Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

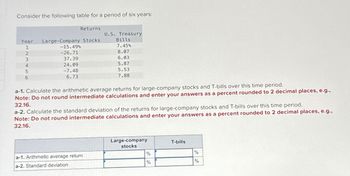

Transcribed Image Text:Consider the following table for a period of six years:

Returns.

Year Large-Company Stocks

123456

-15.49%

-26.71

37.39

24.09

-7.48

6.73

U.S. Treasury

Bills

7.45%

8.07

6.03

5.87

5.53

7.88

a-1. Calculate the arithmetic average returns for large-company stocks and T-bills over this time period.

Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.,

32.16.

a-2. Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period.

Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.,

32.16.

a-1. Arithmetic average return

a-2. Standard deviation

Large-company

stocks

%

%

T-bills

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following return series comes from Global Financial Data. Year Large Stocks LT Gov Bonds US T-bills CPI (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average nominal return earned on large-company stocks. (Enter percentages as decimals and round to 4 decimals)arrow_forwardYou've observed the following returns on Pine Computer's stock over the past five years: -26.7 percent, 14.8 percent, 32.6 percent, 2.9 percent, and 21.9 percent. a. What was the arithmetic average return on the stock over this five-year period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What was the variance of the returns over this period? Note: Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616. c. What was the standard deviation of the returns over this period? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Arithmetic average return b. Variance c. Standard deviation 96 %arrow_forwardbook nt Consider the following table for a period of six years: Returns U.S. Treasury Year Large-Company Stocks Bills 1 -14.99% 7.35% 2 -26.56 8.02 3 37.29 5.93 4 23.99 5.37 5 -7.28 5.48 6 6.63 7.73 a-1. Calculate the arithmetic average returns for large-company stocks and T-bills over this time period. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. a-2. Calculate the standard deviation of the returns for large-company stocks and T-bills over this time period. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. int Large-company stocks T-bills a-1. Arithmetic average return a-2. Standard deviation % % % % ences Calculate the observed risk premium in each year for the large-company stocks versus the T-bills. b-1. What was the arithmetic average risk premium over this period? Note: A negative answer should be indicated by a minus sign. Do not…arrow_forward

- Use the table for the question(s) below. Consider the following realized annual returns: Index Stock A Year End Realized. Realized Return Return 23.6% 46.3% 24.7% 26.7% 30.5% 86.9% 9.0% 23.1% -2.0% 0.2% -17.3% -3.2% -24.3% -27.0% 32.2% 27.9% 4.4% -5.1% 7.4% -11.3% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 Suppose that you want to use the 10-year historical average return on Stock A to forecast the expected future return on Stock A. The 95% confidence interval for your estimate of the expect return is closest to: O 6.5% to 26.3%. O-15.0% to 47.9%. -4.5% to 37.4%. 13.2% to 19.5%.arrow_forwardConsider the following table for different assets for 1926 through 2020. Standard Deviation 19.7% Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation Average return 12.2% 16.2 6.5 6.1 5.3 3.3 2.9 Expected range of returns Expected range of returns a. What range of returns would you expect to see 68 percent of the time for large-company stocks? Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. b. What about 95 percent of the time? 31.3 8.5 9.8 Note: A negative answer should be indicated by a minus sign. Enter your answers from lowest to highest. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % to % to 5.6 3.1 4.0 % %arrow_forwardGiven the following information, what is the standard deviation (in percent) of the returns on this stock? Carry intermediate calculations to at least five decimals. Answer to two decimals Probability of State State of Economy Rate of Return (%) of Economy Recession 15% -12.34 Normal 60% 14.14 Boom 25% 23.77arrow_forward

- The following return series comes from Global Financial Data. US T-bills CPI Year Large Stocks LT Gov Bonds (Rf asset) (inflation) 2017 21.83% 6.24% 0.80% 2.07% 2018 -5.28% -1.25% 1.81% 2.10% 2019 25.45% 3.35% 2.15% 1.10% 2020 18.16% 10.25% 4.50% 1.88% 2021 28.70% -1.54% 0.40% 7.00% 2022 -19.78% -8.55% 2.20% 6.50% Calculate the average real risk premium earned on large-company stocks using the approximate Fisher equation. (Enter percentages as decimals and round to 4 decimals)arrow_forwardNikularrow_forwardReview the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forward

- The last four years of returns for a stock are as follows: Year Return 1 - 4.3% 2 28.1% 3 11.6% a. What is the average annual return? b. What is the variance of the stock's returns? c. What is the standard deviation of the stock's returns? a. What is the average annual return? The average return is%. (Round to two decimal places.) 4 3.7%arrow_forwardSee Attachedarrow_forwardA 228.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education