FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

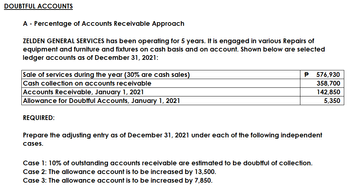

Transcribed Image Text:DOUBTFUL ACCOUNTS

A - Percentage of Accounts Receivable Approach

ZELDEN GENERAL SERVICES has been operating for 5 years. It is engaged in various Repairs of

equipment and furniture and fixtures on cash basis and on account. Shown below are selected

ledger accounts as of December 31, 2021:

P

Sale of services during the year (30% are cash sales)

Cash collection on accounts receivable

576,930

358,700

Accounts Receivable, January 1, 2021

142,850

Allowance for Doubtful Accounts, January 1, 2021

5,350

REQUIRED:

Prepare the adjusting entry as of December 31, 2021 under each of the following independent

cases.

Case 1: 10% of outstanding accounts receivable are estimated to be doubtful of collection.

Case 2: The allowance account is to be increased by 13,500.

Case 3: The allowance account is to be increased by 7,850.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Tyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $39,500 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8%, $35,000 note payable along with paying $4,500 in cash. July 8 Borrowed $63,000 cash from NBR Bank by signing a 120-day, 12%, $63,000 note payable. Paid the amount due on the note to Locust at the _?- maturity date. ? November 28 December 31 Paid the amount due on the note to NBR Bank at the maturity date. Borrowed $24,000 cash from Fargo Bank by signing a 60-day, 7%, $24,000 note payable. Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _ ? Paid the amount due on the note to Fargo Bank at the maturity date. 5. Prepare journal entries for all the preceding transactions and events. Note: Do not round your intermediate…arrow_forwardDavos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1, and the remaining $40,000 was collected in cash during Year 2. Required a. e. & f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts.arrow_forwardOswego Clay Pipe Company sold $46,000 of pipe to Southeast Water District 45 on April 12 of the current year with terms 1/10,n/30. Oswego uses the gross method of accounting for sales discounts. What entry would Oswego make on April 18, assuming the customer made the correct payment on that date? Account Title Debit Credit Cash Sales 45,540 460 Accounts receivable 46,000 Account Title Debit Credit Cash 46,000 Accounts receivable Sales 45,540 460 Account Title Debit Credit Cash 45,540 Sales discounts 460 Accounts receivable 46,000 Account Title Debit Credit Cash 46,000 Sales discounts 460 Accounts receivable 46,000 Sales discounts forfeited 460arrow_forward

- York Company engaged in the following transactions for Year 1. The beginning cash balance was $86,000 and the ending cash balance was $59,100. 1. Sales on account were $548,000. The beginning receivables balance was $128,000 and the ending balance was $90,000. 2. Salaries expense for the period was $232,000. The beginning salaries payable balance was $16,000 and the ending balance was $8,000. 3. Other operating expenses for the period were $236,000. The beginning other operating expenses payable balance was $16,000 and the ending balance was $10,000. 4. Recorded $30,000 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were $12,000 and $42,000, respectively. 5. The Equipment account had beginning and ending balances of $44,000 and $56,000, respectively. There were no sales of equipment during the period. 6. The beginning and ending balances in the Notes Payable account were $36,000 and $44,000, respectively. There were no payoffs of…arrow_forwardam. 134.arrow_forwardRecord these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forward

- In the first year of operations, Ralph's Repair Service recognized $482,000 of service revenue earned on account. The ending accounts receivable balance was $88,900. Ralph estimates that 2% of sales on account will not be collected. During the year, Ralph wrote off a $200 receivable that was determined to be uncollectible. Assume there were no other transactions affecting accounts receivable. Required: a. What amount of cash was collected in Year 1? b. What amount of uncollectible accounts expense was recognized In Year 1? c. What will be Ralph's net realizable value of receivables on the December 31, Year 1 balance sheet? a. Cash collected b. Uncollectible accounts expense c. Net realizable value of receivablesarrow_forwardOn January 1, 2025, the ledger of Wildhorse Co. contained these liability accounts. Accounts Payable $44,700 Sales Taxes Payable 8,800 Unearned Service Revenue 21,200 During January, the following selected transactions occurred. Jan. 1 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. 5 Sold merchandise for cash totaling $5,512, which includes 6% sales taxes. 12 14 20 20 Performed services for customers who had made advance payments of $13,000. (Credit Service Revenue.) Paid state treasurer's department for sales taxes collected in December 2024, $8,800. Sold 720 units of a new product on credit at $49 per unit, plus 5% sales tax. During January, the company's employees earned wages of $58,000. Withholdings related to these wages were $4,437 for FICA, $4,200 for federal income tax, and $1,614 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during…arrow_forwardDuring January 2021, the following transactions occur: January 2 Sold gift cards totaling $12,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $167,000. January 15 Firework sales for the first half of the month total $155,000. All of these sales are on account. The cost of the units sold is $83,800. January 23 Receive $127,400 from customers on accounts receivable. January 25 Pay $110,000 to inventory suppliers on accounts payable. January 28 Write off accounts receivable as uncollectible, $6,800. January 30 Firework sales for the second half of the month total $163,000. Sales include $17,000 for cash and $146,000 on account. The cost of the units sold is $89,500. January 31 Pay cash for monthly salaries, $54,000. 4. Prepare a multiple-step income statement for the period ended January 31, 2021.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education