Exercise 1-6 Effect of transactions on general ledger accounts

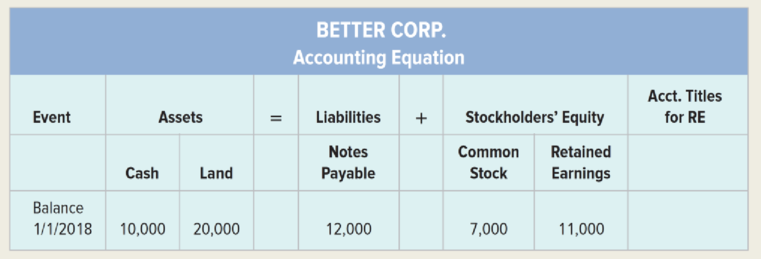

At the beginning of 2018, Better Corp.’s accounting records had the following general ledger accounts and balances:

Better Corp. completed the following transactions during 2018:

1. Purchased land for $5,000 cash.

2. Acquired $25,000 cash from the issue of common stock.

3. Received $75,000 cash for providing services to customers.

4. Paid cash operating expenses of $42,000.

5. Borrowed $10,000 cash from the bank.

6. Paid a $5,000 cash dividend to the stockholders.

7. Determined that the market value of the land purchased in event 1 is $35,000.

Required

a. Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the

b. As of December 31, 2018, determine the total amount of assets, liabilities, and stockholders’ equity and present this information in the form of an

c. What is the amount of total assets, liabilities, and stockholders’ equity as of January 1, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Survey Of Accounting

- Brief Exercise 11-31 (Algorithmic) Determining Net Cash Flow from Financing Activities Madison Company reported the following information: 12/31/2019 12/31/2018 Notes payable $95,000 $75,000 Common stock 120,000 80,000 Retained earnings 20,000 36,000 Madison reported net income of $39,000 for the year ended December 31, 2019. In addition, Madison repaid $27,000 of the notes payable during 2019. Required: Compute net cash flow from financing activities. Use a minus sign to indicate negative cash flows (outflows). $arrow_forwardHelp | System Announcements Balance Sheet As of 12/31/19 Assets: Liabilities and Equity: Cash and marketable securities $28,987 Accounts payable and accruals $154,807 Accounts receivable $142,845 Short-term notes payable $21,639 Inventory $212,722 Total current liabilities $176,446 Total current assets $384,554 Long term debt $155,510 Net plant and equipment $602,309 Total liabilities $331,956 Goodwill and cther assets $42,422 Common stock $314,932 Retained earnings $382,397 Total assets $1,029,285 Total liabilities and equity $1,029,285 In addition, it was reported that the firm had a net income of: $158,531 and net sales of: $4,338,283 Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g. 52.75.): Current Ratio times Quick Ratio times Average Collection Period days Total Asset Turnever times Fixed Asset Turnover times Questionarrow_forwardQuestion Content Area A company reported the following information: Interest receivable, December 31, 2023: $8,000 Interest receivable, December 31, 2022: $11,500 Interest revenue for 2023: $16,000 Interest receivable, December 31, 2023 $8,000 Interest receivable, December 31, 2022 11,500 Interest revenue for 2023 16,000 How much cash was received for interest during 2023?arrow_forward

- Determining Net Cash Flow from Financing Activities Madison Company reported the following information: 12/31/2019 12/31/2018 Notes payable $95,000 $75,000 Common stock 120,000 80,000 Retained earnings 20,000 36,000 Madison reported net income of $26,000 for the year ended December 31, 2019. In addition, Madison repaid $35,000 of the notes payable during 2019. Required: Compute net cash flow from financing activities.arrow_forwardE Print Item Use the following information from Birch Company's balance sheets: Dec. 31, 2018 Dec. 31, 2017 Accounts Receivable $13,100 $15,600 Prepaid Insurance 4,300 3,400 Accounts Payable 9,200 8,300 Accured Liabilities 3,000 3,700 Determine net cash flows from operating activities (indirect method), assuming net income for 2018 of $126,000.arrow_forwardCurrent Attempt in Progress Carla Vista Company's current assets at December 31, 2022 are listed below in alphabetical order. Accounts receivable Cash Finished goods inventory Prepaid expenses Raw materials inventory Work in process inventory $39,360 58,560 24,960 2,880 21,120 30,720arrow_forward

- PROBLEM: Tagaytay Company's summary of cash records show the following for the year 2022, its first year of operation: CASH Transactions Debit Credit Cash receipts 1,280,000 Cash Disbursements 825.000 December 31 balances 455.000 You are contacted by the management to compute its net income using the accrual basis of accounting. During the process of preparation, the following were identified by you that will impact your computation: 1. Property, plant and equipment are depreciated on a straight line basis. Annual depreciation is P 105,000. 2. Prepaid insurance of P 18,000 was recognized as expense when it was paid. P 12,000 of the balance relates to year 2023. 3. The entire amount of P 120,000 which was received as advance rental for office space in its building was recognized as rent income when received. P 70,000 of the amount will be earned in 2023. 4. Employees are due P 28,000 at the end of 2022. 5. Uncollected interest from investment at the end of 2022 is P 31.700. 6. It is…arrow_forwardProblem 1: RM Company disclosed the following information on December 31, 2021: Accrued rent expense Share dividends payable Accounts receivable, after deducting credit balances of customers' accounts amounting to P42, 500 Estimated premium liability Cash in bank, net of bank overdraft of P22,650 Deferred tax liability Accounts payable, net of debit balances in suppliers' accounts amounting to P8,310 Unearned interest income 54,000 750,000 179,300 65,800 481,900 215,500 95,420 225,000 1,500,000 Mortgage payable, issued on March 1, 2012, maturing after 10 years Notes payable due to bank, 12% interest bearing note payable yearly, issued on August 31, 2021, maturing on August 31, 2022 Cash dividends payable SSS payable Serial bonds payable in 5 yearly installment of P250,000 payable every October 31 Estimated damages because of a supposed unsatisfactory „performance on a contract, a possible obligation Income tax payable Notes payable 1,000,000 520,000 57,100 1,250,000 75,000 138,500…arrow_forwardCurrent Attempt in Progress Your examination of the records of a company that follows the cash basis of accounting tells you that the company's reported cash- basis earnings in 2022 are $30,500. If this firm had followed accrual-basis accounting practices, it would have reported the following year-end balances. 2022 $3,800 Accounts receivable Supplies on hand Unpaid wages owed 2,160 2,340 Other unpaid expenses 1.430 1.340 2021 $2,900 1,380 1.550 Determine the company's net earnings on an accrual basis for 2022. Net earnings on an accrual basis for 2022 sarrow_forward

- EXHIBIT 3.5 Operating and Nonoperating Items in Boston Scientific's Balance Sheet December 31, $ millions 2018 2017 Current assets Cash and cash equivalents. . . Trade accounts receivable, net Inventories. Prepaid income taxes. Other current assets. $ 1,608 1,166 161 146 $ 1,548 1,078 66 188 921 942 Total current assets 4,002 1,782 7,911 3,822 Property, plant and equipment, net Goodwill.... 1,697 Other intangible assets, net Other long-term assets 6,372 932 6,998 5,837 688 Total assets $20,999 $19,042 Current liabilities $ 2,253 $ 1,801 Current debt obligations Accounts payable Accrued expenses 349 530 2,246 2,456 Other current liabilities. 412 867 Total current liabilities 5,260 5,654 3,815 Long-term debt. Deferred income taxes 4,803 328 1,882 191 Other long-term liabilities Stockholders' equity 2,370 Calculate the financial leverage ratio for 2018arrow_forwardCASH Transactions Debit Credit Cash receipts 1,280,000 Cash Disbursements 825,000 December 31 balances 455,000 You are contacted by the management to compute its net income using the accrual basis of accounting. During the process of preparation, the following were identified by you that will impact your computation: Property, plant and equipment are depreciated on a straight line basis. Annual depreciation is P 105,000. Prepaid insurance of P 18,000 was recognized as expense when it was paid. P 12,000 of the balance relates to year 2023. The entire amount of P 120,000 which was received as advance rental for office space in its building was recognized as rent income when received. P 70,000 of the amount will be earned in 2023. Employees are due P 28,000 at the end of 2022. Uncollected interest from investment at the end of 2022 is P 31,700. It is estimated that your 2022 fee for accounting services that have not been billed will be P 5,000. QUESTIONS: What is the…arrow_forwardThe financial statements for Romeo and Company follow. Assume that the additional investment and the withdrawals were in the form of cash. Required Prepare a statement of cash flows for the year ended December 31, 2018. Check Figure Net cash flows from operating activities, 172,000arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,