Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

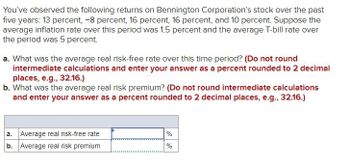

Transcribed Image Text:You've observed the following returns on Bennington Corporation's stock over the past

five years: 13 percent, -8 percent, 16 percent, 16 percent, and 10 percent. Suppose the

average inflation rate over this period was 1.5 percent and the average T-bill rate over

the period was 5 percent.

a. What was the average real risk-free rate over this time period? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

b. What was the average real risk premium? (Do not round intermediate calculations

and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)

a. Average real risk-free rate

b. Average real risk premium

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A security analyst has regressed the monthly returns on Exxon Mobil equity shares over the past five years against those on the Standard & Poor's 500 stock index over the same period. The resulting regression equation is TEM = 0.05+1.41rsp. Use this equation to estimate Exxon Mobil's equity beta. Note: Round your answer to 2 decimal places. Estimated Exxon Mobil's equity betaarrow_forwardYou’ve observed the following returns on Pine Computer’s stock over the past five years: 13 percent, −13 percent, 20 percent, 25 percent, and 10 percent. a. What was the arithmetic average return on the company’s stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.1.) b-1. What was the variance of the company’s returns over this period? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g., .16161.) b-2. What was the standard deviation of the company’s returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Average return % b-1. Variance b-2. Standard deviation %arrow_forward(Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends Time 2 Marsh $10 10 20 4 5 10 (Click on the icon in order to copy its contents into a spreadsheet) 7 a Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of retum earned by investing in Marsh's stock over this period? C. What is the geometric average rate of return earned by investing in Marsh's stock over this period? d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period? a. The annual rate of return at the end of year 2 is%. (Round to two decimal places.) GILEarrow_forward

- Sunset Corporation currently has an EPS of $2.38, and the benchmark PE for the company is 17. Earnings are expected to grow at 7.5 percent per year. a. What is your estimate of the current stock price? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. What is the target stock price in one year? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. Assuming the company pays no dividends, what is the implied return on the company's stock over the next year? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e.g., 32.2. a. Stock price today b. Stock price in one year c. Implied returnarrow_forwardThe average annual return on the S&P 500 Index from 1996 to 2005 was 13.27 percent. The average annual T-bill yield during the same period was 3.92 percent. What was the market risk premium during these ten years? (Round your answer to 2 decimal places.)arrow_forwardYou've observed the following returns on Pine Computer's stock over the past five years: -26.7 percent, 14.8 percent, 32.6 percent, 2.9 percent, and 21.9 percent. a. What was the arithmetic average return on the stock over this five-year period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the variance of the returns over this period? Note: Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616. c. What was the standard deviation of the returns over this period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Arithmetic average return b. Variance c. Standard deviation 96 %arrow_forward

- Financial analysts forecast Safeco Corp.’s (SAF) growth rate for the future to be 8 percent. Safeco’s recent dividend was $1.25.What is the value of Safeco stock when the required return is 10 percent? (Round your answer to 2 decimal places.)arrow_forwardNonearrow_forwardGee-Gee common stock returned a nifty 21.77 percent rate of return last year. The dividend amount was $1.96 a share which equated to a dividend yield of 2.05 percent. What was the rate of price appreciation for the year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Suppose that during a 12 year period, a corporation's stock has a 2:1 split. By what percent would the price per share have to decrease in order for the rate of return during this period to be -7.7% ? ,arrow_forwardNikularrow_forwardConsider the following information on large-company stocks for a period of years. Arithmetic Mean 12.78 3.3 Large-company stocks Inflation a. What was the arithmetic average annual return on large-company stocks in nominal terms? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the arithmetic average annual return on large-company stocks in real terms? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Nominal return b. Real return 12.70% 10.26 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education