Concept explainers

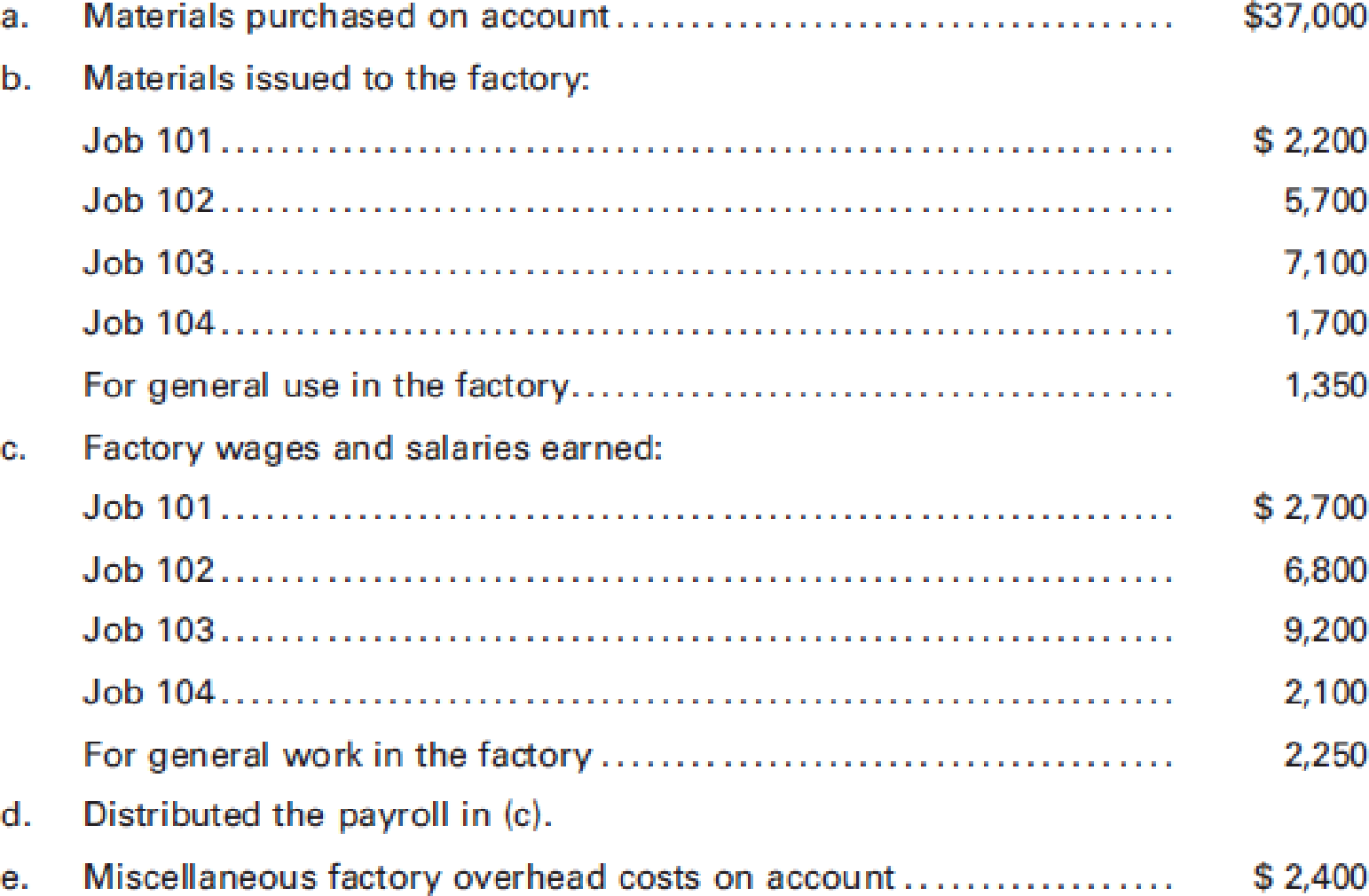

Sultan, Inc. manufactures goods to special order and uses a

Required:

- 1. Prepare a schedule reflecting the cost of each of the four jobs.

- 2. Prepare

journal entries to record the transactions. - 3. Compute the ending balance in Work in Process.

- 4. Compute the ending balance in Finished Goods.

1.

Prepare a schedule that reflects the cost of all four jobs.

Explanation of Solution

Prepare a schedule that reflects the cost of all four jobs.

| Particulars |

Job 101 ($) | Job 102 ($) | Job 103 ($) |

Job 104 ($) |

Total Cost ($) |

| Direct Materials | 2,200 | 5,700 | 7,100 | 1,700 | 16,700 |

| Direct Labor | 2,700 | 6,800 | 9,200 | 2,100 | 20,800 |

| Factory Overhead | 1,200 | 2,000 | 3,800 | 1,000 | 8,000 |

| Total | 6,100 | 14,500 | 20,100 | 4,800 | 45,500 |

Table (1)

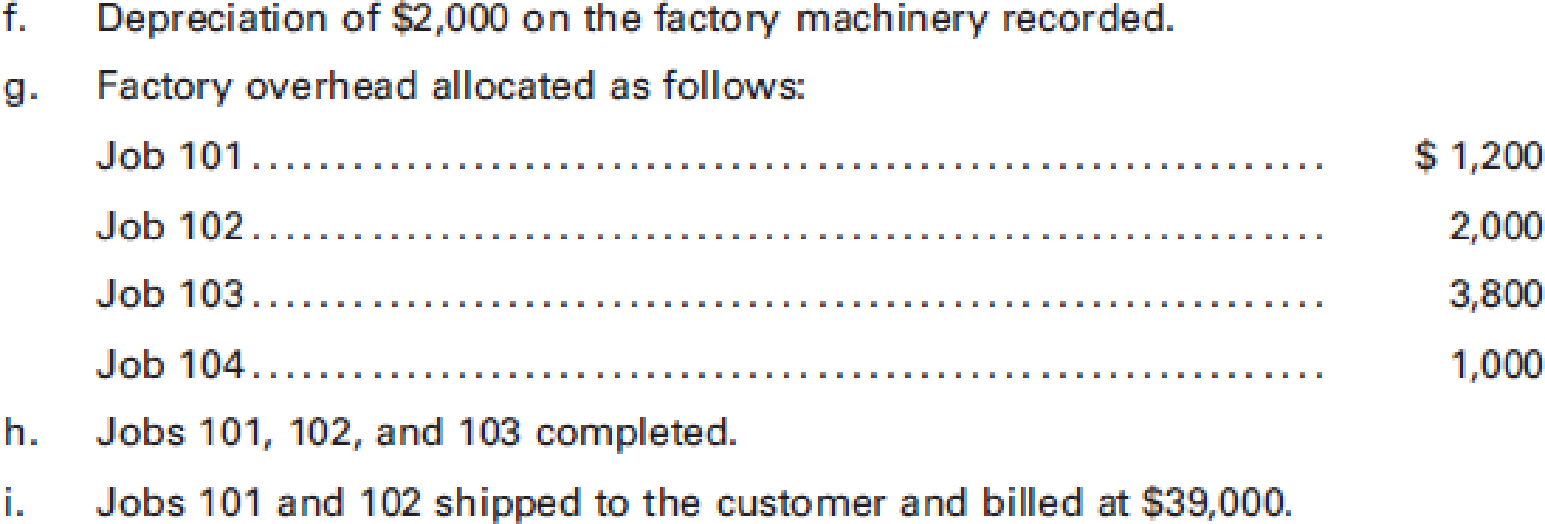

2.

Provide journal entry to record the given transactions.

Explanation of Solution

Provide journal entry to record the given transactions.

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| a | Materials | 37,000 | |

| Accounts payable | 37,000 | ||

| (To record materials purchased on account) | |||

| b | Work in Process | 16,700 | |

| Factory overhead | 1,350 | ||

| Materials | 18,050 | ||

| (To record issue of direct materials and indirect materials) | |||

| c | Payroll | 23,050 | |

| Wages Payable | 23,050 | ||

| (To record factory wages and salaries) | |||

| d | Work in Process | 20,800 | |

| Factory overhead | 2,250 | ||

| Payroll | 23,050 | ||

| (To record payment of wages to the labor) | |||

| e | Factory overhead | 2,400 | |

| Accounts payable | 2,400 | ||

| (To record factory overhead costs on account) | |||

| f. | Factory overhead | 2,000 | |

| Accumulated Depreciation - Machinery | 2,000 | ||

| (To record depreciation on factory machine) | |||

| g. | Work in Process | 8,000 | |

| Factory Overhead | 8,000 | ||

| (To record transfer of factory overhead to Work-in process) | |||

| h. | Finished Goods (1) | 40,700 | |

| Work in Process | 40,700 | ||

| (To record the transfer of cost of completed work to finished goods) | |||

| i | Accounts receivable | 39,000 | |

| Sales | 39,000 | ||

| (To record the sale made on account) | |||

| Cost of goods sold (2) | 20,600 | ||

| Finished goods | 20,600 | ||

| (To record the cost of goods sold) |

Table (2)

Working note 1: Calculate the cost of completed work (finished goods).

Working note 2: Calculate the cost of goods sold.

3.

Calculate the ending balance in work-in process.

Explanation of Solution

Calculate the ending balance in work-in process.

Hence, the ending balance in work-in process is $4,800.

4.

Calculate the ending balance in finished goods.

Explanation of Solution

Calculate the ending balance in finished goods.

Hence, the ending balance in finished goods is $20,100.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Cost Accounting

- Compute the depreciation chargearrow_forwardFor its inspecting cost pool, Brilliant Professor Mullen Company expected an overhead cost of $360,000 and an estimated 14,200 inspections. The actual overhead cost for that cost pool was $395,000 for 16,000 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is __.arrow_forwardCan you help me with accounting questionsarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College