Foundations Of Finance

10th Edition

ISBN: 9780134897264

Author: KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher: Pearson,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 8SP

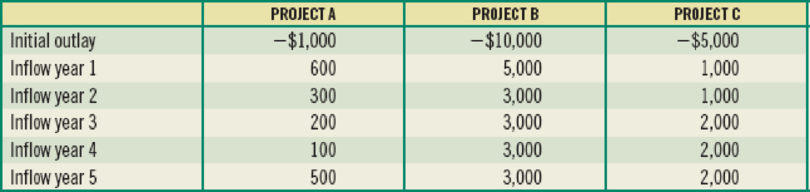

(Payback period calculations) You are considering three independent projects: project A, project B, and project C. Given the following

If you require a 3-year payback before an investment can be accepted, which project(s) would be accepted?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider the following two mutually exclusive projects (W and Z).

-The table-

Whichever project you choose, if any, you require a 12 percent return on your investment.(a) Calculate the payback period for each project.(b) Calculate the net present value (NPV) of each project(c) Based on your answers in (a) and (b), which project will you finally choose? Explain.

Payback period. Given the cash flow of two projects-A and B-in the following table,

and using the payback period decision model, which project(s) do you accept and which proje

period for recapturing the initial cash outflow? For payback period calp

What is the payback period for project A?

6 Data Table

- X

years (Round to one decimal place.)

(Click on the following icon D in order to copy its contents into a spreadsheet.)

Cash Flow

B.

Cost

Cash flow year 1

Cash flow year 2

Cash flow year 3

Cash flow year 4

Cash flow year 5

Cash flow

$12,000

$6,000

$6,000

$6,000

$100,000

$20,000

$10,000

$40,000

$6,000

$30,000

SO

$6,000

$6,000

year

6.

SO

Print

Done

Payback period. Given the cash flow of four projects-A, B, C, and D-in the following table, , and using the payback period decision model, which projects do you accept and which projects do you reject if you have a 3-year cutoff period

for recapturing the initial cash outflow? For payback period calculations, assume that the cash flow is equally distributed over the year.

.....

What is the payback period for project A?

years (Round to two decimal places.)

Data table

With a 3-year cutoff period for recapturing the initial cash outflow, project A would be

What is the payback period for project B?

(Click on the following icon

in order to copy its contents into a spreadsheet.)

years (Round to two decimal places.)

rejected

Cash Flow

B

D

With a 3-year cutoff period for recapturing the initial cash outflow, project B would be

Cost

$10,000

$25,000

$45,000

$100,000

ассepted

Cash flow year 1

$4,000

$2,000

$10,000

$40,000

What is the payback period for project C?

Cash flow year 2

$4,000

$8,000…

Chapter 10 Solutions

Foundations Of Finance

Ch. 10 - Why is capital budgeting such an important...Ch. 10 - What are the disadvantages of using the payback...Ch. 10 - Prob. 4RQCh. 10 - What are mutually exclusive projects? Why might...Ch. 10 - Prob. 6RQCh. 10 - When might two mutually exclusive projects having...Ch. 10 - Prob. 1SPCh. 10 - Prob. 2SPCh. 10 - Prob. 3SPCh. 10 - Prob. 4SP

Ch. 10 - (NPV, PI, and IRR calculations) Fijisawa Inc. is...Ch. 10 - (Payback period, NPV, PI, and IRR calculations)...Ch. 10 - (NPV, PI, and IRR calculations) You are...Ch. 10 - (Payback period calculations) You are considering...Ch. 10 - (NPV with varying required rates of return)...Ch. 10 - Prob. 10SPCh. 10 - (NPV with varying required rates of return) Big...Ch. 10 - (NPV with different required rates of return)...Ch. 10 - (IRR with uneven cash flows) The Tiffin Barker...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (NPV calculation) Calculate the NPV given the...Ch. 10 - (MIRR calculation) Calculate the MIRR given the...Ch. 10 - (PI calculation) Calculate the PI given the...Ch. 10 - (Discounted payback period) Gios Restaurants is...Ch. 10 - (Discounted payback period) You are considering a...Ch. 10 - (Discounted payback period) Assuming an...Ch. 10 - (IRR) Jella Cosmetics is considering a project...Ch. 10 - (IRR) Your investment advisor has offered you an...Ch. 10 - (IRR, payback, and calculating a missing cash...Ch. 10 - (Discounted payback period) Sheinhardt Wig Company...Ch. 10 - (IRR of uneven cash-flow stream) Microwave Oven...Ch. 10 - (MIRR) Dunder Mifflin Paper Company is considering...Ch. 10 - (MIRR calculation) Arties Wrestling Stuff is...Ch. 10 - (Capital rationing) The Cowboy Hat Company of...Ch. 10 - Prob. 29SPCh. 10 - (Size-disparity problem) The D. Dorner Farms...Ch. 10 - (Replacement chains) Destination Hotels currently...Ch. 10 - Prob. 32SPCh. 10 - Prob. 33SPCh. 10 - Why is the capital-budgeting process so important?Ch. 10 - Prob. 2MCCh. 10 - What is the payback period on each project? If...Ch. 10 - What are the criticisms of the payback period?Ch. 10 - Prob. 5MCCh. 10 - Prob. 6MCCh. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Determine the IRR for each project. Should either...Ch. 10 - How does a change in the required rate of return...Ch. 10 - Caledonia is considering two investments with...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What information does the payback period provide? Suppose you are evaluating a project with the expected future cash inflows shown in the following table. Your boss has asked you to calculate the project's net present value (NPV). You don't know the project's initial cost, but you do know the project's regular, or conventional, payback period is 2.50 years. If the project's weighted average cost of capital (WACC) is 9%, the project's NPV (rounded to the nearest dollar) is: $355,048 $287,420 $405,769 $338,141 Which of the following statements indicate a disadvantage of using the regular payback period (not the discounted payback period) for capital budgeting decisions? Check all that apply. The payback period does not take the time value of money into account. The payback period is calculated using net income instead of cash flows. The payback period does not take the project's entire life into account.arrow_forwardComparative NPV analysis. Consider the following cash flows for two different projects: Cash flow 0 1 34 4 Project A -$10 million $ 4 million $ 5 million $ 6 million $ 4 million Project B -$25 million $ 8 million $10 million $12 million $10 millionarrow_forwarda) Calculate the payback period for each project. The maximum allowable payback period setby the company for all projects is 3 years. b) Calculate the net present value (NPV) for each project c) Calculate the profitability index (PI) for each project d) Calculate the internal rate of return (IRR) for each project. e) Based on the answer in (a) – (d), explain briefly which project should be accepted. f) If the project is independent project, how would your answer change in part (e) Note: I need only e,f no question answer. only e and farrow_forward

- Please answer the following questions in detail, provide examples whenever applicable, provide in-text citations. (TABLE IMAGE ATTACHED) What is the payback period on each of the above projects? Given that you wish to use the payback rule with a cutoff period of two years, which projects would you accept? If you use a cutoff period of three years, which projects would you accept? If the opportunity cost of capital is 10%, which projects have positive NPVs? If a firm uses a single cutoff period for all projects, it is likely to accept too many short-lived projects.” True or false? If the firm uses the discounted-payback rule, will it accept any negative-NPV projects? Will it turn down any positive NPV projects?arrow_forwarduring the initial cash outflow? For payback period calp pack period for project A? i Data Table nd to one decimal place.) (Click on the following icon in order to copy its contents into a spreadsheet) Cash Flor B. $15,000 S7,500 S7.500 S7,500 S7.500 S7,500 S7.500 $90,000 $36,000 $27,000 $18,000 $9,000 SO Cost Cash flow year 1 Cash flow year 2 Cash flow year 3 Cash flow year 4 Cash flow year 5 Cash flow year 6 $0 Print Donearrow_forwarda) Calculate the payback period for each project. The maximum allowable payback period setby the company for all projects is 3 years. b) Calculate the net present value (NPV) for each project c) Calculate the profitability index (PI) for each project d) Calculate the internal rate of return (IRR) for each project. e) Based on the answer in (a) – (d), explain briefly which project should be accepted. f) If the project is independent project, how would your answer change in part (e) Note: 1. I need only e,f no question answer. only e and f 2. No need excel formulaarrow_forward

- You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): a. What are the IRRs of the two projects? b. If your discount rate is 4.7%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 0 Project A Year 1 - -$51 $27 B - $101 $22 Year 2 $21 $42 Year 3 $20 Year 4 $13 $51 $59 - ☑arrow_forwardSuppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years, respectively. Time Project A Cash Flow Project B Cash Flow Use the payback decision rule to evaluate these projects, which one(s) should it be accepted or rejected? Multiple Choice 0 -35,000 -45,000 1 25,000 25,000 2 45,000 5,000 3 16,000 65,000arrow_forwardYou are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year 0 Year 1 Year 2 Year 3 Year 4 A −$51 $25 $19 $19 $17 B −$98 $19 $40 $51 $60 a. What are the IRRs of the two projects? b. If your discount rate is 4.8%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently?arrow_forward

- Calculate the payback period, net present value, and internal rate of return for Project A. Assume a discount rate of 10%. Should the firm accept or reject Project A? Explain. If Project A and Project B are mutually exclusive, which is the better choice? Explain. What are “non-conventional” cash flows? What issues arise when evaluating projects with “non-conventional” cash flows? Project A Project B Year Cash Flow Year Cash Flow 0 -$100,000 0 -$1 1 $70,000 1 $0 2 $0 2 $0 3 $50,000 3 $10arrow_forwardCalculate the payback period for both projects each (year, month and days).3.2 Calculate the accounting rate of return for each project. 3.3 Use the net present value (NPV) method to determine which project should be chosen.3.4 Briefly discuss the merits of using the NPV methodarrow_forward(Paybackperiod, NPV, PI, and IRR calculations) You are considering a project with an initial cash outlay of $80,000 and expected free cash flows of $26,000 at the end of each year for 6 years. The required rate of return for this project is 7 percent. a. What is the project's payback period? b. What is the project's NPV? c. What is the project's PI? d. What is the project's IRR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License