Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4P

Statement of cost of goods manufactured; income statement;

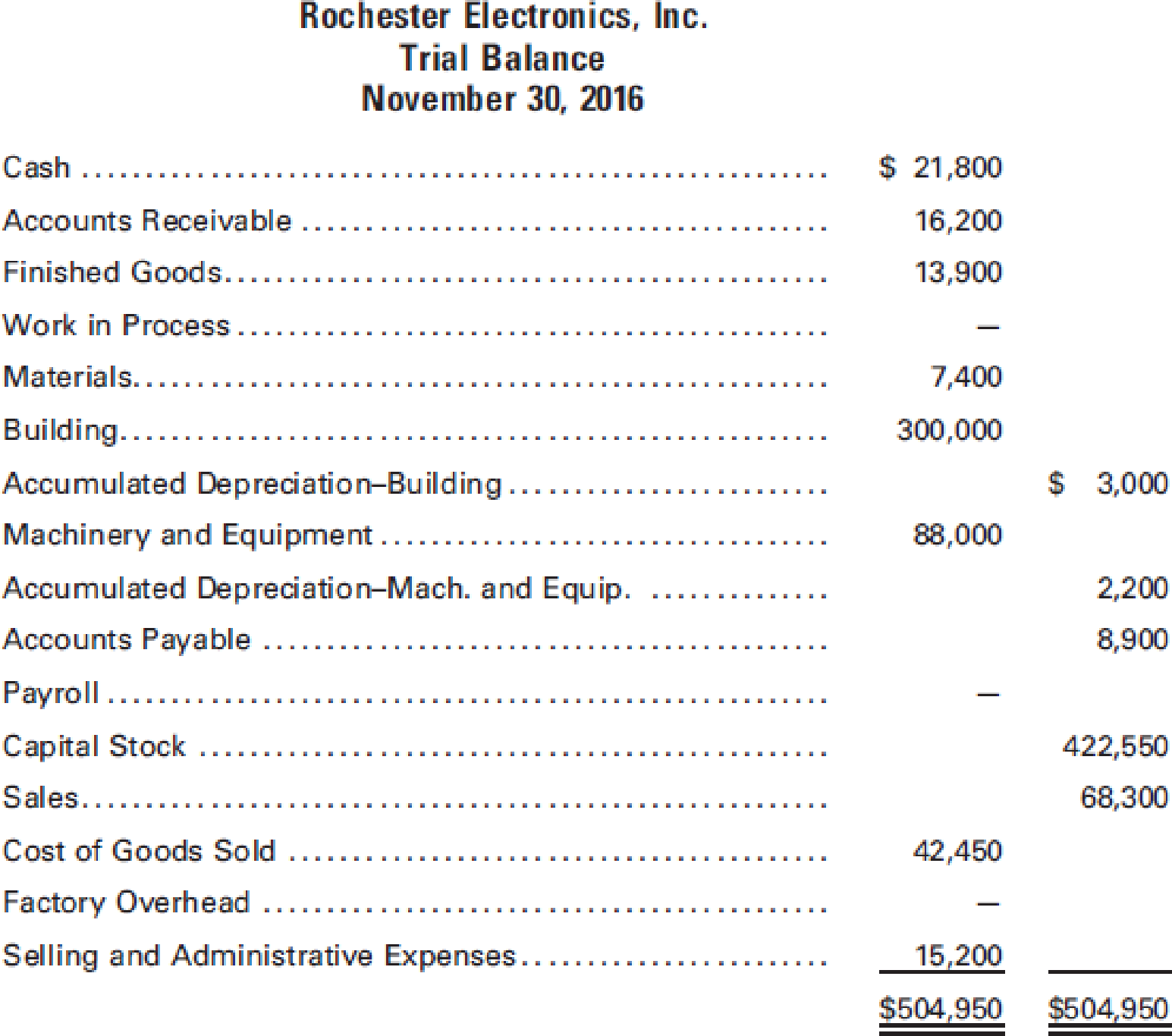

The adjusted

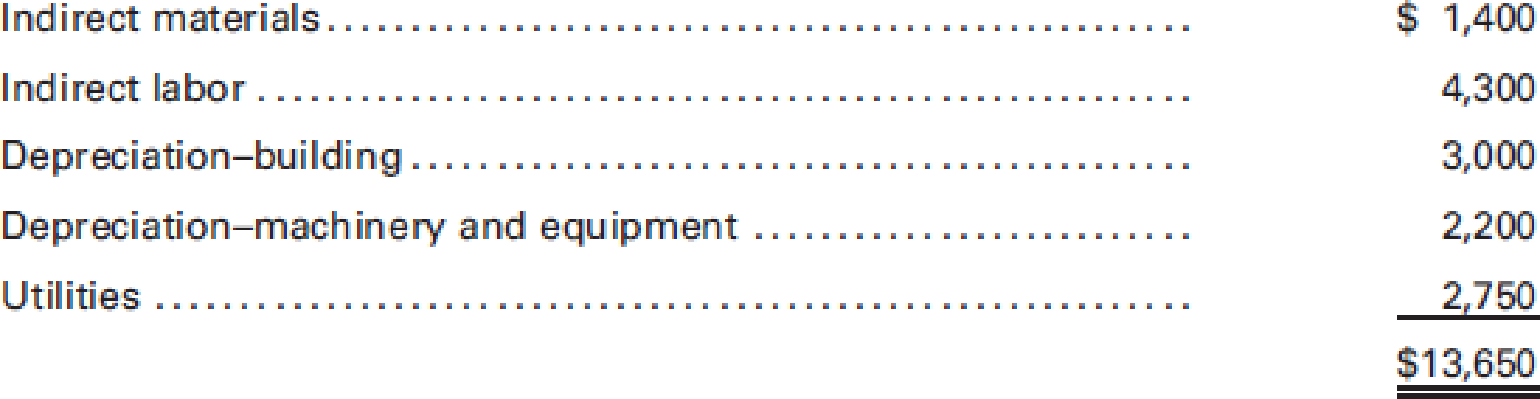

The general ledger reveals the following additional data:

- a. There were no beginning inventories.

- b. Materials purchases during the period were $33,000.

- c. Direct labor cost was $18,500.

- d.

Factory overhead costs were as follows:

Required:

- 1. Prepare a statement of cost of goods manufactured for the month of November.

- 2. Prepare an income statement for the month of November. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.)

- 3. Prepare a balance sheet as of November 30. (Hint: Do not forget

Retained Earnings .)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Give true calculation

The following transactions were incurred by Mooney Fabricators during January, the first month of its fiscal year.

(Click the icon to view the transactions.)

Requirements

1. Record the proper journal entry for each transaction.

2. By the end of January, was manufacturing overhead overallocated or underallocated? By how much?

Date

TWIT

b. $178,000 of materials was used in production; of this amount, $146,000

Journal Entry

uyumiv

era boln

Accounts

b. Work in Process Inventory

Manufacturing Overhead

Raw Materials Inventory

Debit

More info

a. $205,000 of materials was purchased on account.

b. $178,000 of materials was used in production; of this amount, $146,000 was

used on specific jobs.

C. Manufacturing labor and salaries for the month totaled $225,000. A total of

$215,000 of manufacturing labor and salaries was traced to specific jobs, and

the remainder was indirect labor used in the factory.

d.

e.

f.

The company recorded $24,000 of depreciation on the plant and plant

equipment. The…

Godo

Chapter 1 Solutions

Principles of Cost Accounting

Ch. 1 - How does the cost accounting function assist in...Ch. 1 - Prob. 2QCh. 1 - Prob. 3QCh. 1 - Prob. 4QCh. 1 - Prob. 5QCh. 1 - Prob. 6QCh. 1 - How is cost accounting information used by...Ch. 1 - Why is unit cost information important to...Ch. 1 - For a manufacturer, what does the planning process...Ch. 1 - How is effective control achieved in a...

Ch. 1 - Define responsibility accounting.Ch. 1 - What criteria must be met for a unit of activity...Ch. 1 - Prob. 13QCh. 1 - Prob. 14QCh. 1 - What actions should a CMA take when the...Ch. 1 - Prob. 16QCh. 1 - Prob. 17QCh. 1 - Prob. 18QCh. 1 - How is cost accounting related to: financial...Ch. 1 - How does the computation of cost of goods sold for...Ch. 1 - How would you describe the following accounts:...Ch. 1 - Prob. 22QCh. 1 - What is the difference between a perpetual...Ch. 1 - What are the basic elements of production cost?Ch. 1 - How would you define the following costs: direct...Ch. 1 - Why have companies such as Harley-Davidson stopped...Ch. 1 - Distinguish prime cost from conversion cost. Does...Ch. 1 - In what way does the accounting treatment of...Ch. 1 - How do cost of goods sold and cost of goods...Ch. 1 - How are nonfactory costs and costs that benefit...Ch. 1 - What is a mark-on percentage?Ch. 1 - Prob. 32QCh. 1 - When is process costing appropriate, and what...Ch. 1 - What are the advantages of accumulating costs by...Ch. 1 - What is a job cost sheet, and why is it useful?Ch. 1 - What are standard costs, and what is the purpose...Ch. 1 - If the factory operations and selling and...Ch. 1 - Study the performance report for Barbaras Bistro...Ch. 1 - Note that Barbaras Bistro in Figure 1-2 prepares...Ch. 1 - Cost of goods soldmerchandiser The following data...Ch. 1 - The following data were taken from the general...Ch. 1 - Prob. 5ECh. 1 - Explain in narrative form the flow of direct...Ch. 1 - The following data are taken from the general...Ch. 1 - The following data are taken from the general...Ch. 1 - The following inventory data relate to Edwards,...Ch. 1 - The following is a list of manufacturing costs...Ch. 1 - Leen Production Co. uses the job order cost system...Ch. 1 - Gerken Fabrication Inc. uses the job order cost...Ch. 1 - Cycle Specialists manufactures goods on a job...Ch. 1 - Prepare a performance report for the dining room...Ch. 1 - The following data were taken from the general...Ch. 1 - The following data were taken from the general...Ch. 1 - Statement of cost of goods manufactured; income...Ch. 1 - The adjusted trial balance for Appleton...Ch. 1 - The post-closing trial balance of Custer Products,...Ch. 1 - Selected account balances and transactions of...Ch. 1 - OReilly Manufacturing Co.s cost of goods sold for...Ch. 1 - Glasson Manufacturing Co. produces only one...Ch. 1 - Sultan, Inc. manufactures goods to special order...Ch. 1 - Spokane Production Co. obtained the following...Ch. 1 - Bangor Products Co. obtained the following...Ch. 1 - Potomac Automotive Co. manufactures engines that...Ch. 1 - Required Ethics Mary Branson is the Division...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The adjusted trial balance for Appleton Appliances, Ltd. on June 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 23,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for June. 2. Prepare an income statement for June. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of June 30. (Hint: Do not forget Retained Earnings.)arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardCost of Direct Materials, Cost of Goods Manufactured, Cost of Goods Sold Bisby Company manufactures fishing rods. At the beginning of July, the following information was supplied by its accountant: During July, the direct labor cost was 43,500, raw materials purchases were 64,000, and the total overhead cost was 108,750. The inventories at the end of July were: Required: 1. What is the cost of the direct materials used in production during July? 2. What is the cost of goods manufactured for July? 3. What is the cost of goods sold for July?arrow_forward

- OReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardThe books of Petry Products Co. revealed that the following general journal entry had been made at the end of the current accounting period: The total direct materials cost for the period was $40,000. The total direct labor cost, at an average rate of $10 per hour for direct labor, was one and one-half times the direct materials cost. Factory overhead was applied on the basis of $4 per direct labor hour. What was the total actual factory overhead incurred for the period? (Hint: First solve for direct labor cost and then for direct labor hours.)arrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forward

- The post-closing trial balance of Custer Products, Inc. on April 30 is reproduced as follows: During May, the following transactions took place: a. Purchased raw materials at a cost of 45,000 and general factory supplies at a cost of 13,000 on account (recorded materials and supplies in the materials account). b. Issued raw materials to be used in production, costing 47,000, and miscellaneous factory supplies costing 15,000. c. Recorded the payroll and the payments to employees as follows: factory wages (including 12,000 indirect labor), 41,000; and selling and administrative salaries, 7,000. Additional account titles include Wages Payable and Payroll. (Ignore payroll withholdings and deductions.) d. Distributed the payroll in (c). e. Recognized depreciation for the month at an annual rate of 5% on the building, 10% on the factory equipment, and 20% on the office equipment. The sales and administrative staff uses approximately one-fifth of the building for its offices. f. Incurred other expenses totaling 11,000. One-fourth of this amount is allocable to the office function. g. Transferred total factory overhead costs to Work in Process. h. Completed and transferred goods with a total cost of 91,000 to the finished goods storeroom. i. Sold goods costing 188,000 for 362,000. (Assume that all sales were made on account.) j. Collected accounts receivable in the amount of 345,000. k. Paid accounts payable totaling 158,000. Required: 1. Prepare journal entries to record the transactions. 2. Set up T-accounts. Post the beginning trial balance and the journal entries prepared in (1) to the accounts and determine the balances in the accounts on May 31. 3. Prepare a statement of cost of goods manufactured, an income statement, and a balance sheet. (Round amounts to the nearest whole dollar.)arrow_forwardAbbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardPost the journal entries for the transactions to the following T-accounts, each of which started the month with a zero balance.arrow_forward

- The following account balances at the beginning of January were selected from the general ledger of Fresh Bagel Manufacturing Company: Work in process inventory $0 Raw materials inventory $28,800 Finished goods inventory $40,200Additional data: 1. Actual manufacturing overhead for January amounted to $66,100. 2. Total direct labor cost for January was $64,000. 3. The predetermined manufacturing overhead rate is based on direct labor cost. The budget for the year called for $248,000 of direct labor cost and $322,400 of manufacturing overhead costs. 4. The only job unfinished on January 31 was Job No. 151, for which total direct labor charges were $5600 (1600 direct labor hours) and total direct material charges were $14,400. 5. Cost of direct materials placed in production during January totaled $124,000. There were no indirect material requisitions during January. 6. January 31 balance in raw materials inventory was $35,400. 7. Finished goods inventory balance on January 31 was…arrow_forwardThe following balances appear on the accounts of Greusel Fabrication: March 1 (Beginning) $ 36,000 62,000 March 31 (Ending) $ 41,000 66,200 42,500 38,200 Direct materials inventory Work-in-process inventory Finished goods inventory Direct materials used during the month amount to $525,000 and the cost of goods sold for the month was $1,436,000. Required: Prepare a cost of goods sold statement.arrow_forwardWhat is the balance in the Cost of Goods Sold account after the adjustment? Compute One Stop’s gross profit earned on the jobs sold, after adjusting for the manufacturing overhead variance Post the appropriate entries to Materials Inventory, Work-in-Process Inventory and Finished Goods Inventory accounts and determine each account balance on July 31, the end of the month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY