. The cash benefits will be $480,000 per

year. The system costs $2,950,000 and will last 10 years.

b. Evee Cardenas is interested in investing in a women's specialty shop. The cost of the investment is $280,000. She

estimates that the return from owning her own shop will be $45,000 per year. She estimates that the shop will have

a useful life of 6 years.

c. Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was estimated to be 8

years. The required rate of return used for the NPV calculation was 10%. The project was expected to produce

annual after-tax cash flows of $135,000.

Required:

1. Compute the NPV for Campbell Manufacturing, assuming a discount rate of 12%. If required, round all present value

calculations to the nearest dollar. Use the minus sign to indicate a negative NPV.

Should the company buy the new welding system?

No v

2. Conceptual Connection: Assuming a required rate of return of 8%, calculate the NPV for Evee Cardenas' investment.

Round to the nearest dollar. If required, round all present value calculations to the nearest dollar. Use the minus sign to

indicate a negative NPV.

Should she invest?

No v

Transcribed Image Text:What if the estimated return was $135,000 per year? Calculate the new NPV for Evee Cardenas' investment. Would this

affect the decision? What does this tell you about your analysis? Round to the nearest dollar.

The shop should now v be purchased. This reveals that the decision to accept or reject in this case is affected by

differences in estimated cash flow v

3. What was the required investment for Barker Company's project? Round to the nearest dollar. If required, round all

present value calculations to the nearest dollar.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Amna, an inventor, has developed an exciting new process for producing an infinite supply of energy from salt water. Amna believes that she can sell her invention to a major oil company. Amna is asking for a Royalty of $6.5 Million dollars, payable at the end of year one and then increasing at the rate of 5.5% per year forever. If an appropriate discount rate is 16%, how much should Amna accept if the company wants to pay her a lump sum amount today?a. $33.3 Millionb. There is no correct answer given.c. $60 Milliond. $40 Millionarrow_forwardBarbarian Pizza is analyzing the prospect of purchasing an additional fire brick oven. The oven costs $200,000 and would be depreciated (straight-line to a salvage value of $120,000 in 10 years. The extra oven would increase annual revenues by $120,000 and annual operating expenses by $90,000. Barbarian’s marginal tax rate is 25%. This should all be done in excel. What would be the initial, operating, and terminal cash flows generated by the new oven?b. What is the payback period for the additional oven?c. Barbarian Pizza’s RRR is 12%. What is the NPV of the additional oven?d. What is the IRR of the additional oven?arrow_forwardYou have just completed a $25,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $105,000, and if you sold it today, you would net $114,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $35,000 plus an initial investment of $4,700 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Feasibility study for the new coffee shop. B. Amount you would net after taxes should you sell the space today. C. Initial investment in inventory. D. Capital expenditure to outfit the space. E. Price you paid for the space two years ago. Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar.) E 1 2 3 4 Free Cash Flow Carrow_forward

- Joan owns a tanning salon that is expected to produce annual cash flows forever. The tanning salon is worth $902,400.00 and the cost of capital is 11.78%. Annual cash flows are expected with the first one due in one year and all subsequent ones growing annually by 10.00%. What is the amount of the annual cash flow produced by the tanning salon in 1 year expected to be? $506,966.29 (plus or minus $10) $196,542.72 (plus or minus $10) $16,062.72 (plus or minus $10) $50,696,629.21 (plus or minus $10)arrow_forwardTripp Industries is considering buying a new recycling system. The new recycling system would be purchased today for $7,700.00. It would be depreciated straight-line to $1,020.00 over 2 years. In 2 years, the recycling system would be sold and the after-tax cash flow from capital spending in year 2 would be $1,270.00. The recycling system is expected to reduce costs by $2,730.00 in year 1 and by $8,630.00 in year 2. If the tax rate is 52.00% and the cost of capital is 7.73%, what is the net present value of the new recycling system project? $106.43 (plus or minus $10) $191.35 (plus or minus $10) $1,288.60 (plus or minus $10) -$2,245.85 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardYou have just completed a $18,000 feasibility study for a new coffee shop in some retail space you own. You bought the space two years ago for $105,000, and if you sold it today, you would net $120,000 after taxes. Outfitting the space for a coffee shop would require a capital expenditure of $35,000 plus an initial investment of $4,800 in inventory. What is the correct initial cash flow for your analysis of the coffee shop opportunity? Identify the relevant incremental cash flows below: (Select all the choices that apply.) A. Price you paid for the space two years ago. B. Capital expenditure to outfit the space. C. Feasibility study for the new coffee shop. D. Initial investment in inventory. E. Amount you would net after taxes should you sell the space today. Calculate the initial cash flow below: (Select from the drop-down menus and round to the nearest dollar.) 1 Opportunity Cost $ 2 Capital Expenditure (outfit of space) $ 3 Change in Net Working Capital $ $ 4 Free Cash Flowarrow_forward

- You own a restaurant and are considering buying a liquor license. You estimate that it will cost you $200,000 to buy a five-year license and construct a bar and that you will generate $40,000 in after-tax cash flows each year for the next nine years. (The cost of the license is capitalized and the cash flows already reflect the depreciation). If your cost of capital is 15%, estimate the net present value of buying a liquor license. (There is no salvage value at the end of the 9th year). b. Assume now that the bar will bring in additional customers to your restaurant. If your after-tax operating margin is 60%, how much additional revenue would you have to generate each year in your restaurant for the liquor license to make economic sense?arrow_forwardLaurel’s Lawn Care Limited has a new mower line that can generate revenues of $132,000 per year. Direct production costs are $44,000, and the fixed costs of maintaining the lawn mower factory are $17,000 a year. The factory originally cost $1.10 million and is being depreciated for tax purposes over 25 years using straight-line depreciation. Calculate the operating cash flows of the project if the firm’s tax bracket is 25%. Operating Cash Flow = _________arrow_forwardJohn Wiggins is contemplating the purchase of a small restaurant. The purchase price listed by the seller is $800,000. John has used past financial information to estimate that the net cash flows (cash inflows less cash outflows) generated by the restaurant would be as follows: Required: Assuming that John desires a 10% rate of return on this investment, should the restaurant be purchased? (Assume that all cash flows occur at the end of the year.)arrow_forward

- Charlie is planning to buy a small apartment complex; the complex will cost $1,000,000 and they will generate $450,000 in profits over the next three years. The complex will also need $50,000 in renovations during year 4. Charlie's required rate of return is 17%. What is the NPV on Charlie's investment ___? and should Charlie purchase the apartments___? yes or noarrow_forwardMike is considering quitting his job to start a bakery, his dream work. To do so, he would need to make an investment of $80,000 today. He estimates that the bakery would generate revenues of $90,000 over the next five years and would require $20,000 in expenses. At his current job he earns $50,000. Therefore, Mike estimates that the incremental cash flows from opening the bakery would be $20,000 per year for the next five years. Calculate the NPV of the business using a discount rate of 15%. Should Mike quit his job and start the bakery? Calculate the IRR for the project described in problem 3. If Mike requires a return of 15% on the business, should he start the bakery?arrow_forwardAnthony operates a part time auto repair service. He estimates that a new diagnostic computer system will result in increased cash inflows of $1,500 in Year 1, $2,100 in Year 2, and $3,200 in Year 3. If Anthony's required rate of return is 10%, then the most he would be willing to pay for the new diagnostic computer system would be (Ignore income taxes.): Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice $4,599 $5,501 $5,638arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education