Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

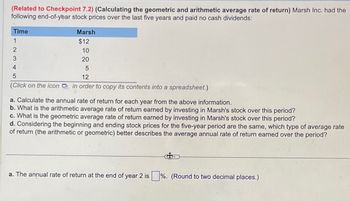

Transcribed Image Text:(Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the

following end-of-year stock prices over the last five years and paid no cash dividends:

Time

1

Marsh

$12

2

3

10

20

4

5

12

(Click on the icon in order to copy its contents into a spreadsheet.)

a. Calculate the annual rate of return for each year from the above information.

b. What is the arithmetic average rate of return earned by investing in Marsh's stock over this period?

c. What is the geometric average rate of return earned by investing in Marsh's stock over this period?

d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate

of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period?

4

a. The annual rate of return at the end of year 2 is

%. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Business has been good for Keystone Control Systems, as indicated by the six-year growth in earnings per share. The earnings have grown from $1.00 to $1.87. a. Determine the compound annual rate of growth in earningsarrow_forwardThe following spreadsheet contains monthly returns for Cola Co. and Gas Co. for 2013. Using these data, estimate the average monthly return and the volatility for each stock. (Click on the following icon in order to copy its contents into a spreadsheet.) Month January February March April May June July August September October November December The average monthly return for Cola Co. is%. (Round to two decimal places.) Cola Co. - 6.80% 7.40% -2.10% 4.30% 11.30% 1.40% 4.10% - 0.60% 0.80% 1.90% 0.70% - 2.90% Gas Co. - 3.00% - 7.70% 0.20% 3.10% - 1.00% 0.00% 4.80% - 3.80% - 5.80% 1.20% - 2.30% 4.70%arrow_forwardCarnes Cosmetics Co.'s stock price is $56, and it recently paid a $2.00 dividend. This dividend is expected to grow by 16% for the next 3 years, then grow forever at a constant rate, g; and rs = 11%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- (Related to Checkpoint 7.2) (Calculating the geometric and arithmetic average rate of return) Marsh Inc. had the following end-of-year stock prices over the last five years and paid no cash dividends Time 2 Marsh $10 10 20 4 5 10 (Click on the icon in order to copy its contents into a spreadsheet) 7 a Calculate the annual rate of return for each year from the above information. b. What is the arithmetic average rate of retum earned by investing in Marsh's stock over this period? C. What is the geometric average rate of return earned by investing in Marsh's stock over this period? d. Considering the beginning and ending stock prices for the five-year period are the same, which type of average rate of return (the arithmetic or geometric) better describes the average annual rate of return earned over the period? a. The annual rate of return at the end of year 2 is%. (Round to two decimal places.) GILEarrow_forwardEcolap Inc. (ECL) recently paid a $0.34 dividend. The dividend is expected to grow at a 12.50 percent rate. The current stock price is $42.52. What is the return shareholders are expecting? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardA company's stock price rose 2.8% in 2011, and in 2012, it increased 79.7%.a. Compute the geometric mean rate of return for the two-year period 2011-2012. (Hint: Denote an increase of 79.7% by .797.)b. If someone purchased $1,000 of the company's stock at the start of 2011, what was its value at the end of 2012?c. Over the same period, another company had a geometric mean rate of return of 10.7%. If someone purchased $1,000 of the other company's stock, how would its value compare to the value found in part (b)?arrow_forward

- The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 6% per year. Callahan's common stock currently sells for $25.75 per share; its last dividend was $2.00; and it will pay a $2.12 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's beta is 1.1, the risk-free rate is 3%, and the average return on the market is 14%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 12%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. % If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round…arrow_forwardBioScience Inc. will pay a common stock dividend of $4.45 at the end of the year (D₁). The required return on common stock (x) is 16 percent. The firm has a constant growth rate (g) of 8 percent. Compute the current price of the stock (Po). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current price Prev 9 of 10 MacBook Air Next >arrow_forwardCarnes Cosmetics Co.'s stock price is $44, and it recently paid a $1.25 dividend. This dividend is expected to grow by 18% for the next 3 years, then grow forever at a constant rate, g; and rs = 16%. At what constant rate is the stock expected to grow after Year 3? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forward

- Suppose that a firm's recent earnings per share and dividend per share are $2.55 and $1.40, respectively. Both are expected to grow at 11 percent. However, the firm's current P/E ratio of 15 seems high for this growth rate. The P/E ratio is expected to fall to 11 within five years. Compute the dividends over the next five years. (Do not round intermediate calculations. Round your answers to 3 decimal places.) Years First year Second year Third year Fourth year Fifth year Dividendsarrow_forwardGee-Gee common stock returned a nifty 21.77 percent rate of return last year. The dividend amount was $1.96 a share which equated to a dividend yield of 2.05 percent. What was the rate of price appreciation for the year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardThe price of the stock of Clarkson Corporation went from P50 to P56 last year. In the following year, the dividend was raised to P2.25. However, a bear market developed toward the end of the year, and the stock price declined from P56.00 at the beginning of the year to P48.00 at the end of the year. What is the rate of return (loss) to stockholders?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education