Concept explainers

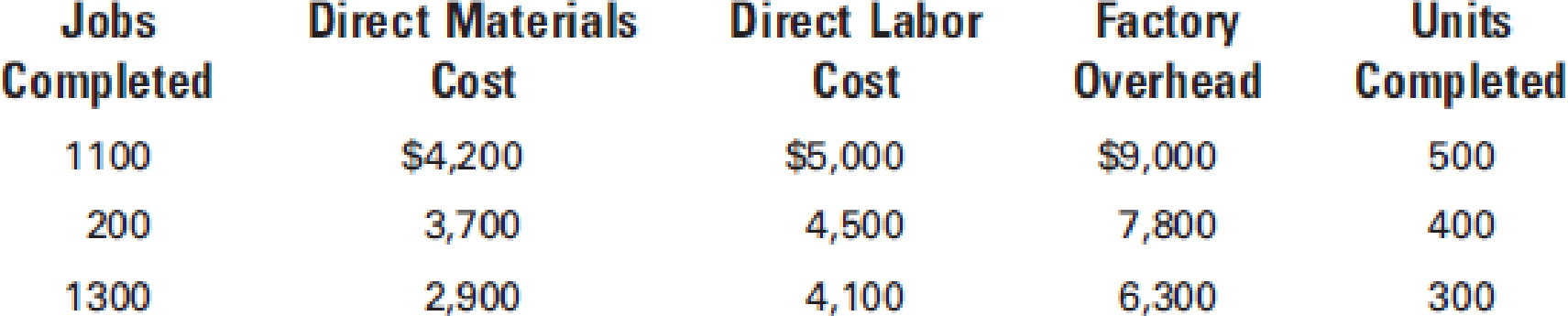

Gerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the company’s books after all posting had been completed at the end of March:

- a. Compute the total production cost of each job.

- b. Prepare the journal entries to charge the costs of materials, labor, and factory

overhead to Work in Process. - c. Prepare the

journal entry to transfer thecost of jobs completed to Finished Goods. - d. Compute the unit cost of each job.

- e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.

a.

Calculate the total production cost for each job.

Explanation of Solution

Production costs are those costs that are incurred for manufacturing a product or providing the service to the end user.

Calculate the total production cost for each job.

| Jobs Completed | Direct Materials Cost ($) | Direct Labor Cost ($) | Factory Overhead ($) | Total Production Cost ($) |

| 1100 | 4,200 | 5,000 | 9,000 | 18,200 |

| 1200 | 3,700 | 4,500 | 7,800 | 16,000 |

| 1300 | 2,900 | 4,100 | 6,300 | 13,300 |

| Total | 10,800 | 13,600 | 23,100 | 47,500 |

Table (1)

Thus, the total value of production cost is $47,500.

b.

Provide journal entry to charge the cost of materials, labor, and factory overhead to work-in process.

Explanation of Solution

Prepare journal entry to charge the cost of materials, labor, and factory overhead to work-in process.

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| Work in Process (Job 1100,1200, 1300) | 10,800 | ||

| Materials | 10,800 | ||

| (To record materials issued to Job 1100,1200, 1300) | |||

| Work in Process (Job 1100,1200, 1300) | 13,600 | ||

| Payroll | 13,600 | ||

| (To record payment of wages to the labor involved in Job 1100,1200, 1300) | |||

| Work in Process (Job 1100,1200, 1300) | 23,100 | ||

| Factory Overhead | 23,100 | ||

| (To record transfer of factory overhead to Work-in process in Job 1100,1200, 1300) |

Table (2)

c.

Provide journal entry for transfer the cost of job completed to finished goods.

Explanation of Solution

Prepare journal entry for transfer the cost of job completed to finished goods.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Finished Goods | 47,500 | ||

| Work in Process (Job 1100,1200, 1300) | 47,500 | ||

| (To record transfer of cost of job completed to finished goods) |

Table (3)

d.

Calculate the unit cost of each job.

Explanation of Solution

Calculate the unit cost of each job.

Hence, the unit cost of Job 1100, Job 1200, and Job 1300 is $36.40, $40.00, and $44.33 respectively.

e.

Calculate the selling price per unit for each job, assuming that a mark-on percentage is 60%.

Explanation of Solution

Calculate the selling price per unit for Job 1100.

Calculate the selling price per unit for Job 1200.

Calculate the selling price per unit for Job 1300.

Hence, the selling price per unit for Job 1100, Job 1200, and Job 1300 is $54.60, $60.00, and $66.50 respectively.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Cost Accounting

- Please give me answer general accounting questionarrow_forwardIngram Enterprises has variable expenses equal to 65% of sales. At a $500,000 sales level, the degree of operating leverage is 4.5. If sales increase by $50,000, what will be the new degree of operating leverage?helparrow_forwardWhat is the company degree of operating leverage?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub