Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

8 marks accounting

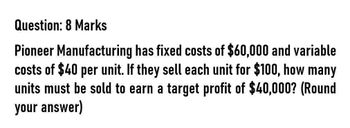

Transcribed Image Text:Question: 8 Marks

Pioneer Manufacturing has fixed costs of $60,000 and variable

costs of $40 per unit. If they sell each unit for $100, how many

units must be sold to earn a target profit of $40,000? (Round

your answer)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Schylar Pharmaceuticals, Inc., plans to sell 130,000 units of antibiotic at an average price of 22 each in the coming year. Total variable costs equal 1,086,800. Total fixed costs equal 8,000,000. (Round all ratios to four significant digits, and round all dollar amounts to the nearest dollar.) Required: 1. What is the contribution margin per unit? What is the contribution margin ratio? 2. Calculate the sales revenue needed to break even. 3. Calculate the sales revenue needed to achieve a target profit of 245,000. 4. What if the average price per unit increased to 23.50? Recalculate: a. Contribution margin per unit b. Contribution margin ratio (rounded to four decimal places) c. Sales revenue needed to break even d. Sales revenue needed to achieve a target profit of 245,000arrow_forwardDelta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.arrow_forwardIf a company has fixed costs of $6.000 per month and their product that sells for $200 has a contribution margin ratio of 30%, how many units must they sell in order to break even? A. 100 B. 180 C. 200 D. 2,000arrow_forward

- Sold?arrow_forwardRound your answerarrow_forwardTotal fixed cost of a product is IDR 10,000,000 and variable cost is IDR 50,000 per unit. The sale price is IDR.75,000 per unit . How much products should be produced to get BEP? Prove your answer and make a graphic. ..And If the company need profit IDR 10,000,000. How much is the sales price? Prove your answer.arrow_forward

- What is the correct choice? How many total dollars of sales must BAC Company sell to break even if the selling price per unit is $8.50, variable costs are $4.00 per unit, and fixed costs are $9,000? a. $4,000 b. $8,500 c. $9,000 d. $17,000arrow_forwardY6arrow_forwardBreak-even analysis Show all your solutions. 1. The Fixed Cost is P4,000. The material and labor costs are P4.00 per unit. The supplier’s selling price is P5.00 per unit. The break-even point is 2. Production has indicated that they can produce widgets at a cost of P4.00 each if they lease new equipment at a cost of P10,000. Marketing has estimated the number of units they can sell at a number of prices (Php4000) Which price/volume option will allow the firm to avoid losing money on this project? 3. A food repacking company estimates sales figures of Php15.5M for their most popular item. Assuming that the item sells at Php375 each, fixed costs are Php4M, and variable cost are Php215 per unit repacked. a. What is the break-even sales volume? b. Find the corresponding profit figures if the actual sales will be as estimated. 4. A manufacturer can sell a certain health supplement for P1,100 per unit. Its total cost consists of a fixed overhead of Php75,000 plus production costs of…arrow_forward

- Assume your product is priced at $10. The variable cost per unit is currently $5, and fixed costs are $10,000. What is your breakeven point? O 3,000 units O 2,000 units O 2,500 units 3,500 unitsarrow_forwardProduct X sells P25 per unit and has related variable costs of P20 per unit. The fixed costs of producing Product X are P40,000 per month. How much should be the sales of product X to earn an operating income of P80,000? P 24,000 P 120,000 P 200,000 P 600,000 Group of answer choices 1 2 3 4arrow_forwardCan you help me with CVP Drill #10?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT