Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

I need help with this problem and how to set it up in excel with formulas.

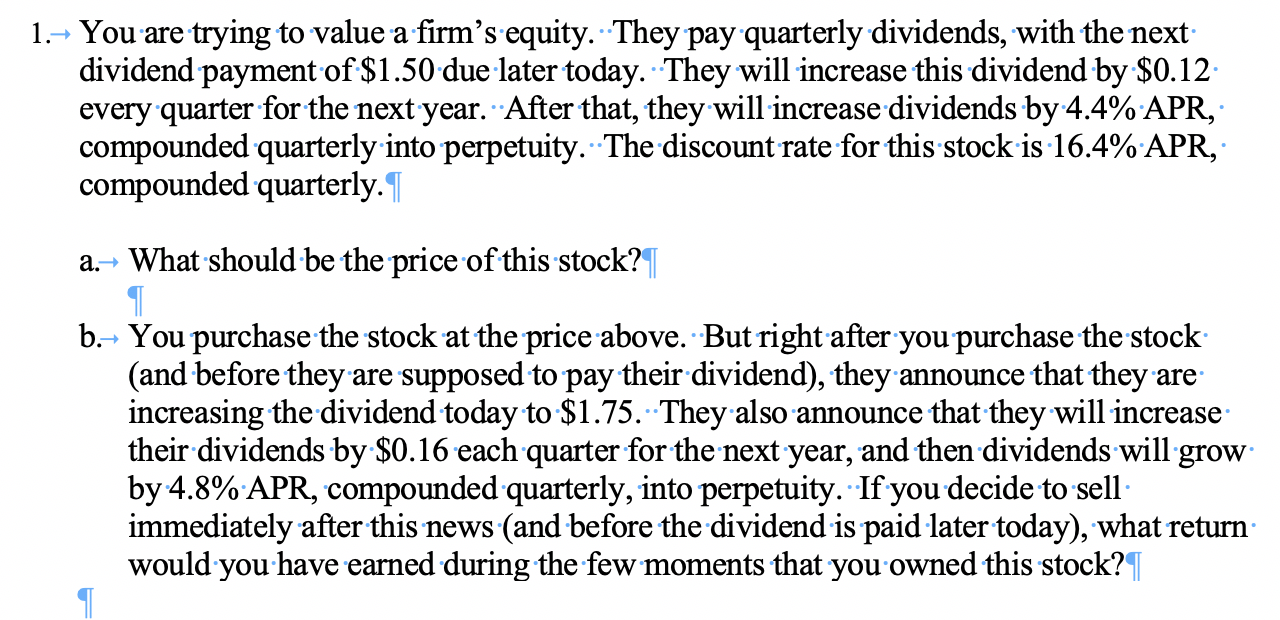

Transcribed Image Text:1.- You are trying to value a firm's equity. They pay quarterly dividends, with the next

dividend payment of $1.50 due later today. They will increase this dividend by $0.12

every quarter for the next year. After that, they will increase dividends by 4.4% APR,

compounded quarterly into perpetuity. The discount rate for this stock is 16.4% APR,

compounded quarterly.

a. What should be the price of this stock?

b.

You purchase the stock at the price above. But right after you purchase the stock

(and before they are supposed to pay their dividend), they announce that they are

increasing the dividend today to $1.75. They also announce that they will increase

their dividends by $0.16 each quarter for the next year, and then dividends will grow

by 4.8% APR, compounded quarterly, into perpetuity. If you decide to sell

immediately after this news (and before the dividend is paid later today), what return

would you have earned during the few moments that you owned this stock?T

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I really need help with this item below. I have tried a few different ways to do this problem, but the top box keeps coming back as incorrect. I know that the amounts are correct, but the first box is wrong for some reason. Please read the feedback boxes and include the appropriate formulas and cell references for this item. This is done through Excel. PLEASE HELP!!!!!! Note that the pictures are the same exact problem, but I used two separate formulas to try and solve this problem.arrow_forwardI'm stuck on how to do the excel formulasarrow_forwardEducate these stakeholders on the advantages of utilizing a spreadsheet solution and how simple it was to process data in order to generate the information provided in the report in Excelarrow_forward

- When should you use Power BI Services?arrow_forwardWhy is data quality so crucial to data warehousing? List excellent data's advantages and indications.arrow_forwardIdentify two specific IT-related risks in computerized accounting information systems. Propose a strategy that might be implemented to mitigate or eliminate each selected risk. Be sure to effectively support your rationale.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education