Income Tax Fundamentals 2020

38th Edition

ISBN: 9780357391129

Author: WHITTENBURG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

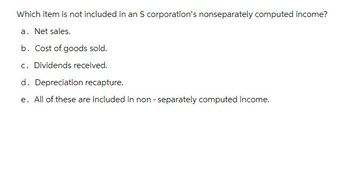

Transcribed Image Text:Which item is not included in an S corporation's nonseparately computed income?

a. Net sales.

b. Cost of goods sold.

c. Dividends received.

d. Depreciation recapture.

e. All of these are included in non-separately computed income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- When a business calculates taxable income from gross income, which ofthe following is true? a. Depreciation, interest, and principal are all subtracted b. Depreciation and interest are subtracted, principal is not c. Depreciation is subtracted, interest and principal are not d. Interest and principal are subtracted, depreciation is not.arrow_forwardGross profit is equal to Select one: a. revenues - expenses b. sales - cost of goods sold c. profits plus depreciation d. earnings before taxes minus taxes payablearrow_forwardFor fi nancial assets classifi ed as available for sale, how are unrealized gains and losses refl ected in shareholders’ equity? C . Th ey are a component of accumulated other comprehensive income.arrow_forward

- Assume an income statement with the following classifications: A. Revenues B. Cost of goods sold C. Distribution expenses D. General & administrative expenses E. Other revenues and expenses F. Income tax on income from continuing operations G. Gain from disposal of discontinued operations H. Income tax on gain from discontinued operations I. None of the above Indicate by letter how each of the following should be classified: 1. Advertising expense 2. Amortization of a patent held as an investment 3. Cash dividend received on short-term investment 4. Depreciation on plant that manufactures good for sale (prior to sale of the (spoob 5. Freight on sales 6. Income tax effect of loss on sale of plant 7. Income tax on gain on sale of short-term investment in securities 8. Interest expense 9. Interest revenue 10. Loss on sale of patent 11. Dividend revenue from investment 12. Salary of 13. Sales 14. Sales returns 15. Services sold company presidentarrow_forwardCorporations report which of the following in a separate section of the income statement? O Other revenues and gains. O Cost of goods sold. O Gross profit. O Income tax expense.arrow_forwardCalculate the EBIT which should be used for the EV / EBIT multiple given the information below: Net revenues Cost of sales Gross Profit Selling, general and administrative expenses Amortization expense Restructuring costs Acquisition-related costs Asset impairment charges Gain on sales of assets Operating income Interest expense, net Loss on early extinguishment of debt Other expense, net Income (loss) before taxes (Benefit) provision for income taxes Net income (loss) Select one: 1,394,8 1,444.4 1,474.3 S 1,419.6 5,248.1 1,746.0 3,502.1 2,027.8 During fiscal 2050, the company sold assets relating to the Cutey brand for a total disposal price of $29.2. The Company allocated $4.2 of goodwill to the brand as part of the sale. The Company recorded a gain of $24.8 which has been reflected in Gain on sales of assets in the Consolidated Statement of Operations for the fiscal year ended June 30, 2050. 79.5 86.9 174.0 5.5 (24.8) 1,153.2 81.9 3.1 30.4 1,037.8 (40.4) 1,078.2arrow_forward

- The Principle of Taxation class: What is the difference between income which is "realized" and income which is "recognized"? Which respect to gains/losses from Capital Assets like equity securities (stock), at what point is the gain realized and when is it currently recognized?arrow_forwardWhich of the following refers to the elements of Comprehensive Income? a) Net Income, Interest Payments and Income Tax Payments b) Retained Earnings and Other Comprehensive Income c) Net Income and Other Comprehensive Income d) Sales and Other Comprehensive Incomearrow_forward1. Which statement is incorrect regarding presentation of statement of profit or loss and other comprehensive income?a. An entity may use the title 'statement of comprehensive income' instead of 'statement of profit or loss and other comprehensive income'.b. An entity may present the profit or loss section in a separate statement of profit or loss.c. If presented separately, the statement of profit or loss shall immediately precede the statementpresenting comprehensive income, which shallbegin with profit or loss.d. An entity may present a single statement of profit or loss and other comprehensive income, withprofit or loss and other comprehensive incomepresented in one section. 2. The statement of profit or loss and other comprehensive income shall presenta. Profit or lossb. Total other comprehensive incomec. Comprehensive income for the period, being the total of profit or loss…arrow_forward

- Please explain.arrow_forwardThe trial balance of Rollins Inc. included the following accounts as of December 31, 2021: Credits 5, 200, 000 36, 500 Debits Sales revenue Interest revenue Loss on sale of investments Loss on debt investments Gain on projected benefit obligation Cost of goods sold Selling expense Restructuring costs Interest expense General and administrative expense 20, 000 122, 000 225, 000 3,770,000 330,000 145, 000 10, 000 230, 000 The loss on debt investments represents a decrease in the fair value of debt securities and is classified as part of other comprehensive income. Rollins had 100,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 25%. Required Prepare a 2021 single, continuous statement of comprehensive income for Rollins Inc. Use a multiple-step income statement format: (Amounts to be deducted should be indicated with a minus sien. Roind Earnings per share answer to 2 decimal places. ROLLINS INC Statement of…arrow_forwardAccounting: type question:, Which of the following items is not taken in profit and loss appropriation account? A. Transfer to dividend equalisation reserve B. Transfer to general reserve C. Provision for taxation D. Proposed dividendarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,